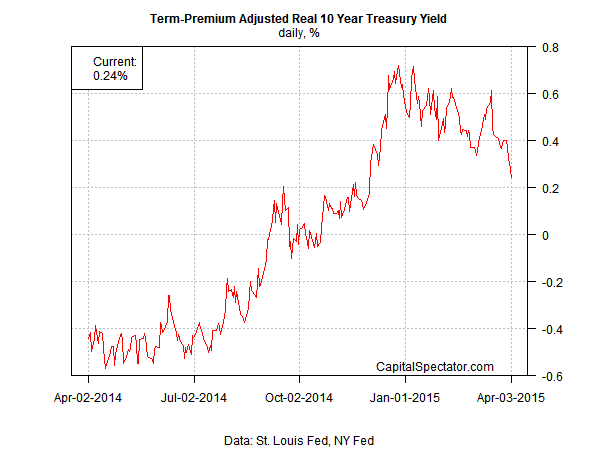

Friday’s disappointing news for US payrolls in March — the smallest gain in more than a year — has launched a new debate about the economy’s strength. It’s premature to assume too much from the latest monthly change, in part because year-over-year growth in payrolls is still robust, as I discussed last week. Nonetheless, the crowd (and the Fed) will be considerably more sensitive to incoming data in the search for fresh clues about what, if anything, the latest payrolls numbers mean for adjusting the near-term outlook. One market-based measure that’s worthy of monitoring for this task: the term-premium adjusted real (inflation-adjusted) yield for the benchmark 10-year Treasury Note.

Economist David Beckworth recently advised that the 10-year real risk-free yield is a useful real-time proxy for the business cycle. As such, the recent revival in this rate to positive territory has been taken as a sign that economic conditions have improved. Since late last year, the 10-year term-premium-adjusted real rate has moved above zero on a sustained basis for the first time since the recession ended in mid-2009. In January, Beckworth cited this fact as a reason to consider the view that the economy is on the mend.

After being negative for several years, the real risk-free interest rate has been steadily climbing and is now positive. This only happens when the economic outlook improves as seen in the figure below. It shows a close relationship between the real risk-free interest rate and the business cycle.

So the upward trend of the real risk-free rate implies we are in the midst of a solid recovery in the United States. This interpretation is supported by the spate of positive economic news shows. Yes, the economic problems in Europe and China could eventually harm the U. S. economy. But for now the U.S. economy seems to be in the clear.

Is it time to reassess that view in the wake of the March payrolls report? Maybe, depending on what the economic releases tell us in the weeks ahead. One way to monitor how the crowd’s interpreting the news is watching the 10-year term-premium-adjusted real rate. As you’d expect, this yield has fallen lately, tumbling to 0.24% on Friday, the lowest so far this year — and roughly a third lower since Beckworth penned his upbeat analysis in January. It’s still positive, as it has been for several months, but macro numbers of late have taken a bite out of this previously rising metric. The big question: Will it stay positive? Stay tuned—I’ll be posting updates in the days and weeks ahead.

Meantime, here’s how I’m calculating this yield, as per Beckworth’s definition:

10-year nominal yield less expected inflation (nominal 10-year less 10-year TIPS yields)

less the 10-year term premium

I’m using the New York Fed’s estimate of the term premium—daily updates can be found here. The yields on the nominal and inflation-indexed 10-year Notes are published by the US Treasury, also with daily updates here.

Pingback: 04/06/15 - Monday Interest-ing Reads -Compound Interest Rocks

Pingback: Is the Economy's Strength in Question?