Recent history has been humbling for nearly every corner of portfolio management. There are exceptions, of course. Several managed futures ETFs, for example, have been relatively stable in the recent market correction. But extreme stress has afflicted most corners of the financial markets, which in turn has unleashed unexpected challenges for many portfolio strategies.

Category Archives: Uncategorized

Macro Briefing | 23 April 2020

The grim calculus for deciding when to reopen the economy: NY Times

US jobless claims expected to rise 4.5 million in today’s report: USA Today

Trump signs order to suspend immigration: Bloomberg

Eurozone PMI: “unprecedented collapse of Eurozone economy” in April: IHS Markit

Record decline in UK economic output in April amid public health crisis: IHS Markit

Japan’s economic decline intensified in April via PMI survey data: IHS Markit

Bankruptcy threatens US energy industry after supply/demand shock: Reuters

A closer look at IMHE’s widely cited Covid-19 forecasting model: Quartz

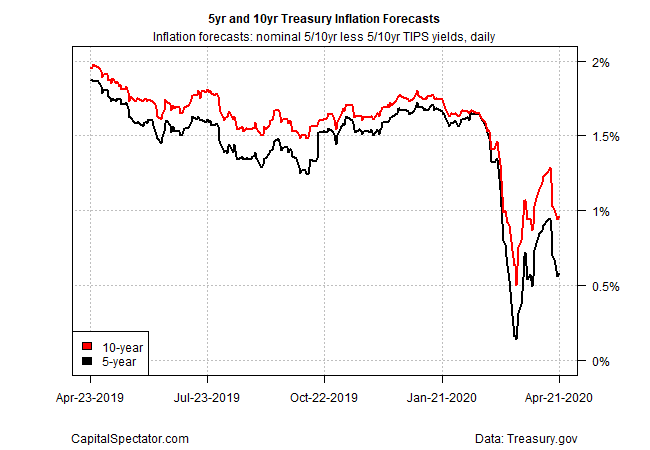

Treasury market’s implied inflation outlook is below 1% for 5- and 10-yr maturities:

Health Care Stocks Lead This Year For US Equity Sector Returns

Every sector of the US stock market has lost ground so far in 2020, but the dispersion of results is wide and health care shares have lost considerably less than the rest of the field, based on a set of exchange-traded funds.

Macro Briefing | 22 April 2020

Senate passes coronavirus bill for small business: CNBC

Oxford University’s coronavirus vaccine may start human trials this week: MW

CDC director warns that a 2nd coronavirus could strike next winter: CNN

Federal gov’t response to coronavirus still falls short of what’s needed: Politico

Trump promises to save oil industry after epic price collapse: CNN

Collapse in oil prices is a warning for stocks markets and economies: FT

Dramatic slide in oil prices will hit hard in US oil patch economies: WSJ

US-China tensions rise in disputed waters of South China Sea: NY Times

How many department stores will survive coronavirus shock? ‘Very few’: NY Times

US existing home sales fell sharply in March: CNBC

Are daily death tolls for coronavirus peaking? FT

Next Week’s Q1 GDP Data Expected To Show US Recession’s Start

There had been hope that the coronavirus-triggered recession that’s now roiling the US economy wouldn’t show up in the data until the second quarter. But recent updates for March have smashed that idea and so next week’s initial estimate of Q1 GDP is on track to post a loss, based on several nowcasting models and survey results compiled by CapitalSpectator.com.

Macro Briefing | 21 April 2020

Trump says he’s temporarily suspending immigration due to coronavirus: CNBC

Oil futures fall below $0 as demand collapses: WSJ

Global hunger set to double this year due to coronavirus: Reuters

Congressional leaders still negotiating deal for small biz relief: BBG

States quickly depleting funds targeted for laid-off workers: WSJ

Health of N. Korea’s leader, Kim Jong Un, draws US attention: CNN

Chicago Fed Nat’l Activity Index (3mo avg) signaled deep recession for March: CF

US Stocks Led Rebound In Global Equities Last Week

For the first time since February, shares of US companies rose for a second calendar week through the close of trading on Apr. 17. The rally echoed similar gains in foreign shares, based on a set of exchange-traded funds.

Macro Briefing | 20 April 2020

Protests against coronavirus restrictions spread across US: Reuters

US governors: testing still isn’t enough to lift restrictions: CNN

Have US markets priced in risk of a second wave of infections? CNBC

Treasury Sec. and Democrats: close to small-business funding agreement: WSJ

Oil prices resume decline, falling below $15 a barrel — 21-year low: CNBC

US Leading Economic Index in March suffered largest monthly loss in 60 years: CB

Gov Cuomo: NY appears ‘past the plateau’ of coronavirus cases: NY Times

Global gov’t spending as % of economy reaches highest since World War II: FT

Book Bits | 18 April 2020

● The Money Hackers: How a Group of Misfits Took on Wall Street and Changed Finance Forever

By Daniel P. Simon

Summary via publisher (HarperCollins)

Every day, businesses, investors, and consumers are grappling with the seismic changes technology has brought to the banking and finance industry. The Money Hackers is the dramatic story of fintech’s major players and explores how these disruptions are transforming even money itself.

Whether you’ve heard of fintech or not, it’s already changing your life. Have you ever “Venmoed” someone? Do you think of investing in Bitcoin-even though you can’t quite explain what it is? If you’ve deposited a check using your iPhone, that’s fintech. And if you’ve gone to a bank branch and discovered it has been closed and shuttered for good, odds are that’s because of fintech too. The Money Hackers focuses on some of fintech’s most powerful disruptors — a ragtag collection of financial outsiders and savants-and uses their incredible stories to explain not just how the technology works, but how the Silicon Valley thinking behind the technology, ideas like friction, hedonic adaptation, democratization, and disintermediation, is having a drastic effect on the entire banking and finance industry.

Continue reading

US Business Cycle Risk Report | 17 April 2020

The economic data is catching up with reality, although the gap between the formal reports and what’s unfolding in the real world remains huge. For the high-frequency numbers that capture the blowback from the coronavirus in close to real time, the results are painfully clear. In particular, the soaring applications for jobless claims in recent weeks speaks volumes about the economic rampage that’s unfolding across America. In the past four weeks, more than 22 million workers have lost jobs—a loss that reverses all the employment gains in the past decade.