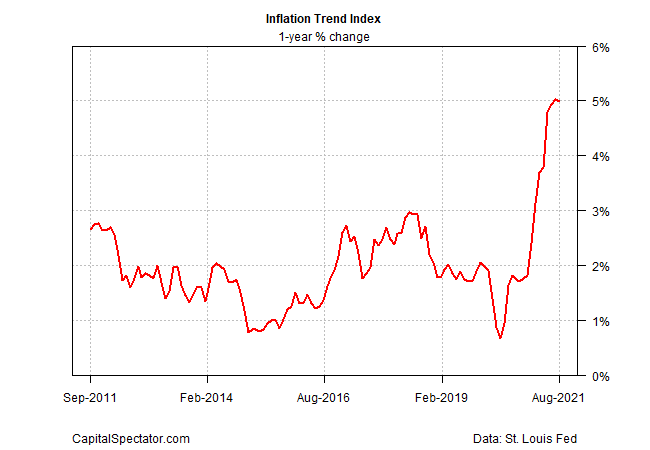

Earlier this month, hints emerged that the recent surge in US inflation pressures was ebbing. New data released in the two weeks since that update strengthen the case for calling a peak, albeit only slightly, based on revised numbers for CapitalSpectator.com’s Inflation Trend Index (ITI).

Even if inflation is peaking, pricing pressure could remain elevated for an extended period. Alternatively, if the increase in the inflation trend is pulling back, it could be an early sign that substantially lower readings are approaching.

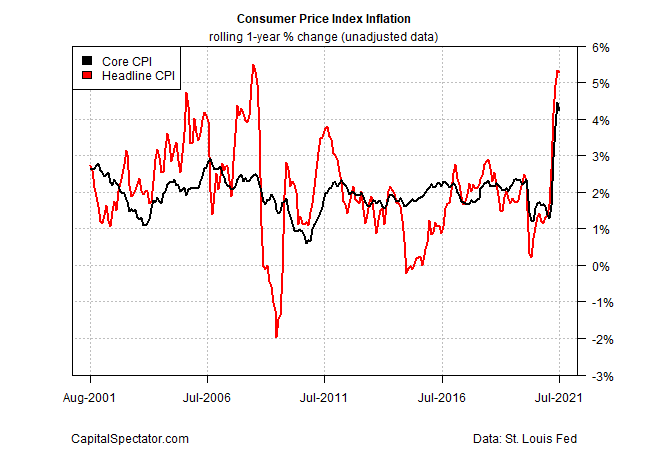

For perspective, let’s begin with the official inflation numbers from the US Bureau of Labor Statistics, which reports a slight easing in the one-year change in the Consumer Price Index (CPI). At the headline level, the CPI one-year trend was effectively unchanged at 5.4% (technically, there was a fractional downtick) through July. More importantly, the core reading of CPI (a more reliable measure of the trend) slipped to a 4.3% year-over-year change from 4.5% previously. The downshift marks the first decline since February.

It’s still too early to reliably determine that the recent runup in US inflation pressures has peaked, but data releases since our last ITI update on Aug. 12 are moving in that direction. Notably, ITI’s updated estimate for August reflects a decline in the one-year change – the first lower print in ten months. It could be noise, but for the moment it’s an encouraging sign for thinking that the inflation surge of late is subsiding.

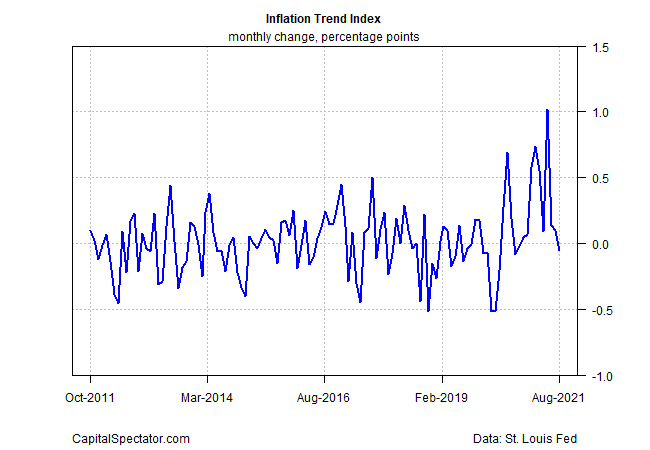

The change in the directional bias for ITI is clearer when we look at the monthly changes in ITI.

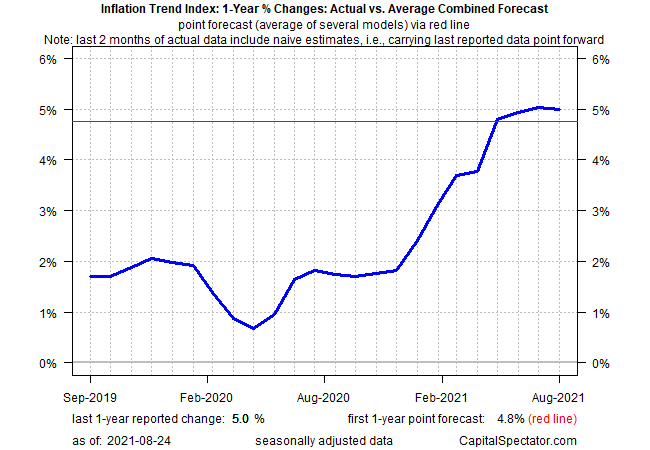

Let’s forecast ITI’s one-year change for September via The Capital Spectator’s combination forecasting model, which uses the average of eight models to estimate the near-term future. On this basis, ITI continues to show a downside bias that will remain intact through next month, which is projected to report a softer annual gain of 4.8%, down from this month’s estimated 5.0% increase. The forecast comes with a non-trivial amount of uncertainty, of course – like every forecast. But for now, there’s ongoing support for thinking that this year’s inflation surge may be fading, if only modestly.

The Capital Spectator’s Inflation Trend Index (ITI) is designed to provide a degree of forward guidance on the directional bias of pricing activity in real time. Note that ITI is NOT a proxy for estimating the government’s inflation measures. Rather, ITI provides an estimate of how inflationary pressures are trending and whether a change in the trend appears likely or not. Aggregating a mix of data sets may provide a clearer picture of how inflationary pressures are evolving in real time by pulling together numbers that are, to some degree, complimentary as a group. For additional details on ITI’s design, see this summary.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Pingback: Inflation's One-Year Trend Eased in August - TradingGods.net