Recession forecasts continue to swirl in some corners of the economics profession, but early econometric estimates for third-quarter GDP data suggest that the expansion will persist for now.

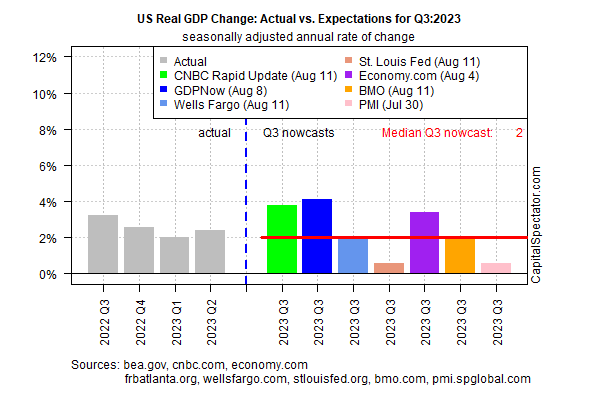

US output for the July-through-September period is expected to rise 2.0% for GDP’s seasonally adjusted annualized change, based on the median estimate via several sources compiled by CapitalSpectator.com. This nowcast marks a modest dip from the Q2’s 2.4% increase, but it’s fair to say that today’s Q3 estimate suggests that the start of the next NBER-defined recession is a low risk event for the current quarter.

The main caveat: it’s still too early in the quarter to take the current nowcasts too seriously. In other words, there’s a long road of data releases ahead until the Bureau of Economic Analysis publishes its initial Q3 GDP report on Oct. 26.

Meantime, the 2.0% median nowcast for Q3 implies that cautious optimism is warranted for expecting the US economy’s recent resiliency to endure for the near term.

A growing list of economists agree, Bloomberg reports. “An increasing number of economists — including the Federal Reserve’s own staff — are predicting the US will escape a recession, though it’ll be well into 2024 before anyone can be sure of it.”

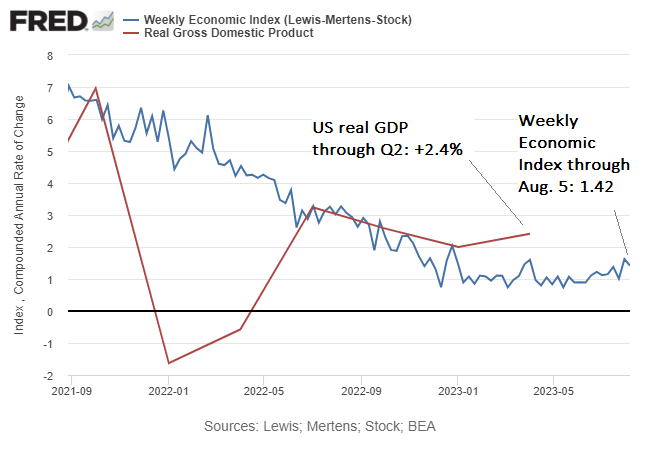

Several real-time business-cycle indicators also suggest that the expansion persists through Q3’s first month. The New York Fed’s Weekly Economic Index estimates that growth has eased since Q2, but the pace still looks strong enough and sufficiently stable to keep recession forces at bay for the immediate future.

The Philly Fed’s ADS Index also paints a relatively upbeat profile for the US economy through Aug. 5. The current reading indicates that current conditions are only slightly below average and that recession risk is still low.

Looking further out, into Q4 and beyond, is a far more speculative affair. As for Q3, the current numbers strongly advise that whenever the next recession begins it’s probably not going to claim Q3 as a start date.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report