* Biden set to announce of additional oil reserve sales to reduce gas prices

* Central banks will continue to raise rates to fight inflation, predicts Nordea

* Inflation in Britain rose 10.1% n September–a 40-year high

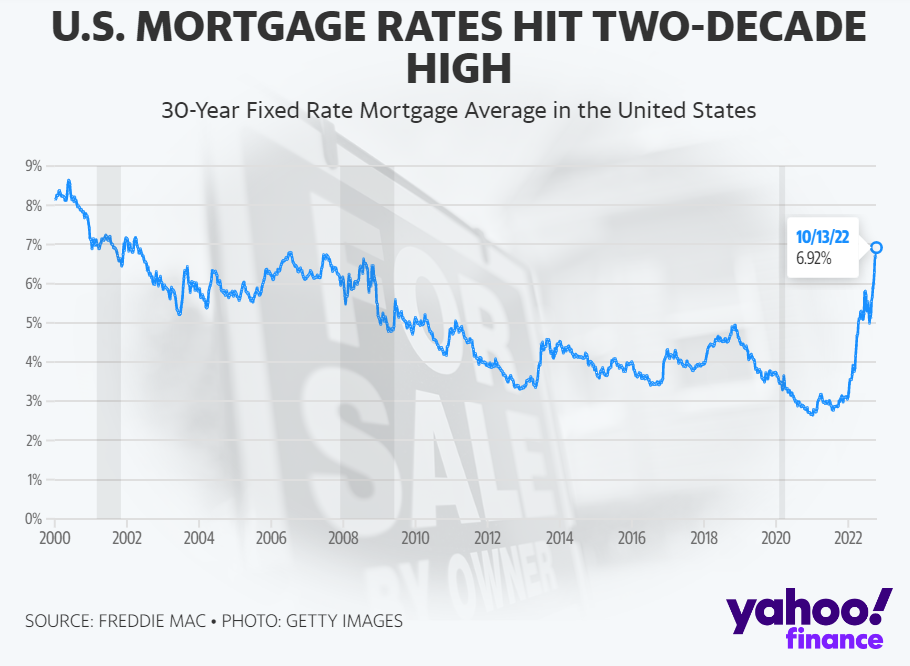

* US homebuilder sentiment falls to 2-1/2 year low in October

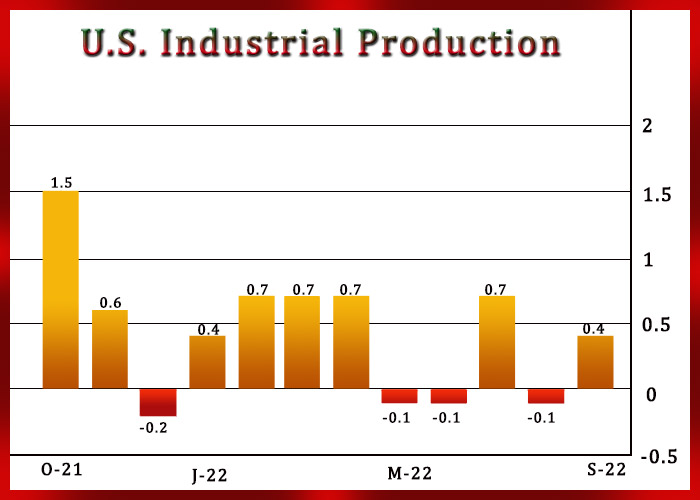

* US industrial production rebounds more than expected in September:

High factory utilization rate in US is a factor that’s supporting high inflation. Tuesday’s release of September data show the utilization rate for manufacturers edged up to 80% in September. “Strong manufacturing capacity utilization is adding to inflationary pressures in the US economy,” says Bill Adams, chief economist at Comerica Bank. “The Fed will see this industrial production report as another reason to go full speed ahead with its tightening plans.”

The delay of key economic reports for China raises new warning flags about the country’s economy. Postponing the publication of GDP data “does show the primacy of politics in influencing the very competent, institutional technocracy that China has,” says Victor Shih, a China analyst of politics and finance at the University of California, San Diego. “The very likely reason the numbers were delayed was the State Council leaders were afraid the numbers would detract from the triumphant tone of the party congress.” Taisu Zhang, a Yale University law professor who studies legal and economic history, adds: “I don’t know if they are massaging the numbers — even if they need to massage the figures, the better thing to do would be to massage them within the usual time frame.”

Fitch sees a 1990-style mild recession for the US by the spring of 2023. “The US recession we expect is quite mild,” economists at the credit ratings agency advise. “US household finances are much stronger now than in 2008, the banking system is healthier and there is little evidence of overbuilding in the housing market.”

US mortgage rates may rise further following the recent surge, predicts a housing economist. “We are seeing consumer prices continuing to remain elevated and continue growing. I don’t see the Fed being successful this year in putting a dent in inflation come December,” says George Ratiu, senior economist and manager of economic research at Realtor.com. “That tells me that we are potentially looking at a 7.50% as the next threshold. What happens beyond that remains in the hands of the Fed.”