* US shoots down several aerial objects over North America

* Some economists consider possibility of an economic growth upturn for US

* Fears of a US debt crisis are overblown, writes economist Barry Eichengreen

* This week’s US consumer inflation data will test disinflation optimism

* Recession risk is lower due to labor hoarding, analyst reasons

* Will higher yields in Japan pull back assets invested overseas?

* US home prices set to fall further despite lower rates, says market expert

* Half of Americans say they’re worse off vs. year ago, survey finds

* US consumer inflation revised up for December

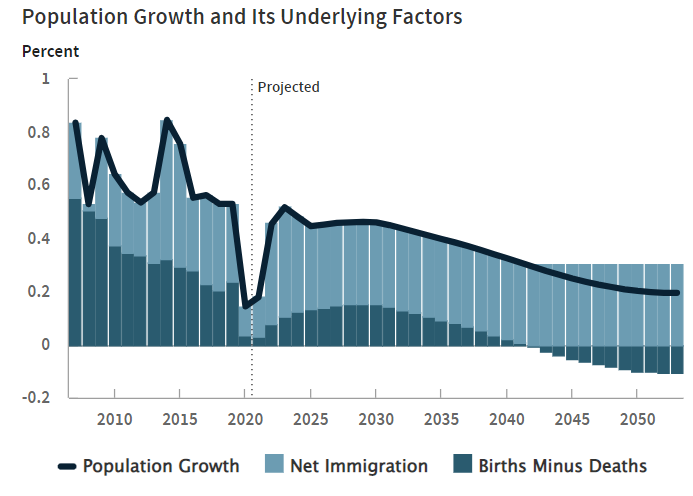

* Population growth in US is increasingly driven by net immigration, CBO projects:

Book Bits: 11 February 2023

● At Work in the Ruins: Finding Our Place in the Time of Science, Climate Change, Pandemics and All the Other Emergencies

Dougald Hine

Summary via publisher (Chelsea Green Publishing)

In eloquent, deeply researched prose, Hine demonstrates how our over-reliance on the single lens of science has blinded us to the nature of the crises around and ahead of us, leading to ‘solutions’ that can only make things worse. At Work in the Ruins is his reckoning with the strange years we have been living through and our long history of asking too much of science. It’s also about how we find our bearings and what kind of tasks are worth giving our lives to, given all we know or have good grounds to fear about the trouble the world is in.

Will This Year’s Recovery In US Bonds Continue?

After taking a beating last year, US fixed income securities have clawed back some of the losses so far in 2023, based on a set of ETFs through yesterday’s close (Feb. 9). But with the Federal Reserve still intent on lifting interest rates to tame inflation, the outlook for bonds is still murky.

Macro Briefing: 10 February 2023

* US looks set to further restrict tech exports to China after balloon incident

* Russia will cut oil output by 5% in response to West’s price cap

* UK economy stagnates in Q4

* China inflation edges higher as economy reopens

* Recession risk for US appears to be falling, analysts predict

* Will the rush into artificial intelligence be the next bubble on Wall Street?

* US Energy Dept. will loan $2 billion to battery recycling firm

* Yahoo reportedly will cut 20% of its staff this year

* US jobless claims remain low, but are rising again on a year-over-year basis:

Is It Risk-On Again?

This year’s rebound in asset prices around the world suggests that investor sentiment is shifting to risk-on after a year of playing defense. Trying to divine the future for pricing is always precarious, especially in the near term. But there’s no charge for looking at proxies of key market trends through various ETF pairs. As we’ll see, certain slices of markets are predicting a new bull run, but it’s still early to ring the all-clear signal, according to a broad measure of US stocks relative to US bonds, which is arguably a more reliable indicator. But let’s start with the sizzle.

Macro Briefing: 9 February 2023

* US-China tensions are high, but so is commerce between the two nations

* Fed officials reaffirm that higher rates needed to tame inflation

* China deploys surveillance balloons worldwide, say US officials

* Disney announces 7,000 job cuts as streaming business falters

* Credit Suisse reports huge annual loss as it continues with reforms

* Mortgage refinance demand ticks up as mortgages rate fall for fifth week

* JPMorgan reportedly cuts hundreds of mortgage employees

* Commodities prices near lowest level in over a year:

Early US GDP Nowcasts For Q1 Are Wide Ranging

Depending on the source, the preliminary estimates for US economic activity in this year’s first quarter are encouraging, mediocre or distinctly bearish, based on a set of nowcasts compiled by CapitalSpectator.com. But it’s still early in the quarter and it’s best to look at the numbers with a hefty dose of caution at this point.

Macro Briefing: 8 February 2023

* Biden outlines his economic agenda in State of the Union speech

* Death toll from Syria-Turkey quake keeps rising, close to 10,000

* Fed’s Powell gives hawkish speech but investors stay bullish

* Shipping giant Maersk expects global trade to shrink by as much as 2.5% in 2023

* Inflation’s “worst is behind us”, says Charles Schwab’s top fixed-income strategist

* Zoom is latest tech firm to announce big layoffs

* US trade deficit widens in December–reaches record high for 2022

* US junk bond yield spread stays low despite surge in tighter lending standards:

High Beta, Small Cap Value Still Lead Equity Factors In 2023

The US stock market rally this year continues to be led by so-called high-beta stocks, which are outperforming the broad market by a wide margin, based on a set of proxy ETFs through Monday’s close (Feb. 6).

Macro Briefing: 7 February 2023

* Death toll rises above 5000 in Turkey-Syria earthquake

* US economy is key challenge for Biden in tonight’s State of Union address

* GOP House Speaker McCarthy calls on Biden to agree to spending cuts

* Chinese search engine giant Baidu’s shares surge after AI bot announcement

* Google set to launch Bard, an artificial intelligence bot to rival ChatGPT

* CVS set to acquire primary-care provider Oak Street Health for $10.5 billion

* Market breadth improves in this year’s stock market rally

* Policy-sensitive 2-year US Treasury yield rises to one-month high: