The Wall Street Journal’s Jon Hilsenrath — considered to be one of the most “well-connected” Fed reporters — writes today that “A Bad Jobs Report Still Might Not Shake Fed’s View.” In other words, today’s payrolls data from the Labor Department that’s scheduled for release later this morning at 08:30 am eastern isn’t likely to derail the central bank’s plans to start raising interest rates—perhaps as early as next month. Nonetheless, the near-term outlook for the timing of tighter monetary policy remains cloudy, based on the mixed signals in Treasury yields.

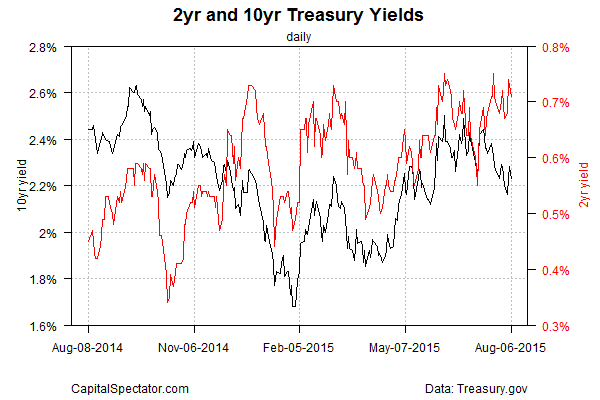

On the one hand, the 2-year yield is looking relatively firm these days. Considered as the most sensitive spot on the yield curve for rate expectations, this yield ticked down to 0.71% yesterday (Aug. 6), according to Treasury.gov data. But that’s still close to the recent high of 0.75% in late-July. The benchmark 10-year yield, by contrast, has been sliding lower in recent weeks, dipping to 2.23% yesterday—close to a two-month low.

Meanwhile, the Treasury market’s implied inflation forecasts (nominal less inflation-indexed yields) continue to trend lower. Indeed, inflation estimates for the 5- and 10-year yields are currently at the lowest levels since March. Using these estimates as a guide, the prospects for a near-term rate hike appear quite low.

Turning to yield momentum, the 2-year Note continues to trend higher, based on exponential moving averages (EMAs). This trend is Exhibit A for those making the case that a rate hike is close at hand.

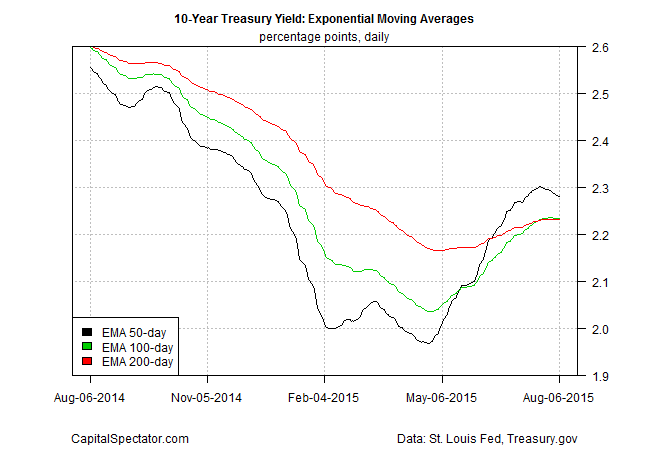

But the trend looks a bit softer via the 10-year yield. In particular, the 50-day EMA for the 10-year yield is inching lower these days and the 100-day EMA is having a tough time rising above the 200-day EMA. In short, upside momentum looks a bit shaky when measured by the 10-year yield.

“In a classic risk-off move, investors are selling equities and buying bonds,” Goldman Sachs advised in a research note yesterday. “It is this uncertainty around [Fed] timing that may – in part – be responsible for the risk aversion we’re seeing [on Thursday].”

The question is whether today’s jobs report will help clarify the outlook, one way or the other? Stay tuned…