Bloomberg reports that “one of Wall Street’s biggest bulls” has cooled on consumer stocks and is shifting to energy shares: “Thomas Lee, managing partner at Fundstrat Global Advisors, has opted to upgrade energy to overweight while downgrading the consumer discretionary sector, citing rising labor costs and the inverse relationship between energy and consumer-oriented stocks over the past decade and a half.”

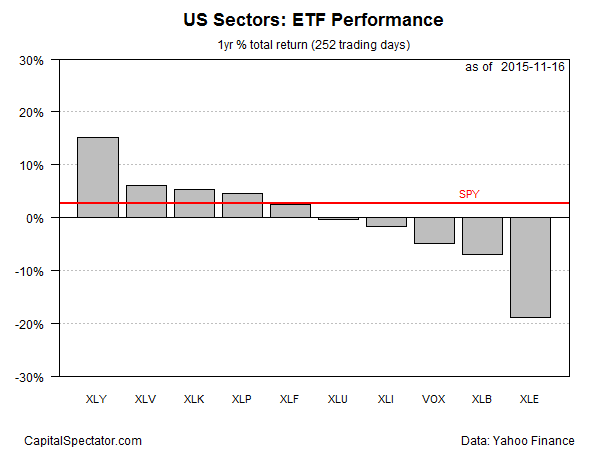

Meantime, Mr. Market still holds a favorable view of consumer shares, or so it seems based on trailing one-year total return data for a set of ETF proxies. The Consumer Discretionary SPDR ETF (XLY) continues to hold on to its sizable performance edge over the rest of the field among the major sectors for the US stock market. As for energy shares, the Energy SPDR ETF (XLE) is still in last place for trailing one-year return, although this ETF continues to trade above its 50-day moving average. Is that a sign that the long-battered energy sector has bottomed? At least one high-profile investor is inclined to agree at the moment.

As for the rear-view mirror, XLY, which holds consumer-focused stocks such as Amazon and Walt Disney, still enjoys a comfortable lead in the one-year return category. The ETF is ahead by more than 15% for the 12 months through yesterday (Nov. 16). Energy may be headed higher, but from a trailing one-year perspective XLE is still in the hole by nearly 19%. The US market overall, based on the SPDR S&P 500 ETF (SPY), is up a modest 2.7% through yesterday over the past year.

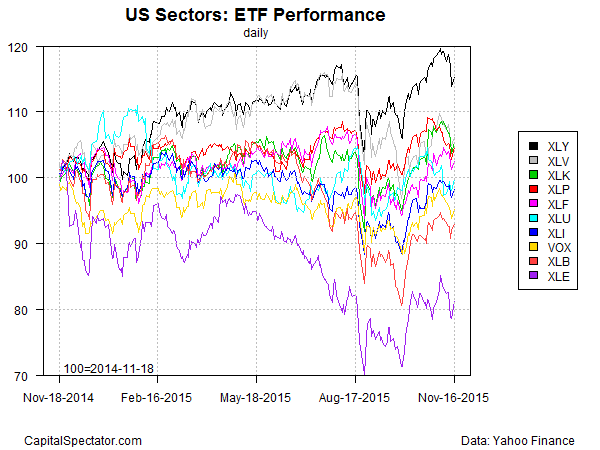

The lead in consumer discretionary shares is quite striking when we re-index all the sector ETFs to a value of 100 as of Nov. 18, 2014. As you can see in the chart below, XLY (black line at top of chart) has no obvious challengers at the moment. As for energy shares, XLE is still deep in the red at the bottom of the chart (purple line), although it’s been showing hints of a rebound lately.

XLE’s current momentum looks relatively encouraging, at least when compared to its dismal trend up until a few months ago. It’s anyone’s guess if we’re looking at a dead-cat bounce or the start of a new bullish trend. In any case, there’s a whiff of revival swirling about energy shares these days, in part because XLE continues to trade above its 50-day moving average. A refreshing bit of change, although one reason for reserving judgment is the fact that prices over a longer stretch still look weak, as suggested by the still-negative reading for the current price vs. the 200-day average.

Yesterday’s sharp rise in energy shares, however, implies that there’s a growing case for optimism for these stocks. Can it last? A number of analysts suggest as much, according to Bloomberg:

Barclays believes an entrance into a new regime for the stock market in tandem with interest rate liftoff from the Federal Reserve will prove to be supportive of energy stocks, and boosted the sector to overweight. The commodity team at Barclays anticipates that Brent crude will recover to roughly $70 per barrel by the end of next year.

Bank of Montreal chief investment strategist Brian Belski also recently upgraded energy to market weight from underweight, saying that the space had reached “peak negativity.”

For additional research on the sector ETFs cited above, here are links to the summary pages at Morningstar.com:

Consumer Discretionary (XLY)

Consumer Staples (XLP)

Energy (XLE)

Financial (XLF)

Healthcare (XLV)

Industrial (XLI)

Materials (XLB)

Technology (XLK)

Utilities (XLU)

Telecom (VOX)

Pingback: 11/17/15 – Tuesday’s Interest-ing Reads | Compound Interest-ing!

Pingback: Weighing The Week Ahead: What Are The Best Year-End Investments? | OptionFN

Pingback: What are the best year-end investments?

Pingback: What I’m Reading | Adam Chudy.com