* US strikes targets in Syria in possible sign of widening Middle East conflict

* US government shutdown deadline on Nov. 17 is key test for new House speaker

* European Central Bank leaves rates unchanged after 10 straight hikes

* Pending home sales in US rose last month despite higher mortgage rates

* US jobless claims tick higher but remain ultra low

* Durable goods orders in US rise sharply in September

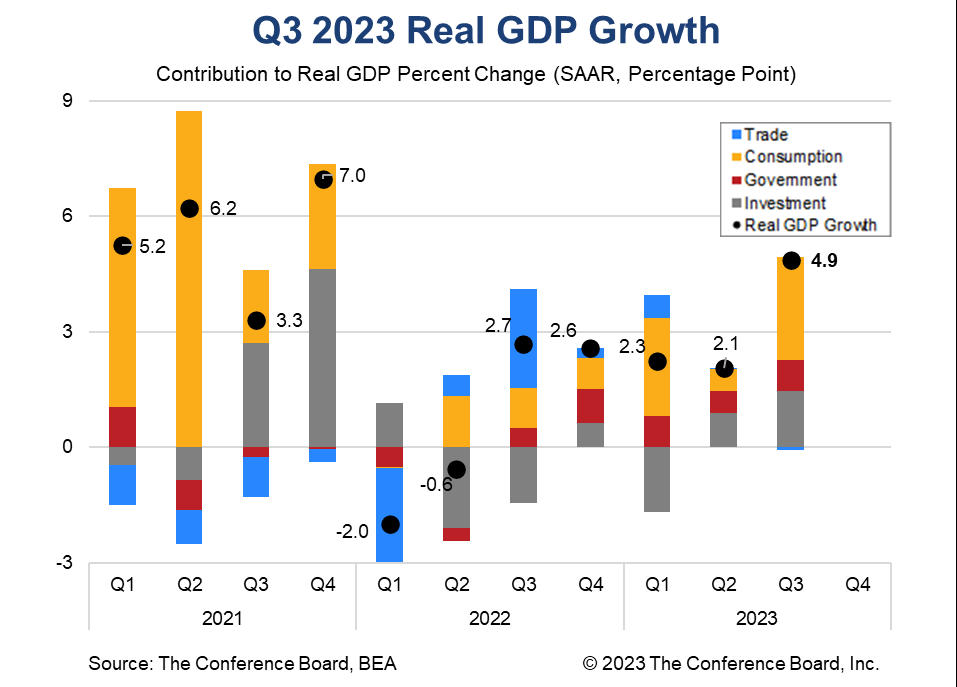

* US economic growth accelerates in Q3 to fastest pace since Q4:2021:

Large-Cap Stocks Continue To Lead US Equity Factors In 2023

Large-cap shares remains on track to dominate US equity factor performance for 2023, based on a set of ETFs through Wednesday’s close (Oct. 25). Within the large-cap space, technology shares are the driving force behind the outperformance.

Macro Briefing: 26 October 2023

* Newly elected House Speaker Mike Johnson faces 5 key challenges

* Strong US consumer spending at risk of reversing, strategist predicts

* Seven large US tech stocks have driven all of the gains in global stocks this year

* Autoworkers reach deal with Ford, marking a move toward ending strikes

* Big oil companies are doubling down on outlook for rising use of fossil fuels

* California suspends Cruise robotaxis after accident

* New US home sales rise to 19-month high in September:

US Soft-Landing Odds Rise As Q3 GDP Nowcast Ticks Up

Tomorrow’s release of third-quarter economic data is expected to show that US output accelerated, based on GDP nowcasts from several sources compiled by CapitalSpectator.com.

Macro Briefing: 25 October 2023

* The Israel-Gaza war threatens to re-ignite conflicts across the Middle East

* China announces more stimulus to aid struggling economy

* Central banks ‘100% dead wrong’ on economic forecasts: JPMorgan’s Dimon

* US orders AI-chip exports to China to halt immediately

* Bitcoin surges ahead of expected launch of BlackRock bitcoin ETF

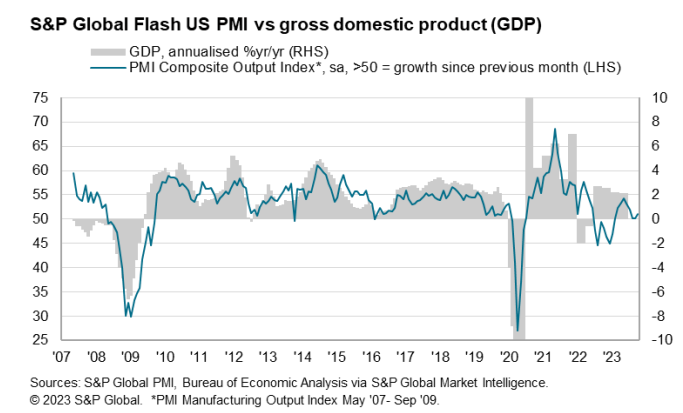

* US Composite PMI (GDP proxy) rises, suggests higher odds of soft landing:

Market Sentiment Suggests Fed Funds Rate Has Peaked… Again

In January 2023 the clues appeared to be aligning in favor of an end to the Federal Reserve’s rate hikes. It was a false dawn – the Fed lifted its target rate four times in subsequent months, by a total of 100 basis points.

Macro Briefing: 24 October 2023

* World fossil fuel use projected to peak in 2030, IEA forecasts

* Autoworkers strike expands to plant that makes Ram 1500 trucks

* China stock market selling accelerates amid rising anxiety

* Despite upbeat data, Bill Gross still expects US recession by year end

* Rising geopolitical risks are buying opportunity for stocks: Jeremy Siegel

* Why is the US economy resilient? Paul Krugman looks for answers

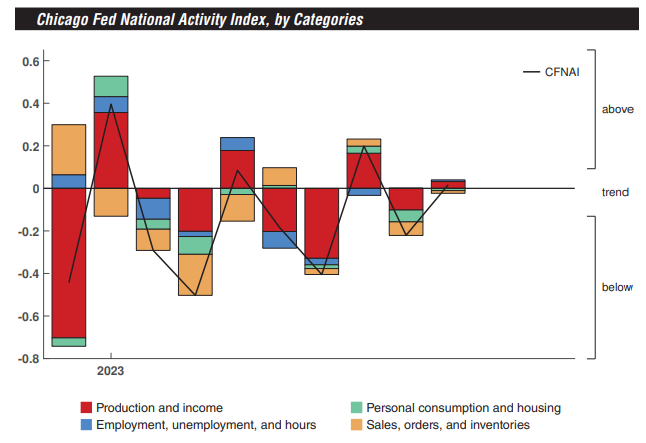

* US economic activity rebounded in September, posting above-trend growth:

US Stocks’ Upside Outlier Performance In 2023 Looks Vulnerable

American equities have enjoyed a hefty return premium for much of this year relative to the rest of the major asset classes, but in the current environment that outlier performance looks increasingly vulnerable.

Macro Briefing: 23 October 2023

* Recent economic data suggest US economy is accelerating

* Bond vigilantes are coming back, says UBS strategist

* US economy appears to be less interest-rate sensitive

* Chevron will acquire Hess in latest deal for oil majors

* China opens tax investigation into Foxconn, Apple’s iPhone maker

* Time horizon still matters for asset allocation decisions

* US 10-year Treasury yield tops 5% in early trading on Monday:

Book Bits: 21 October 2023

● The Big Fail: What the Pandemic Revealed About Who America Protects and Who It Leaves Behind

Joe Nocera and Bethany McLean

Essay by co-author via Financial Times

Legislators and regulators give a great deal of lip service to the importance of small banks and small business — but in reality, their actions almost always aid the big at the expense of the small, particularly when it comes to banks. Yet without small banks, small business will struggle.

Starting with bank deregulation in the 1980s, and then the response to the global financial crisis, we’ve made big banks bigger at the expense of the small. This despite the fact the crisis was caused by the big banks, not the small ones (and the small ones didn’t need bailouts). From 2002 to 2022, the number of banks insured by the Federal Deposit Insurance Corporation declined by nearly half.