How’s your US equities strategy doing this year? If you’re outperforming the market overall, there’s a good chance the bullish momentum is linked to overweights in energy, real estate, financials or tech – or perhaps all of the above.

Category Archives: Uncategorized

Macro Briefing: 10 December 2021

* Senate approves bill to lift debt ceiling and avoid US government shutdown

* US consumer inflation expected to rise to 39-year high in today’s Nov. update

* Online inflation rises to record 3.5% year-over-year, Adobe reports

* Ukraine-Russia efforts on new ceasefire in eastern Ukraine breaks down

* Germany’s foreign minister warns Russia on aggressive moves toward Ukraine

* Insiders selling stock at historic levels amid soaring share valuations

* China’s rising currency is outperforming the US dollar this year

* In upbeat sign for labor market, US jobless claims fall to a 52-year low:

US Economy Remains On Track For Strong Rebound in Q4

With the end of the year in sight, the US economy continues to show signs of a sharp pickup in growth in the fourth quarter, based on several nowcasts.

Macro Briefing: 9 December 2021

* US jobless claims appear to be stabilizing at pre-pandemic levels

* Another hot inflation report expected for tomorrow’s November update

* Policy shift at next week’s Fed meeting may damage central bank’s credibility

* US export challenges mounting due to bottlenecks at American ports

* China inflation continued rising in November but signs of peaking emerge

* China property developer Evergrande has defaulted on its debt: Fitch Ratings

* Could it happen again? World isn’t prepared for the next pandemic, report warns

* Italy fines Amazon $1.3 billion on charges of exploiting its market power

* US job openings rebounded in October, surprising forecasters on the upside:

Will US Inflation Continue To Accelerate?

Yes, according to economists’ forecast for this Friday’s November update (Dec. 10) on consumer prices.

Macro Briefing: 8 December 2021

* Biden says US preparing ‘strong measures’ on Russia if it invades Ukraine

* House takes first step in preventing a possible default on US debt

* Omicron variant partly evades protection offered by Pfizer vaccine, study shows

* Inflation is a leading concern for American voters via a new survey

* Debt-default worries persist for two of China’s biggest property companies

* Credit card giant Visa launches consulting service for cryptocurrencies.

* Germany’s parliament elects Olaf Scholz as new chancellor

* Is the flattening yield curve a sign that the Fed can’t/shouldn’t raise rates?

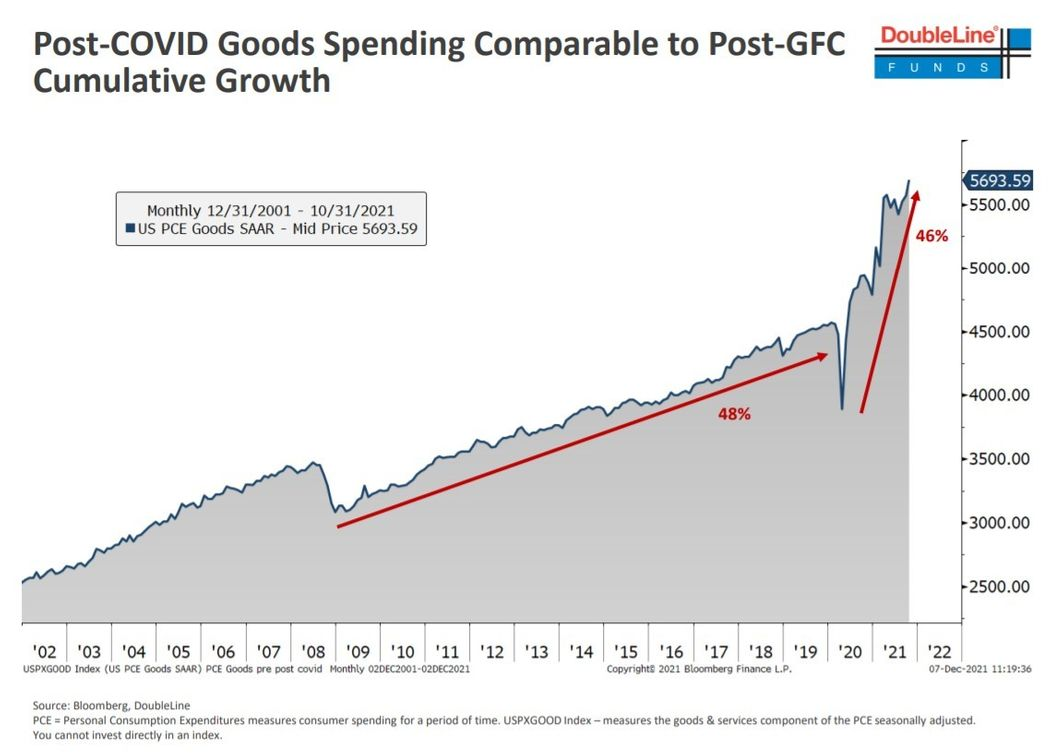

* US post-Covid goods spending has surged:

Inflation-Indexed Treasuries Lead US Bond Market Returns In 2021

How’s that allocation to bonds working out this year? Probably pretty good, if you favored Treasury Inflation Protected Securities (TIPS).

Macro Briefing: 7 December 2021

* Biden expected to give Russia’s Putin stark warning on attacking Ukraine

* China says US will ‘pay a price’ for diplomatic boycott of Olympics in Beijing

* Fed officials suggest bond-buying program will end sooner than expected

* New data law in China makes it hard for foreigners to assess economy

* Consumer spending was biggest contributor to Eurozone Q3 expansion

* Will falling ‘excess’ cash reserves for working class pinch consumer spending?

* Policy-sensitive 2-year US Treasury yield edges up to new pandemic high:

Major Asset Classes Post Wide Range Of Results For Last Week

US junk bonds and several slices of foreign fixed-income markets led a mixed run of returns for the major asset classes last week, based on a set of ETFs through Friday’s close (Dec. 3).

Macro Briefing: 6 December 2021

* Goldman Sachs cuts forecast of US 2022 GDP growth due to Omicron

* US health experts say early signs suggests Omicron less dangerous than delta

* China’s economic influence on global economy has been fading

* China’s central bank eases banking reserve requirement to boost liquidity

* China Evergrande Group is again on the brink of default; shares plunge

* German industrial orders fell sharply in October due to soft foreign demand

* US payrolls grew much less than expected in November

* Services PMI reaches record high in US, reflecting strong sector activity

* US 10yr-2yr Treasury yield curve narrows to smallest spread in over a year: