● The Collapse of Global Liberalism: And the Emergence of the Post Liberal World Order

● The Collapse of Global Liberalism: And the Emergence of the Post Liberal World Order

Philip Pilkington

Summary via publisher (Wiley)

In the 1990s, a vision emerged of a frictionless world of globalization in which the West would become ever richer on the basis of a tech-based service economy, all underpinned by a rules-based liberal international order. It became the basis for the mainstream politics of centre-left and right. Philip Pilkington argues that this vision was always delusional and is now dying. It is based on a doctrinaire and unrealistic form of liberalism and has given rise to hollowed-out financialised economies and disintegrating societies that can barely even reproduce their population or meet their energy needs. The US and UK find themselves ill-equipped to compete with China and other non-liberal states within an emerging post-liberal order in which what really matters is industrial capacity, realpolitik and military strength. Only by abandoning our liberal delusions and advancing our own brand of hard-headed post-liberalism can the West survive.

Markets Continue To Price In Higher Odds For Rate Cuts

The Federal Reserve’s wait-and-see approach for monetary policy is starting to crack, or so markets are indicating. The central bank is still expected to leave interest rates unchanged at the next FOMC meeting in July, but confidence for a no-change decision has slipped recently while the estimated probability for a cut in September has increased.

Macro Briefing: 27 June 2025

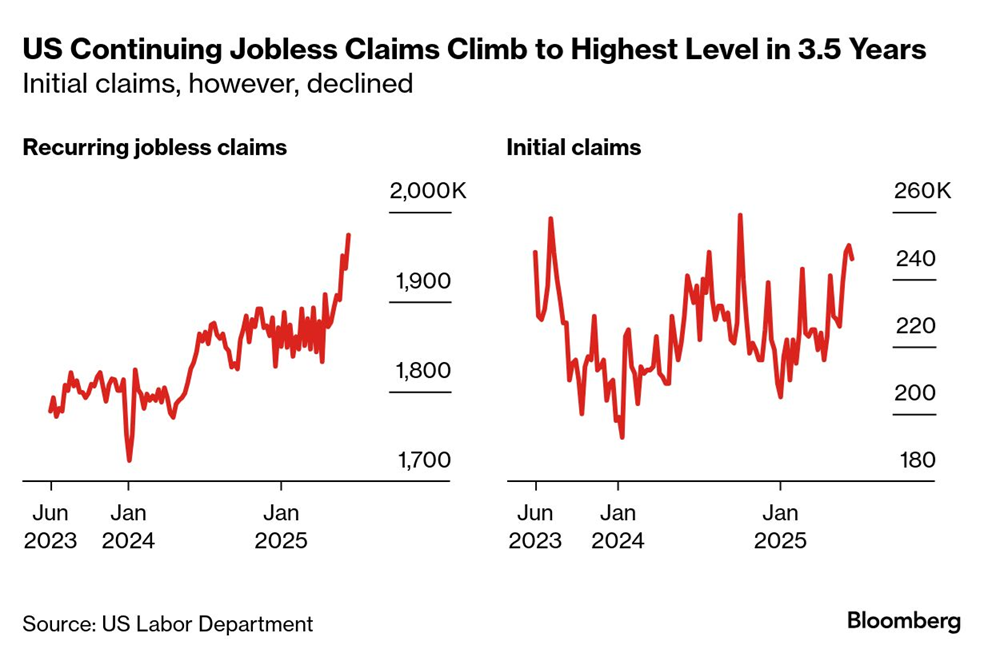

US initial jobless claims pulled back last week as continuing claims continued rising. The number of Americans collecting unemployment insurance on a recurring basis rose to the highest level in 3-1/2 years — a possible warning sign for the labor market. “The data are consistent with softening of labor market conditions, particularly on the hiring side of the labor market equation,” said Nancy Vanden Houten, lead economist at Oxford Economics. “For now, we don’t think the labor market is weak enough to prompt the Fed to cut rates before December, but the risk is increasing that once the Fed starts to lower rates, it will have some catching up to do.”

Foreign Bonds Are Having A Very Good Year In US Dollar Terms

In line with the strong rally in foreign equities year to date, bond markets ex-US are also posting solid gains, based on a set of ETFs through Wednesday’s close (June 25).

Macro Briefing: 26 June 2025

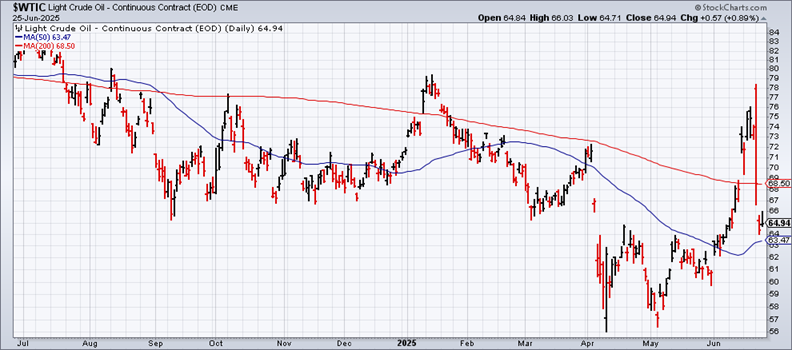

US crude oil fell on Wednesday to a level that’s below the price on June 13, when the Israel-Iran conflict started. “There could be hiccups along the way, but the market is saying this (conflict) is likely over,” Robert Yawger, commodities specialist at Mizuho Securities, told CNN Tuesday. “Markets breathed a sigh of relief following Trump’s ceasefire declaration, but the celebration could be short-lived,” said Lukman Otunuga, senior market analyst at FXTM, in a note to investors. “If tensions flare again or the ceasefire is violated, we could see a swift return to risk aversion — boosting safe havens like gold and pressuring global equities.”

Foreign Stocks Still Lead US Shares By Wide Margin This Year

Despite war, tariffs and a host of other threats that weigh on the outlook for the global economy, the rise of the international equity premium over US stocks remains intact this year, based on a set of ETFs through Tuesday’s close (June 24).

Macro Briefing: 25 June 2025

Job worries weigh on the US Consumer Confidence Index in June. “Consumer confidence weakened in June, erasing almost half of May’s sharp gains,” said Stephanie Guichard, Senior Economist, Global Indicators at The Conference Board. “The decline was broad-based across components, with consumers’ assessments of the present situation and their expectations for the future both contributing to the deterioration. Consumers were less positive about current business conditions than May. Their appraisal of current job availability weakened for the sixth consecutive month but remained in positive territory, in line with the still-solid labor market.

Will The Fed Cut Rates Sooner Than Recently Expected?

It’s been less than a week since Fed Chairman Powell said the central bank remained in a wait-and-see mode for deciding if tariff-related inflation was a significant risk factor that would delay interest rate cuts. But expectations for monetary policy are moving fast these days and so assumptions from a week ago may already be ancient history.

Macro Briefing: 24 June 2025

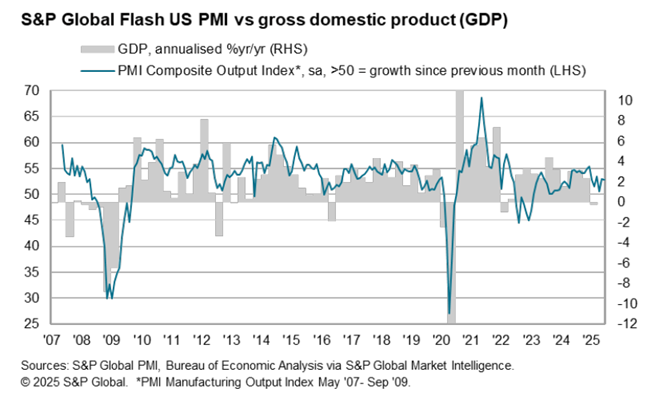

US business activity slowed in June but continues to post modest growth, according to a survey-based estimate of GDP. The S&P Global Flash US PMI ticked down last month to 52.8 from 53.0 in May, above the neutral 50 mark that separates growth from contraction. “The June flash PMI data indicated that the US economy continued to grow at the end of the second quarter, but that the outlook remains uncertain while inflationary pressures have risen sharply in the past two months,” said the chief business economist at S&P Global Market Intelligence.

Markets Weigh Middle East Risk After US Strikes Iran

The potential for a wider Middle East war has been lurking ever since Israel first attacked Iran more than a week ago. The risk may have increased after the US strike on Iran over the weekend. But markets continue to shrug off the threat of a wider conflagration. A key factor for the path ahead could be a direct function of how or if Iran responds.