Looking for robust diversification opportunities in equity risk factors has turned up modest and sometimes disappointing results in recent years in broad-brush terms and it’s only gotten worse in the pandemic. The question is whether the worst has passed? Possibly, although the outlook remains cautious at best. Let’s dig into the numbers for some details.

Recall that the goal is to decompose broad stock market beta into several flavors of the risk premia that, in the aggregate, capture the overall footprint of the asset class while dispensing lower risk, higher return or some combination of both vs. holding, say, the S&P 500 Index. By rebalancing the mix, it’s possible to exploit the natural ebb and flow of factors so that 1+1=3. That, at least, is the theory. Not surprising, it’s a tall order and putting it into practice and reaping substantial benefits is no mean feat.

To be fair, some slices of the various equity factors do outperform the broad market in absolute and risk-adjusted terms. But there’s also plenty of underperformers. Overall, it tends to be a wash and so simply holding everything and rebalancing back to a quasi-market weights probably won’t provide much value-added performance and/or risk reduction. You’ll almost certainly need to do more.

That leads to the main event: Which equity factors do you favor, which ones do you pan, and when? Like any attempt at deconstructing a broadly defined beta footprint and timing the choices, the answers are warm and fuzzy in real time.

“A multi-factor strategy is placing a lot of bets,” says Josh Russell, an analyst at Franklin Templeton Investment Solutions. “If all of these collapse into one unidirectional bet, you really lose your edge.”

The Bloomberg article that quotes Russell also presents data that shows that equity factor strategies “are failing to live up to their diversification label in an era when recession-spurring lockdowns, rally-inducing stimulus and game-changing vaccines are all moving markets.” The smoking gun: “Factor correlations have risen to the highest in at least two decades.”

As one example, strategists at Bernstein show that rolling six-month pairwise correlations of global long-short returns for four factors (value, quality, growth and momentum) are at two-decade highs. (Note: correlations range from +1.0, which is perfect positive correlation, to 0.0 or no correlation, and -1.0 perfect negative correlation.)

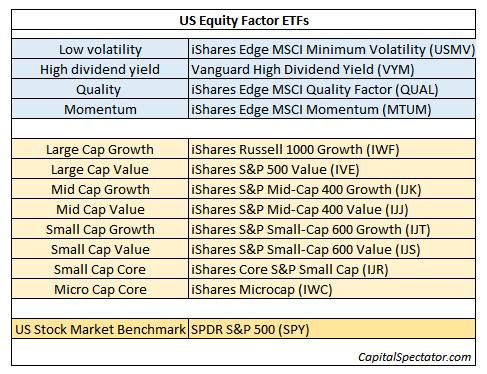

Keep in mind that you can show different results by changing the rolling period, measuring returns on a long-only basis and tweaking the factor list, to name a few of the possible adjustments that are standard fare with analytical explorations in this niche. With that in mind, let’s run the numbers from a different perspective by using a set of ETFs as proxies for the opportunity set:

Before we run the analysis in R, we’ll process the raw returns by subtracting a “risk-free” rate from the ETF performances. Representing the risk-free return: iShares Short Treasury Bond (SHV).

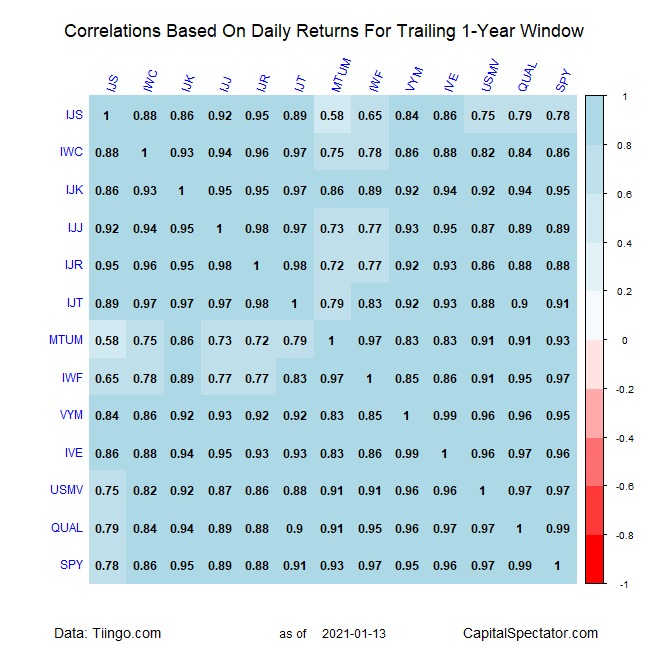

As a starting point, the chart below shows the median correlation of all the pairwise correlations for the ETFs in the table based on a rolling one-year window (252 trading days) through yesterday’s close (Jan. 13). It’s clear that correlations recently spiked, courtesy of the initial coronavirus shock last spring. Despite the best efforts of slicing and dicing equity factors, the market beta component overwhelmed those efforts and stocks of every stripe took a beating when the world shifted to risk-off in the extreme last March and April.

Let’s sort out the details in the table below, which shows all the pairwise combinations for tailing one-year window via daily returns. The good news is that there are some encouraging results. The lowest correlation is 0.58 for momentum (MTUM) and small-cap value (IJS). Mid-cap value (IJJ) and large-cap growth (IWF) also post a relatively modest correlation: 0.77.

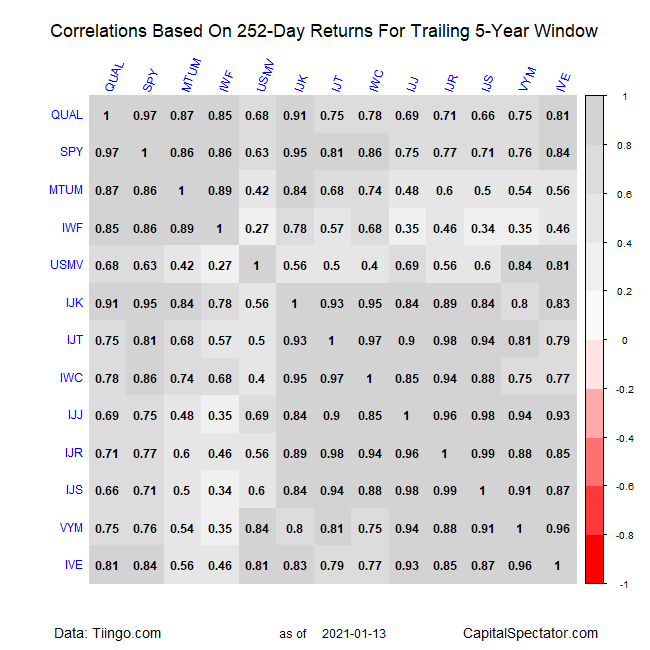

Not surprisingly, the numbers change if we change the parameters. For instance, moving further out on the time window to one-year returns over the trailing 5-year period delivers the following:

On this basis, the opportunities look more encouraging. Indeed, the lowest correlation for the five-year window falls to just 0.27, once again for momentum (MTUM) and small-cap value (IJS). for momentum (MTUM) and large-cap growth (IWF).

It’s fair to say that it’s still premature to dismiss the idea that building an equity portfolio with factor building blocks has run out of road. As the numbers above suggest, the opportunities may fading and in short supply, but (at the risk of testing your tolerance for metaphor) the well has yet to run dry in this corner.

Nonetheless, the marketplace of equity factors is relatively efficient (most of the time) and so the best results on this front will likely deliver modest advantages over the broad market. There are just too many investors fishing in this lake (there I go again) to expect blowout results after adjusting for risk. But if you’re willing to put in the work and tolerate the not-trivial possibility of high tracking error vs. the market overall, you can find some degree of pay dirt (sorry) here. But be warned: your odds of success, which were never particularly higher in the best of circumstances, have slumped recently.

The good news: correlations aren’t static and what goes up tends to come down and it appears that the recent surge is pulling back. For some factor pairs, the potential diversification payoff could be substantial in 2021 and beyond. But it’s hardly a free lunch since the price tag for earning market-beating results is directly related to how far you’re willing to deviate from the standard equity market portfolio? For the average investor, it’s not an enticing proposition. That leads to the standard question: Are you average? If not, what does that imply? One possibility: customize your equity factor allocation.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Mr. Picerno:

You state: “On this basis, the opportunities look more encouraging. Indeed, the lowest correlation for the five-year window falls to just 0.27, once again for momentum (MTUM) and small-cap value (IJS).”

I am wondering if the text is in error. It appears from the table that IWF and USMV show the 0.27 correlation.

DanM,

You are correct: I goofed. The 0.27 correlation, the lowest in the 5-year table, is for MTUM and IWF, which is large-cap growth. The IJS reference here is wrong. Apologies. I’ve corrected this portion of the text in the article. Thanks for alerting me and readers!

–Jim

Pingback: Robust Diversification Opportunities in Equity Risk Factors Has Been Modest - TradingGods.net