* Build Back Better spending bill will be delayed until next year, says Biden

* Central banks see inflation as bigger threat than Omicron variant

* Bank of England is first major central bank to raise interest rates in pandemic

* US economy remains resilient in December via PMI survey data

* US industrial output continued rising in November

* Jobless claims rose last week but remain close to lowest level in decades

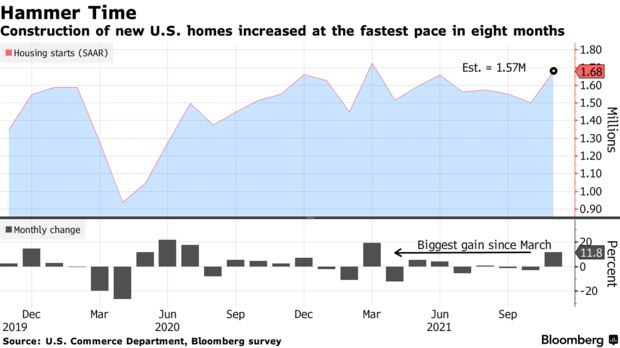

* US housing starts rose more than forecast in Nov, reaching 8-month high:

Category Archives: Uncategorized

Still Waiting For Inflation To Peak

The Federal Reserve yesterday decided to take a slightly more hawkish position on inflation, laying the groundwork for several rate hikes in 2022. Part of the calculus, probably the dominant part: inflation continues to accelerate.

Macro Briefing: 16 December 2021

* Fed hints at several rate hikes for 2022 to fight inflation

* Study finds Omicron variant infects dramatically faster with less severe effects

* Leaders of China and Russia show united front amid rising tensions with US

* Eurozone growth slows to 9-month low in December via PMI survey data

* Omicron variant weighs on UK growth in December, PMI survey data shows

* Homebuilder sentiment in US continued rebounding in December

* Business activity continued to grow “strongly” in December: NY Fed Mfg Index

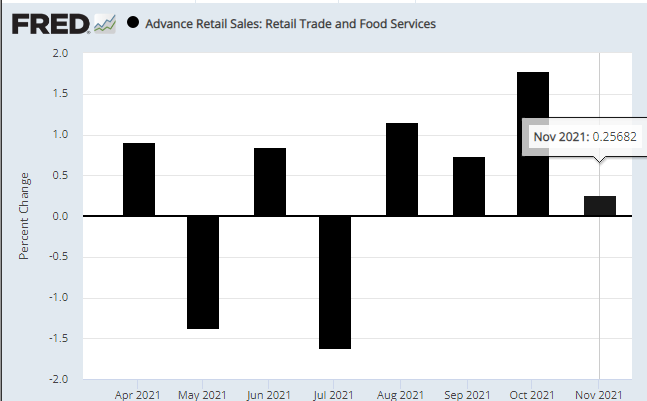

* US retail sales slowed in November, rising at pace well below expectations:

Desperately Seeking Yield: 15 December 2021

Interest rates are front and center today as the Federal Reserve prepares to update the world on its current thinking about monetary policy. The main question: Will the central bank offer new clues on laying the groundwork for interest-rate hikes to combat the recent surge in inflation?

Macro Briefing: 15 December 2021

* Federal Reserve expected to move closer to rate hike in today’s announcement

* Investments in US inflation-protected Treasuries surged in 2021

* China’s economic activity slowed in November

* Germany is on brink of recession due to coronavirus

* UK inflation reaches 10-year high in November

* US producer-price inflation accelerated in November to highest on record

* Congress votes to raise US debt ceiling

* Small US business optimism ticked up slightly in November

* US financial stress is below average but rising fast through early December:

10-Year Treasury Yield ‘Fair Value’ Estimate: 14 December 2021

The recent rise in the 10-year US Treasury yield has stalled. It’s unclear if this is a pause before the upside trend resumes vs. the early stages of new leg down. The sharp rise in inflation this year and the potential for an economic slowdown in the new year are conflicting factors that are muddying the outlook. While this scenario continues, our baseline forecast anticipates that a trading range for the 10-year rate will prevail in the near term, in part based on today’s update of The Capital Spectator’s ensemble model for estimating the benchmark yield’s “fair value.”

Macro Briefing: 14 December 2021

* California reimposes mandatory indoor mask requirement

* 2-dose Pfizer jab reportedly protects 70% against hospitalization from omicron

* US secretary of state warns China to end ‘aggressive actions’ in Asia-Pacific

* Second case of Omicron variant found in China

* US small business sentiment ticked up in Nov but still far below previous peak

* Wall St is starting to see opportunity in China’s battered stock market

* Apple on track to become world’s first $3 trillion company

* US 10yr Treasury yield falls to 1.42%–second-lowest level in over two months:

Risk Assets Rallied Last Week

Risk-on sentiment expanded across global markets last week, led by a rebound in US shares, based on a set of ETFs representing the major asset classes through Friday’s close (Dec. 10).

Macro Briefing: 13 December 2021

* G-7 countries warn Russia of ‘massive consequences’ if it attacks Ukraine

* US real interest rates go deeper into negative terrain as inflation rises

* Will 2020’s US borrowing binge create headwinds for Fed in fighting inflation?

* Share buybacks among S&P 500 companies hits record high for 2020

* The flattening yield curve suggests the economy’s tolerance for rate hikes is low

* US 10yr-2yr Treasury yield curve near 12mo low ahead of Fed meeting:

Book Bits: 11 December 2021

Tony Davidow

Summary via publisher (McGraw-Hill)

The wealth management industry has undergone a major transformation over the last decade, including increased concerns and skepticism from investors, the growth of robo-advisors, product evolution, and an evolving value proposition—in addition to geopolitical risks, increased correlation across asset classes, changing demographics, and social tensions. Concepts like “Modern Portfolio Theory” aren’t modern anymore, and even Post-Modern Portfolio Theory has become passé. Investing products have evolved significantly over the past two decades, making it easier than ever for advisors and investors to access various segments of the market and unique asset classes. Goals-Based Investing examines product evolution and discusses how to use these tools to achieve your goals.