The Global Market Index (GMI) continued ticked up again in October from the previous month, extending the recent upside trend. Today’s revised long-run forecast for the benchmark — a market-value-weighted portfolio that holds all the major asset classes (except cash) via a set of ETF proxies — reached an annualized 6.9% return.

Macro Briefing: 2 November 2023

* Federal Reserve leaves interest rates unchanged for a second time

* Another Fed pause helps support stocks and trim Treasury yields

* Treasury outlines plan to lift bond sales to manage growing debt load

* US private sector payrolls rose less than forecast in October: ADP

* ISM Manufacturing Index indicates 12th straight month of contraction in October

* US construction spending increases for ninth straight month in September

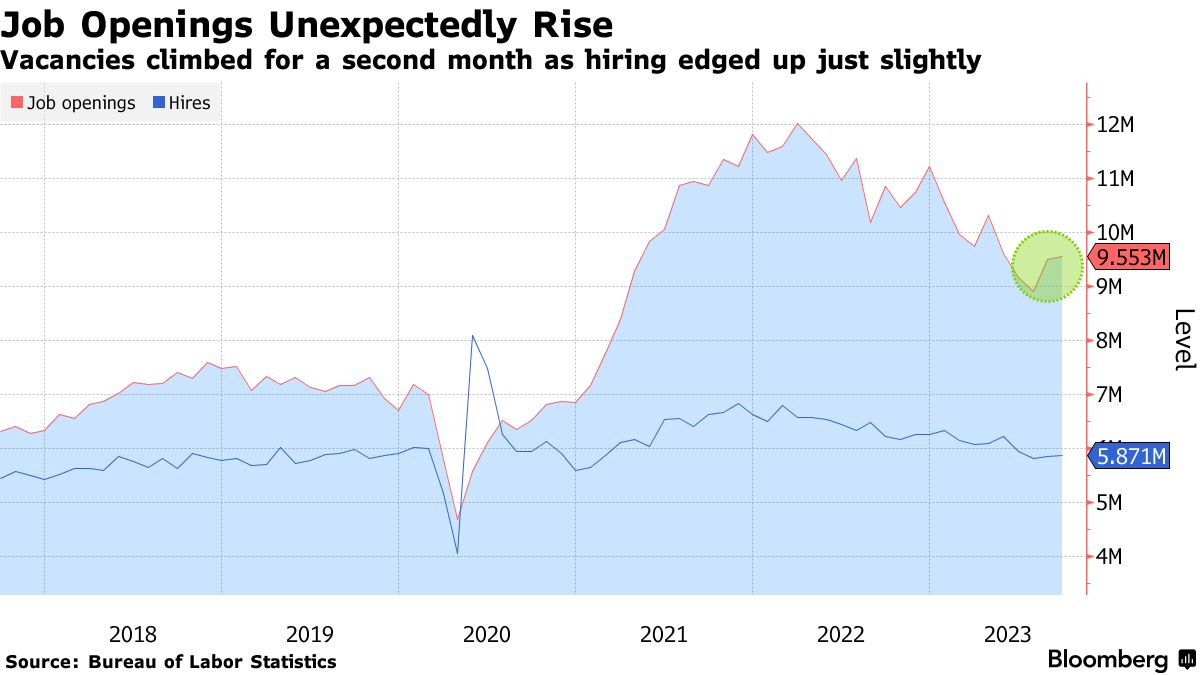

* US job openings rise more than forecast in September:

Major Asset Classes | October 2023 | Performance Review

October was another rough for global markets. With the exception of cash, all the major asset classes fell last month – the third straight month of red ink for all but a handful of markets, based on a set of ETF proxies.

Macro Briefing: 1 November 2023

* What does the UAW victory mean for the labor movement?

* China factory activity unexpectedly contracts in October

* Europe flirts with recession after Q3 GDP posts slight decline

* US Consumer Confidence Index fell for third straight month in October

* US employment costs rise in Q3 as wage growth picks up

* Chicago PMI continues to show business contraction in October

* US home prices rose for a seventh-straight month in August:

Communications And Tech Are Leading Equity Sectors In 2023

The US stock market continues to post a moderate gain year to date, in large part due to strong sector performances in the communications services and technology sectors. Both slices of the market are still enjoying red-hot gains in 2023 through yesterday’s close (Oct. 30), based on a set of ETFs.

Macro Briefing: 31 October 2023

* UAW reaches deal to end autoworkers strike

* China manufacturing sector contracts in October

* German economy shrank in the third quarter–a warning sign for Europe

* Eurozone inflation declines to 2-year low in October

* US commercial real-estate lending falling to historically low levels

* Manufacturing recovery in Texas continues in October, Dallas Fed reports

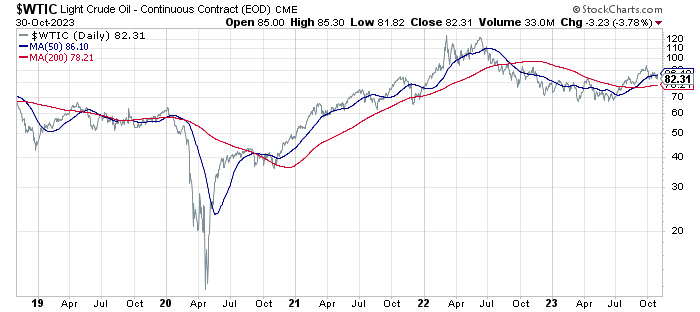

* Oil could soar to $150/bbl if Middle East conflict intensifies: World Bank

Year-To-Date Returns For Major Asset Classes Continue To Fade

A mixed run for markets last week offered a partial reprieve, but the trend profile still skews negative overall, based on a broad measure of the major asset classes via a set of ETFs.

Macro Briefing: 30 October 2023

* Israel ground assault into Gaza expands on Monday

* Markets pricing in low probability for wider Mideast war

* Initial GDPNow nowcast for US Q4 GDP: +2.3%, down from Q3’s red-hot +4.9%

* US consumer spending rose by a brisk 0.4% in September

* Several factors are supporting US consumer spending spree

* Americans say household expenses outpacing income, poll finds

* Some estimates equate recent rise in bond yields with two, three Fed rate hikes

* Gold near $2000/oz. as Israel starts ground offensive:

Book Bits: 28 October 2023

● Ours Was the Shining Future: The Story of the American Dream

David Leonhardt (Author)

Review via The New York Times

His striking contention, based on a study of census and income tax data by the Harvard economist Raj Chetty, is that where once the great majority of Americans could hope to earn more than their parents, now only half are likely to. Although the precise ratio depends on assumptions about inflation, and is less striking, as Chetty notes, when one takes into account shrinking household size, the general point is unquestionable. Economic progress used to define America. Now, Leonhardt finds “stagnation in nearly every reliable measure of well-being.” He arguably overstates the case — for instance, median household income has generally continued to rise — but the malady he identifies is real.

Early Q4 US GDP Guesstimate Points To Sharp Economic Slowdown

Yesterday’s blowout rise for US economic growth in the third quarter delivered an upside surprise, especially for analysts who remain all in with forecasting recession. But perhaps the warnings will finally find traction via the current run of softer Q4 nowcasts.