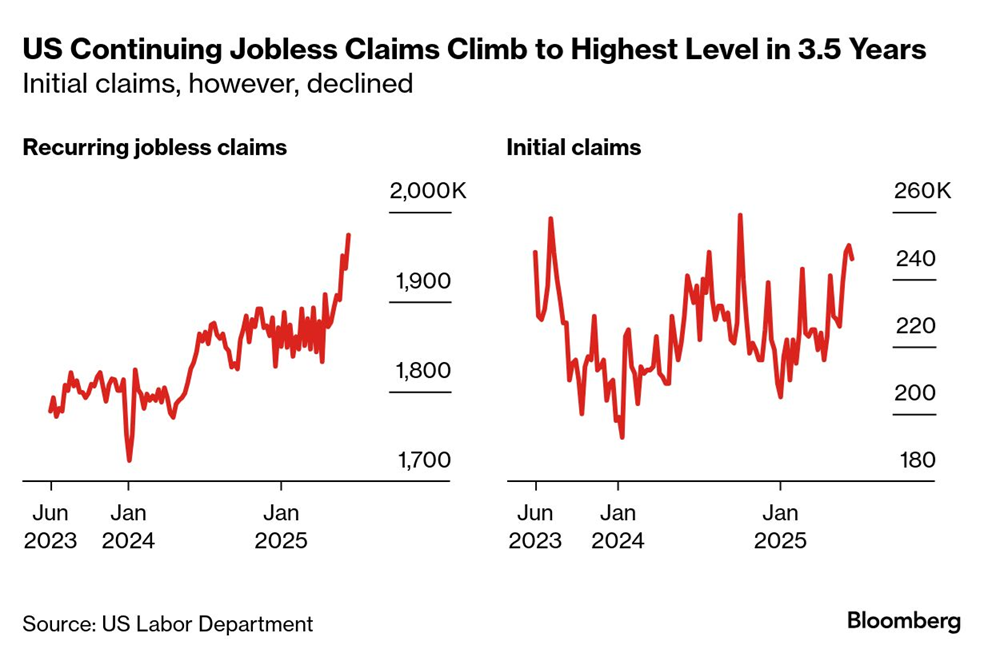

US initial jobless claims pulled back last week as continuing claims continued rising. The number of Americans collecting unemployment insurance on a recurring basis rose to the highest level in 3-1/2 years — a possible warning sign for the labor market. “The data are consistent with softening of labor market conditions, particularly on the hiring side of the labor market equation,” said Nancy Vanden Houten, lead economist at Oxford Economics. “For now, we don’t think the labor market is weak enough to prompt the Fed to cut rates before December, but the risk is increasing that once the Fed starts to lower rates, it will have some catching up to do.”

Foreign Bonds Are Having A Very Good Year In US Dollar Terms

In line with the strong rally in foreign equities year to date, bond markets ex-US are also posting solid gains, based on a set of ETFs through Wednesday’s close (June 25).

Macro Briefing: 26 June 2025

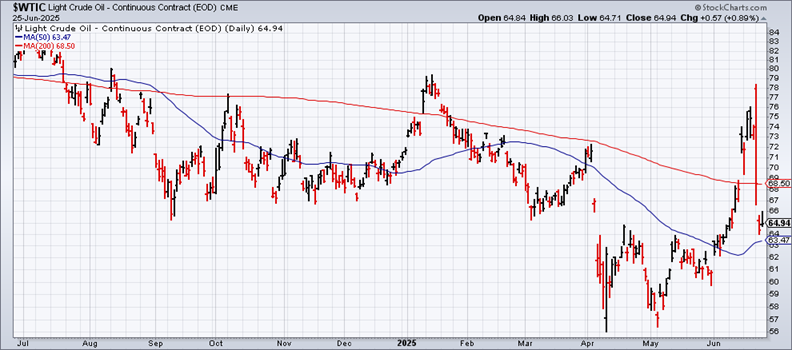

US crude oil fell on Wednesday to a level that’s below the price on June 13, when the Israel-Iran conflict started. “There could be hiccups along the way, but the market is saying this (conflict) is likely over,” Robert Yawger, commodities specialist at Mizuho Securities, told CNN Tuesday. “Markets breathed a sigh of relief following Trump’s ceasefire declaration, but the celebration could be short-lived,” said Lukman Otunuga, senior market analyst at FXTM, in a note to investors. “If tensions flare again or the ceasefire is violated, we could see a swift return to risk aversion — boosting safe havens like gold and pressuring global equities.”

Foreign Stocks Still Lead US Shares By Wide Margin This Year

Despite war, tariffs and a host of other threats that weigh on the outlook for the global economy, the rise of the international equity premium over US stocks remains intact this year, based on a set of ETFs through Tuesday’s close (June 24).

Macro Briefing: 25 June 2025

Job worries weigh on the US Consumer Confidence Index in June. “Consumer confidence weakened in June, erasing almost half of May’s sharp gains,” said Stephanie Guichard, Senior Economist, Global Indicators at The Conference Board. “The decline was broad-based across components, with consumers’ assessments of the present situation and their expectations for the future both contributing to the deterioration. Consumers were less positive about current business conditions than May. Their appraisal of current job availability weakened for the sixth consecutive month but remained in positive territory, in line with the still-solid labor market.

Will The Fed Cut Rates Sooner Than Recently Expected?

It’s been less than a week since Fed Chairman Powell said the central bank remained in a wait-and-see mode for deciding if tariff-related inflation was a significant risk factor that would delay interest rate cuts. But expectations for monetary policy are moving fast these days and so assumptions from a week ago may already be ancient history.

Macro Briefing: 24 June 2025

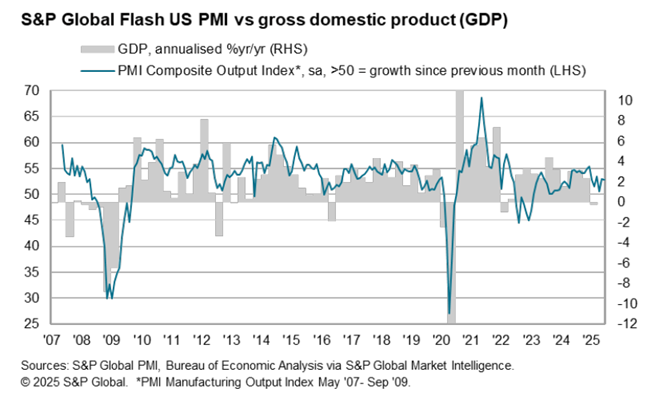

US business activity slowed in June but continues to post modest growth, according to a survey-based estimate of GDP. The S&P Global Flash US PMI ticked down last month to 52.8 from 53.0 in May, above the neutral 50 mark that separates growth from contraction. “The June flash PMI data indicated that the US economy continued to grow at the end of the second quarter, but that the outlook remains uncertain while inflationary pressures have risen sharply in the past two months,” said the chief business economist at S&P Global Market Intelligence.

Markets Weigh Middle East Risk After US Strikes Iran

The potential for a wider Middle East war has been lurking ever since Israel first attacked Iran more than a week ago. The risk may have increased after the US strike on Iran over the weekend. But markets continue to shrug off the threat of a wider conflagration. A key factor for the path ahead could be a direct function of how or if Iran responds.

Macro Briefing: 23 June 2025

Israel and Iran continued to exchange missile attacks on Monday as Iran asks Russia for more support following the US strike on Tehran’s nuclear facilities. Meanwhile, markets are on edge as investors consider how or if Iran may respond. A key vulnerability for the world economy is the Strait of Hormuz in the Persian Gulf, a chokepoint through which roughly a third of global oil exports flow. At the moment, the price of crude oil (a proxy for risk sentiment re: Iran) is mostly steady, trading around the $77 mark for Brent. “Traders are holding their breath, waiting to see if Israel or Iran expand this conflict beyond military and political targets into traded energy,” said Bob McNally, founder of Rapidan Energy Advisers LLC and a former White House energy official. “So far, no one has pulled that trigger — and if they don’t, I can see the price reversing.”

Book Bits: 21 June 2025

● Algorithmic Harm: Protecting People in the Age of Artificial Intelligence

● Algorithmic Harm: Protecting People in the Age of Artificial Intelligence

Oren Bar-Gill and Cass R. Sunstein

Summary via publisher (Princeton U. Press)

Will algorithms help people or hurt them? What about artificial intelligence in general? If consumers know what they need to know and do not suffer from behavioral biases, algorithms and AI are likely to be helpful. Consumers will be more likely to get what they want and need. But if consumers lack information, algorithms in particular will be able to convince them to make harmful or foolish choices. And if consumers suffer from behavioral biases, such as unrealistic optimism or a focus on the short term, algorithms will be able to produce serious harms. In Algorithmic Harm: Protecting People in the Age of Artificial Intelligence, Oren Bar-Gill and Cass Sunstein consider the harms and benefits of AI and algorithms and catalog the different ways in which algorithms are being or may be used in consumer and other markets.