US payrolls rose more than forecast in June, increasing 147,000 for the month. “The solid June jobs report confirms that the labor market remains resolute and slams the door shut on a July rate cut,” said Jeff Schulze, head of economic and market strategy at ClearBridge Investments. For the 1-year trend, payrolls effectively held steady at a 1.15% pace of growth, in line with gains in recent months.

Cue Up The Fireworks!

When in the course of human events this week, it becomes necessary for yours truly to dissolve the usual routine and declare a particular truth to be self-evident: A long July 4 holiday weekend is an unalienable right, and so the Capital Spectator finds it necessary to declare independence from the office until the standard fare resumes on Monday, July 7. Happy Independence Day!

When in the course of human events this week, it becomes necessary for yours truly to dissolve the usual routine and declare a particular truth to be self-evident: A long July 4 holiday weekend is an unalienable right, and so the Capital Spectator finds it necessary to declare independence from the office until the standard fare resumes on Monday, July 7. Happy Independence Day!

Total Return Forecasts: Major Asset Classes | 02 July 2025

The long-run expected total return for the Global Market Index (GMI) ticked higher for a third straight month in June, rising to an annualized 7.3% from the 7.2% estimate in the previous month. Today’s estimate is moderately below GMI’s realized 10-year performance. The forecast is calculated as the average of three models (defined below) for GMI, an unmanaged global benchmark that’s based on a market-value weighted mix of the major asset classes (excluding cash).

Macro Briefing: 2 July 2025

US job openings rose in May, reaching the highest level since November 2024. The increase surprised economists, who expected openings to decline. Despite the latest upturn, “We suspect underlying demand for new workers continues to recede amid growing signs of consumer spending fatigue,” said Sarah House, a senior economist at Wells Fargo.

Major Asset Classes | June 2025 | Performance Review

Stocks in emerging markets extended their rally in June, posting the strongest gain for the major asset classes last month, based on a set of ETFs. A broad measure of US equities delivered a robust second-place performance amid rallies for all the main categories of global markets for the month.

Macro Briefing: 1 July 2025

The US dollar has fallen more than 10% year to date, the weakest start for a calendar year since 1973. The combination tariffs, inflation concerns and rising government debt are weighing on the greenback. The dollar’s slide is making investments in the US by foreigners more expensive. “A weaker dollar has become a crowded trade and I suspect the pace of decline will slow,” said Guy Miller, chief market strategist at insurance group Zurich.

Risk Appetite Rebounds For Global Strategies After Tariff Tantrum

For a brief few weeks it looked like the jig was up. But the selling wave has all but faded as sentiment has recovered and markets have rebounded from the perspective of a high-level global asset allocation perspective. Reviewing a select set of proxy ETFs suggests that risk-on sentiment has returned for the strategic outlook, based on prices through Friday’s close (June 27).

Macro Briefing: 30 June 2025

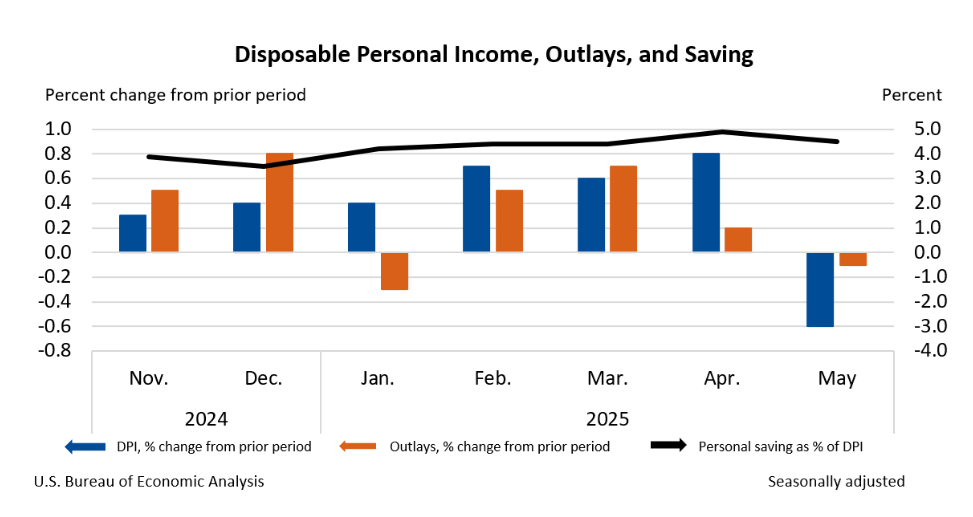

US consumer spending and income fell in May, the Bureau of Economic Analysis reported on Friday. Inflation also ticked up, based on core PCE. This measure of inflation, which is the Fed’s preferred benchmark for monitoring prices, edged up to a 2.7% year-over-year rate. “The report is a wash for the Fed and won’t alter its wait-and-see stance,” said Sal Guatieri, a senior economist at BMO Capital Markets. “The pullback in spending in May partly reflects payback from earlier tariff front-running, while the slightly warmer core price increase doesn’t settle the debate about how much tariffs will impact inflation.”

Book Bits: 28 June 2025

● The Collapse of Global Liberalism: And the Emergence of the Post Liberal World Order

● The Collapse of Global Liberalism: And the Emergence of the Post Liberal World Order

Philip Pilkington

Summary via publisher (Wiley)

In the 1990s, a vision emerged of a frictionless world of globalization in which the West would become ever richer on the basis of a tech-based service economy, all underpinned by a rules-based liberal international order. It became the basis for the mainstream politics of centre-left and right. Philip Pilkington argues that this vision was always delusional and is now dying. It is based on a doctrinaire and unrealistic form of liberalism and has given rise to hollowed-out financialised economies and disintegrating societies that can barely even reproduce their population or meet their energy needs. The US and UK find themselves ill-equipped to compete with China and other non-liberal states within an emerging post-liberal order in which what really matters is industrial capacity, realpolitik and military strength. Only by abandoning our liberal delusions and advancing our own brand of hard-headed post-liberalism can the West survive.

Markets Continue To Price In Higher Odds For Rate Cuts

The Federal Reserve’s wait-and-see approach for monetary policy is starting to crack, or so markets are indicating. The central bank is still expected to leave interest rates unchanged at the next FOMC meeting in July, but confidence for a no-change decision has slipped recently while the estimated probability for a cut in September has increased.