Trump outlines guidelines for states to emerge from shutdown: Reuters

US coronavirus deaths spiked higher on Thursday: WSJ

Experimental drug for treating coronavirus offers encouraging test results: STAT

US-China economic breakup more likely as coronavirus crisis rolls on: WSJ

France’s Macron warns of EU’s collapse as ‘political project’: FT

The sharp economic downturn in China is a warning for the world: NY Times

US housing construction fell sharply in March: Bloomberg

Philly Fed Mfg Index falls to lowest reading ever in April: Philly Fed

US jobless claims continued to rise by the millions last week: CNBC

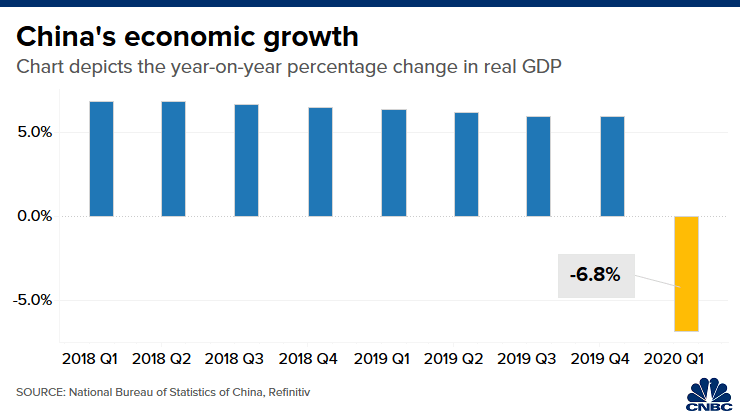

China’s economy contracts by a hefty 6.8% in the first quarter: CNBC

Category Archives: Uncategorized

Is A ‘V’ Recovery Still Possible For The US Economy?

The deep recession triggered by the coronavirus is the worst downturn since the Great Depression, but the hope is that the rebound will be equally swift and strong–a ‘V’ recovery. Unfortunately, the outlook for this best-case scenario is precarious.

Macro Briefing | 16 April 2020

Global debt is soaring, posing a risk after pandemic fades: WSJ

Surge in US jobless claims filings expected to continue in today’s update: Reuters

Fed’s Beige Book paints grim economic profile for US: Barron’s

Business inflation expectation fell sharply in April: Atlanta Fed

US industrial output plummets 5.4% in March–biggest decline since 1946: MW

NY Fed Mfg Index falls to a record low in April: NY Fed

Homebuilder sentiment posts biggest monthly decline in data’s 35yr history: CNBC

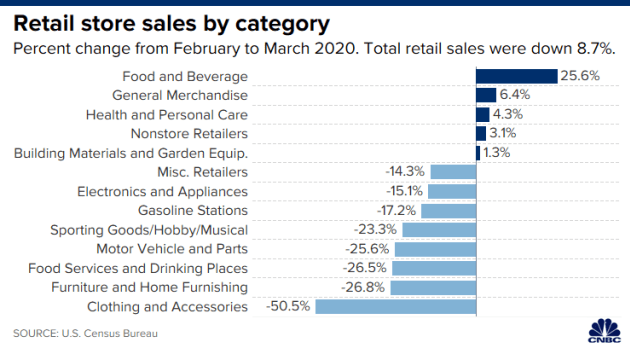

US headline retail sales collapsed in March although some segments rose: CNBC

Long Treasuries Continue To Enjoy Monster Gains In 2020

The extraordinary gains in long Treasuries so far this year is a sight to behold. In the rush to safety this year, US debt has been a clear winner and within this space long maturities have left the rest of the fixed-income realm in the dust, based on a set of exchange-traded funds through yesterday’s close (Apr. 14).

Macro Briefing | 15 April 2020

Trump suspends US funding for World Health Organization: Politico

US resists IMF plan to support emerging economies’ finances: FT

IEA estimates that a decade of oil-demand growth will evaporate in 2020: CNBC

Social distancing may need to last longer than widely expected: Reuters

IMF expects worst global recession since Great Depression: NY Times

Record drop expected for retail sales in today’s report for March: Reuters

Gold rises to 8-year high: Bloomberg

Managed Futures ETFs Are Having A Good Year So Far

There have been few places to hide from this year’s dramatic crash in stock markets around the world. Cash, US Treasuries and a select group of government bonds in foreign markets have been a rare source of safety. For funds that held risk assets, managed futures strategies have also been an island of calm, at least for some portfolios, including several of the largest ETFs in this niche.

Macro Briefing | 14 April 2020

Governors of 10 states announce plans for gradual economic reopenings: Reuters

US economic reopening expected to be slow and tenuous: WSJ

Fed’s plan to favor certain cities for relief funding draws criticism: FT

Advanced economies on track for deeper slump vs. 2008 crisis: Bloomberg

Coronavirus-earnings season starts with today’s update from JP Morgan: CNBC

Treasury Dept: first round of coronavirus checks have been sent: USA Today

Economic pain will linger longer after economy reopens: NY Times

Is Texas in play for Nov election after state’s economic troubles? Politico

Treasury market’s inflation expectations continue to snap back:

US REITs Led Last Week’s Broad-Based Rebound

Most of the major asset classes mounted a strong rebound in the shortened trading week through Thursday, Mar. 9, led by US real estate investment trusts (REITs), based on a set of exchange-traded funds. The lone exception: broadly defined commodities, which continued to slump.

Macro Briefing | 13 April 2020

Dr. Fauci: ‘cautious optimism’ that US coronavirus outbreak is slowing: CNBC

China’s new daily coronavirus cases rise to nearly 6-week high: Reuters

China imposes restrictions on publication of coronavirus research: CNN

Trump eyes reopening US economy but governors have the authority: USA Today

Minneapolis Fed President: US economic rebound could be ‘long, hard road’: CNBC

OPEC, Russia and US sign off on cut in oil production cut: Reuters

Goldman Sachs predicts that US stocks have seen their lows: Bloomberg

US consumer prices fell 0.5% in March–biggest monthly fall in 5 years: CNBC

US Coronavirus Deaths Appear To Peaking For Daily Changes

We’ve seen this movie before, only to learn otherwise with subsequent updates. But maybe it’s the real deal this time. The daily change for Covid-19 fatalities in the US is showing renewed signs of trending lower, based on data through Apr. 12, according to numbers published this evening by Johns Hopkins. As always, it’ll take several days at the least before we can even begin to take the shift seriously. Meantime, there’s bad news to consider: the apex for the sum of cumulative fatalities is still nowhere on the immediate horizon. But if the downturn in the daily change persists, the fatalities may be close to flat-lining.

Continue reading