Category Archives: Uncategorized

The ETF Portfolio Strategist: 5 Feb 2021

In this issue:

- Global markets rebound

- Strong week for portfolio-strategy benchmarks

- Risk-on pays off for one of our managed-risk strategies

Return to form in February: The late-January correction turned out to be another head fake for risk assets, which rebounded sharply this week. Equities across the board were higher, led by a strong gain in Africa stocks, which topped our set of fund proxies that collectively represent the world’s major asset classes. (For details on all the risk metrics in the table below, along with profiles of the strategies and benchmarks discussed, see this summary.)

Inflation Expectations Are Rising. Will Actual Inflation Follow?

The Treasury market continues to price in higher odds of reflation and the Federal Reserve remains inclined to let the economy expand for longer with little if any monetary pushback due to nascent signs of pricing pressure. That lays the foundation for higher inflation. But so far, the hard data offers minimal support. Will 2021 be the year of an inflationary regime shift?

Macro Briefing: 5 February 2021

* Biden ends support for Saudi Arabia’s military operations in Yemen

* J&J seeks approval from US regulators for its Covid-19 vaccine

* House removes Marjorie Taylor Greene from committee assignments

* Senate rejects minimum wage bill in Biden’s relief package

* EU diplomat tells Russia ties are low over case of Kremlin critic Navalny

* US warship sails near Chinese-controlled Paracel Islands

* Bank of England says negative interest rates may be near

* US job cuts rose to highest January total since 2009

* US factory orders rose in December–eighth straight monthly gain

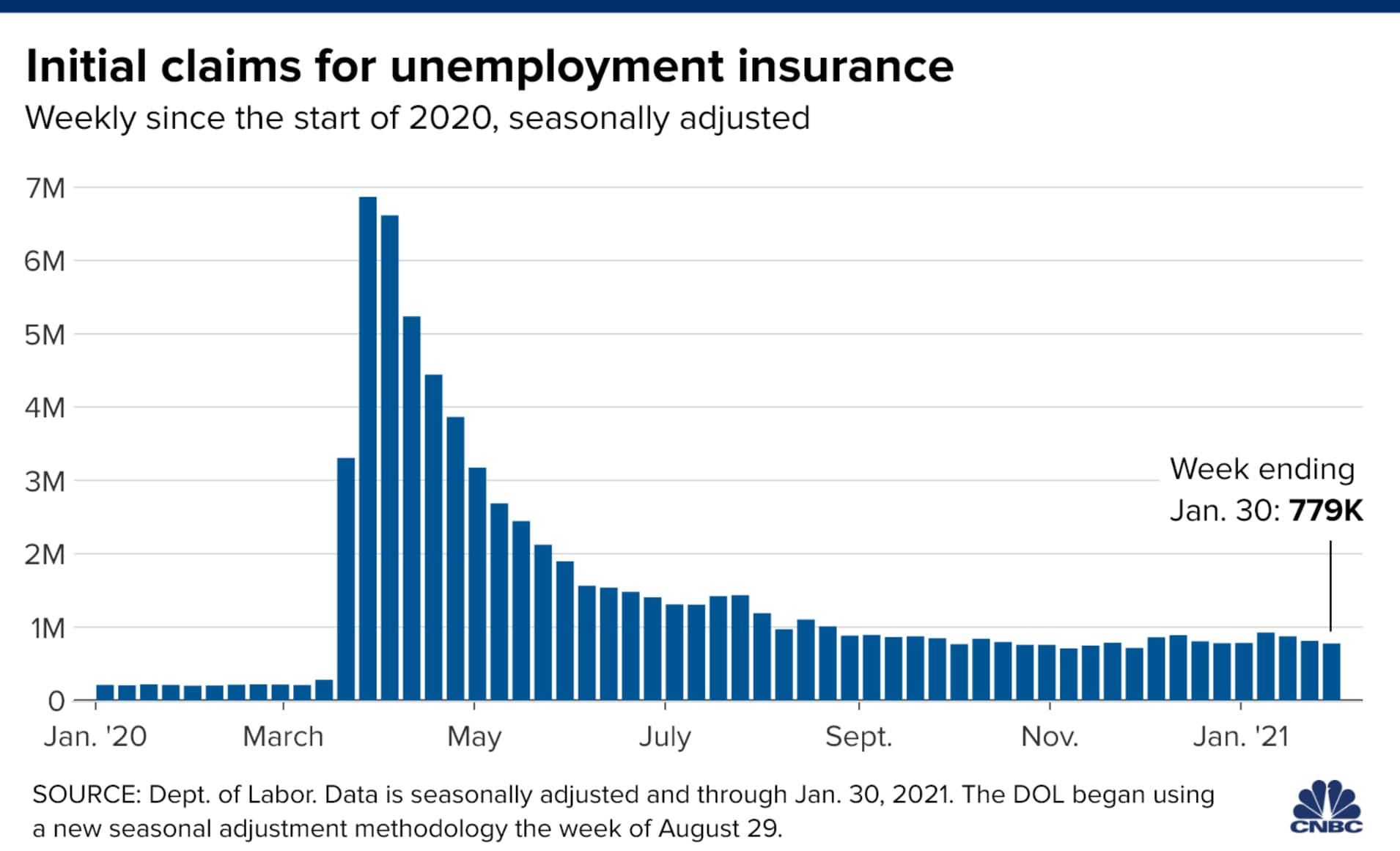

* US jobless claims fell to two-month low last week:

Year-To-Date Equity Leaders: Asia ex-Japan, Small Caps And Energy

The year is still young, but not too young to see trends that could define 2021 for leaders and laggards in US and world equity markets. Reviewing a set of exchange traded funds as proxies highlights three key trends that deserve monitoring: leadership in energy shares, small-cap stocks and markets in Asia ex-Japan.

Macro Briefing: 4 February 2021

* Researchers explore mixed vaccine shots as COVID-19 variants surge

* House GOP keeps Liz Cheney in leadership, rebuking Trump loyalists

* Treasury yield curve at steepest level since 2017

* Biden pushes ahead on his proposed $1,400 stimulus checks

* Survey: nearly 70% of Americans support Biden’s $1.9 trillion relief plan

* Global economic rebound slowed for a third month in January

* Is tighter liquidity in China a new global headwind?

* Sen. Klobuchar (D-Minn.) unveils sweeping antitrust reform bill

* Lazy investing strategy has been a winning strategy

* US Services PMI indicates “sharp upturn in business activity” in January

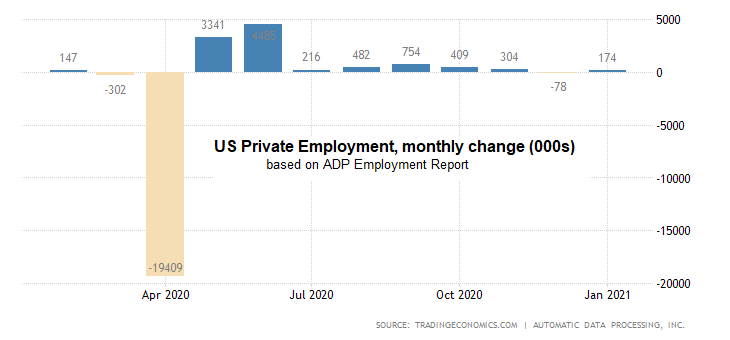

* US private payrolls rebounded modestly in January after December decline:

Should You Manage Tech Stocks As A Distinct Asset Class?

It’s a tempting idea, and one that’s been bubbling for some time. The recent outperformance of tech stocks relative to the broad equity market has helped fuel the notion that this sector deserves to be treated differently.

Macro Briefing: 3 February 2021

* Senate Dems may pass Biden’s relief package without GOP support

* Today’s ADP estimate of US payrolls for Jan expected to post slight gain

* Jeff Bezos will step down as Amazon CEO

* Eurozone consumer inflation rebounded much more than expected in January

* Europe’s economy continued to contract in January amid weak services sector

* China’s services sector growth slowed in January amid coronavirus resurgence

* US crude oil (West Texas Intermediate) rises to nearly $55 a barrel, a 1-year high:

Risk Premia Forecasts: Major Asset Classes | 2 February 2021

The expected risk premium for the Global Market Index (GMI) continues to hold in the mid-5% range. In today’s revision, the long-run projection ticked down to 5.4% for January, slightly below the previous month’s 5.5% estimate. The forecast is a long-term outlook for this multi-asset-class index’s performance over the “risk-free” rate via a risk-based model (details below).

Macro Briefing: 2 February 2021

* GOP pushes Biden to embrace smaller relief bill

* China’s top diplomat warns US not to cross ‘red line’ on human rights issues

* Mynamar coup complicates Biden’s Asia strategy

* CBO projects that US economic expansion will continue in 2021

* US construction spending rose for a third month in December

* Eurozone economy contracted 0.7% in final quarter of 2020

* US Manufacturing PMI reaches record high in January

* US ISM Manufacturing Index: sector growth slowed in January: