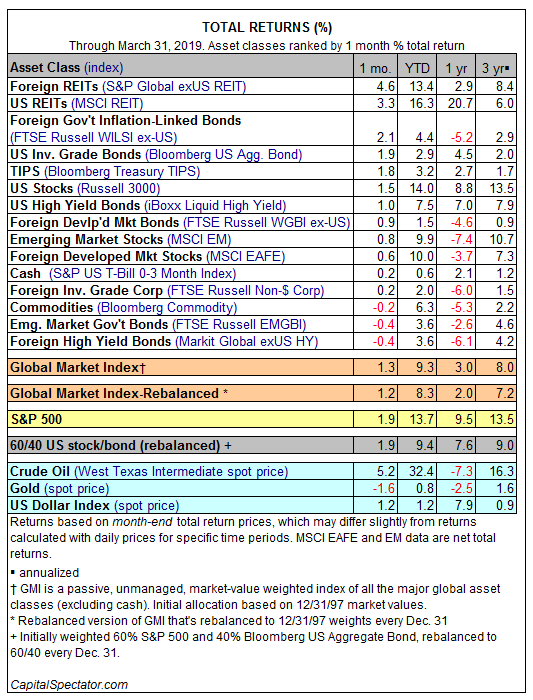

Property shares dominated the broad-based performance gains for the major asset classes in March. Foreign real estate securities led the rally last month, closely followed by US-listed property linked stocks. The only slices of global markets that retreated: foreign high-yield bonds, bonds issued by emerging markets and a broad definition of commodities. Otherwise, the 2019 rebound in assets rolled on in March.

The strongest gain last month was posted by S&P Global Ex-US Property Index, which increased 4.6%. US-based real estate investment trusts (REITs) were a strong second-place winner in March via MSCI REIT Index, which gained 3.3%. Note, too, that US REITs are currently posting the strongest year-to-date gain for the major asset classes with a stellar 16.3% surge.

The deepest loss in the major asset classes in March was in foreign high-yield bonds. Markit Global ex-US High Yield Bond Index dipped a modest 0.4%, the first monthly setback for the benchmark since November.

The Global Market Index (GMI) rose 1.3% in March, marking its third straight monthly gain. This unmanaged benchmark, which holds all the major asset classes (except cash) in market-value weights, is currently up a solid 9.3% year-to-date.

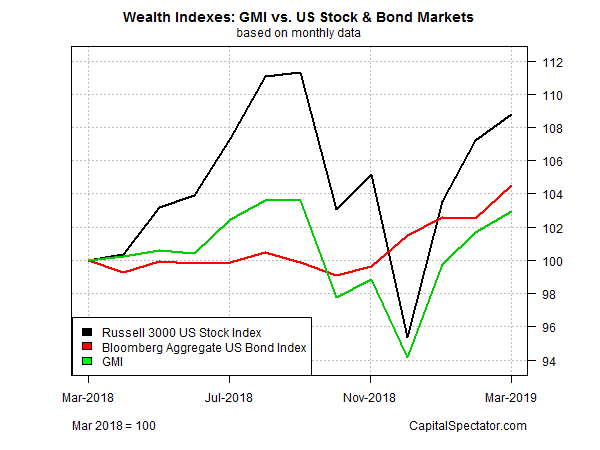

For the trailing one-year period, US stocks and bonds (along with GMI) continue to post gains, courtesy of this year’s broad-based rebound in markets after the sharp correction in late-2018.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Pingback: Performance Gains for March for Major Asset Classes - TradingGods.net

Pingback: Commodities Lead for Last Week's Broad-Based Markets Gains - TradingGods.net

Pingback: Real Estate Investment Trusts Tumble Last Week - TradingGods.net

Pingback: US Assets Enjoyed Across-the-Board Gains Last Week - TradingGods.net