Stocks in emerging markets continued to lead the major asset classes in January as the top monthly performer.

Continue reading

Category Archives: Uncategorized

Macro Briefing: 1 February 2021

* Biden invites Republican senators to White House for relief talks

* Myanmar’s military seizes power and detains civilian leader Aung San Suu Kyi

* Russia arrests thousands amid protests over jailed opposition leader Navalny

* Reddit investor mania turns to precious metals

* China’s economy expected to overtake US earlier than previously forecast

* China manufacturing growth slowed, sliding to 7-month low in Jan

* Eurozone manufacturing growth remained “resilient” in January

* UK manufacturing growth slowed to 3-month low in January

* US Consumer Sentiment Index stabilized in January via slight decline

* Chicago region factory activity continued rising at strong pace in January

* How might US cryptocurrency regulation change with the Biden administration?

* US pending home sales fell in December–fourth straight monthly decline

* US consumer spending fell for a second month in December:

Book Bits: 30 January 2021

● The Inflation Myth and the Wonderful World of Deflation

● The Inflation Myth and the Wonderful World of Deflation

Mark Mobius

Summary via publisher (Wiley)

The Inflation Myth and the Wonderful World of Deflation illustrates our rapidly changing world where constant technological innovation leads to cheaper and better products. These changes are no longer reflected in the ways we measure inflation. Renowned investor and author Mark Mobius persuasively argues that what we believe to know about inflation today does not reflect the reality any longer. It is a myth, a legend, a fable, and, yes, a falsehood for a number of reasons.

The ETF Portfolio Strategist: 29 Jan 2021

In this issue:

- Risk-off returns to global markets

- No place to hide in the strategy benchmarks this week

- Managed-risk strategies suffered too

A rough way to end January: Markets around the world took it on the chin this week. Commodities and Treasuries managed to edge higher, but otherwise it was red ink across the board for our ETF proxies representing the major asset classes.

New Research Tries To Solve For Beta Risk’s “Failure” For Stocks

At the core of modern finance is the proposition that beta (market) risk is the dominant factor that drives performance. But numerous empirical tests of the capital asset pricing model (CAPM) over the decades suggest otherwise. There have be various attempts to adjust CAPM to find a closer mapping of risk and return, but the results have been mixed. Perhaps two new research papers move us closer to the elusive goal of revising a CAPM-based view of asset pricing so that its theoretical ideal for risk and return moves closer to empirical results in money management practice.

Macro Briefing: 29 January 2021

* Democrats plan to ‘act big’ on Covid-19 rescue plan, with or without GOP

* Novax vaccine is 90% effective, but far less so against Covid-19 variants

* US consumer income likely rose and spending fell in today’s December report

* Is a new currency war brewing for Treasury Sec. Janet Yellen?

* General Motors plans to sell only zero-emission cars by 2035

* US economy rose 4.0% (annualized) in Q4, modestly slower than expected

* US Leading Economic Index rose in December, but at slower pace vs. November

* German economy eked out a tiny gain in last year’s fourth quarter

* New US home sales rose in December–first increase since July

* Trade deficit for US narrowed in December

* US jobless claims up less than expected but remain unusually high:

Energy Stocks Have Rallied In 2021. Will It Last?

Shares in the energy patch took a beating in 2020, but this slice of US equity sectors has posted a strong rebound so far in 2021, based on a set of exchange traded funds. Encouraging, but it’s unlikely that stocks in the conventional realm of energy are gearing up for an extended bull run.

Macro Briefing: 28 January 2021

* Biden pauses oil drilling on federal lands amid focus on climate change

* China issues new warning on Taiwan via increasingly belligerent tone

* Sec. of State Antony Blinken criticizes Russia’s treatment of Alexei Navalny

* Biden administration reviewing US weapons sales to Gulf Arab states

* US Q4 growth expected at 4%-plus annual pace in today’s Q4 GDP report

* Wave of US store closures in 2021 due to Covid-19, research group predicts

* Can vaccines eliminate coronavirus? Maybe not

* Fed leaves rates near zero, says economic growth has slowed

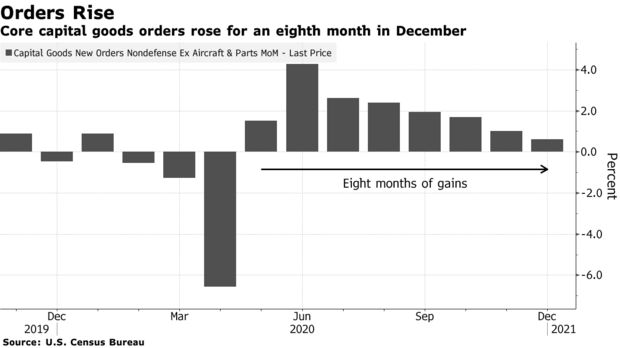

* US core capital goods orders rose for eighth straight month in December:

Making Sense Of Diverging Real And Nominal Treasury Yields

The US Treasury market is confused, or so it appears. While nominal yields have been rebounding recently, real (inflation-adjusted) rates keep falling, plumbing deeper into the sub-zero realm. One of these trends will eventually break and fall in line with the other. Which one will cry “uncle” first? The answer probably resides with how the incoming inflation data shakes out in the months ahead.

Macro Briefing: 27 January 2021

* Senate vote suggests Trump won’t be convicted in impeachment trial

* Surge in household savings point to strong economic recovery this year

* Pfizer is developing booster shot to protect against coronavirus variants

* Biden raises election meddling in call to Russia’s Putin

* Fed expected to maintain its aggressive stimulus at today’s FOMC meeting

* US Consumer Confidence Index rose modestly in January

* German consumer confidence weakens amid new coronavirus restrictions

* Mid-Atlantic manufacturing growth slows in January

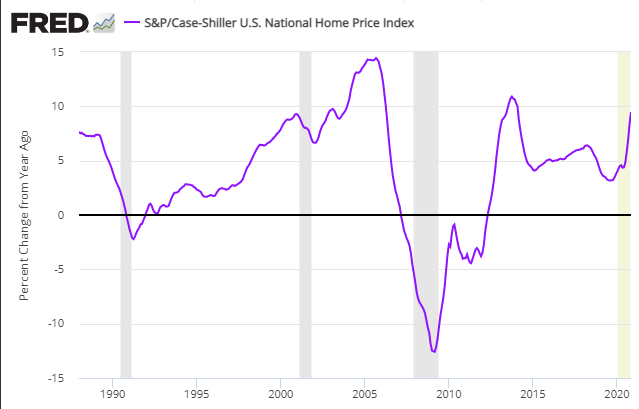

* US home prices rose 9.5% year-over-year in November–highest pace in 7 years: