● Limitless: The Federal Reserve Takes on a New Age of Crisis

Jeanna Smialek

Review via The Economist

As covid-19 struck, markets were in meltdown and economic disaster loomed. The central bank swung into emergency mode, injecting vast, if not quite infinite, sums of cash into the financial system in order to avert a crisis… The actions worked a little too well. Before long, growth was recovering, markets were booming and price pressures were building. The Fed ended up having to fight America’s worst outbreak of inflation in decades—a fight that is ongoing. This sharp duality poses a dilemma for any appraisal of the Fed’s record during the pandemic… “Limitless” by Jeanna Smialek of the New York Times is a useful corrective. She provides a bracing account of just how badly things could have turned out when covid shutdowns led millions to lose their jobs overnight—and pushed the financial system to the brink of collapse.

Is It Time To Rethink Stock-Bond Allocations After Rate Hikes?

The case for raising equity allocations when interest rates were close to zero was easy. After a year of interest rate hikes by the Federal Reserve, the calculus is more complicated.

Macro Briefing: 24 February 2023

* Ukraine leader vows to push on for victory on anniversary of Russia’s invasion

* Amid questions of neutrality, China calls for ceasefire in Russia-Ukraine war

* China’s online retail spending rebound after lockdown is modest, reports Alibaba

* US regulators warn banks of liquidity risks with crypto-related deposits

* Demand is up for dividend-paying stocks as interest rates rise

* Retirement account balances down nearly 25% last year, Fidelity reports

* US jobless claims tick lower and continue to indicate tight labor market

* US GDP growth for Q4 revised down to 2.7% annual rate

* US economic activity rebounds in January, rising at strongest pace in six months:

Desperately Seeking Yield: 23 February 2023

Cash is no longer trash, courtesy of sharply higher interest rates. Trailing yields on risky assets are looking up too.

Macro Briefing: 23 February 2023

* Putin says China President Xi will visit Russia

* Fed minutes: officials remain set on more rate hikes to tame inflation

* US proposes first offshore wind auction in Gulf of Mexico.

* Several popular Chinese apps remove access to AI chatbot ChatGPT

* US home-purchase applications tumble to 28-year low

* US mortgage rates rise to highest level since November:

Early Median Estimate For US GDP In Q1 Skews Slightly Negative

The economic rebound in the second half of 2022 looks challenged in early estimates for first-quarter GDP, based on the median for a set of nowcasts compiled by CapitalSpectator.com.

Macro Briefing: 22 February 2023

* Biden to meet eastern NATO flank after Poland visit

* US may impose new sanctions on China for its economic support of Russia

* Russia will suspend last remaining U.S.-Russia arms control treaty

* Walmart turns cautious on economic outlook

* Amazon has approval from FTC to acquire One Medical primary-care clinics

* Existing home sales in US fall for 12th straight month in January

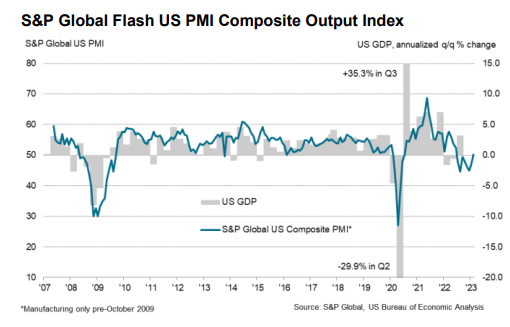

* US business activity rebounds in February via PMI survey data:

Oversold-Overbought Watch: S&P 500 Index | 21 February 2023

The low-hanging fruit has been picked. Casual observation suggests as much. The S&P 500 Index has rebounded sharply off its previous low in October, closing up 14% on Friday (Feb. 17) since October’s trough.

Macro Briefing: 21 February 2023

* Supreme Court case could change immunity standard for Big Tech’s social media

* China is mobilizing its courts to undermine foreign intellectual-property rights

* The Fed’s preferred inflation gauge is expected to run hot in Friday’s update

* Eurozone rebound in business activity accelerates in February

* UK private sector grows in February after six-month decline

* US earnings decline for companies expected in Q1 and Q2, analysts predict

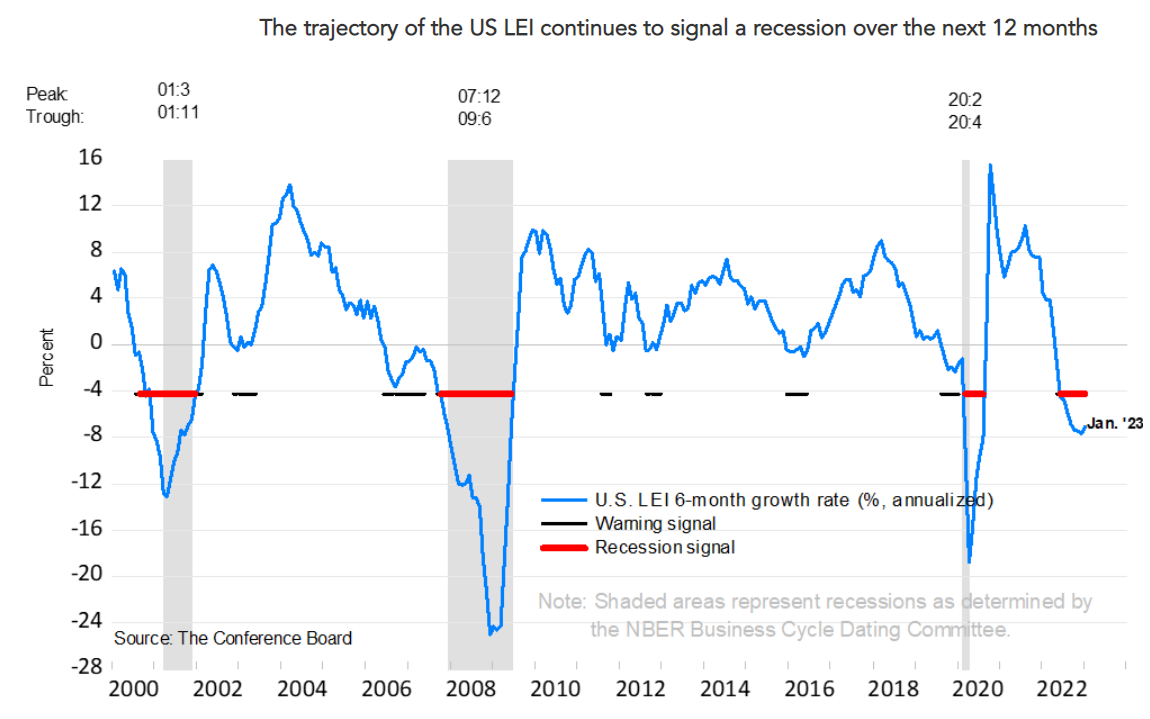

* US Leading Economic Index continues to signal high recession risk, CB reports:

Happy President’s Day!

“You cannot escape the responsibility of tomorrow by evading it today.”

– Abraham Lincoln