* Bipartisan lawmakers prepare plan to defuse debt-ceiling crisis

* China’s reopening may boost global inflation

* Market-based gauges of inflation project rapid inflation slide in months ahead

* The first ETF celebrates its 30th birthday this week

* Banks set for deepest layoffs since the financial crisis

* The long and winding road to the US government’s $31 trillion pile of debt

* Big tech’s big reversal linked to mistaken bets on pandemic-fueled growth

* Fed’s Waller supports slowing next rate hike to 25 basis points

* US existing home sales fell again in December, lowest since November 2010:

Book Bits: 21 January 2023

● Edible Economics: A Hungry Economist Explains the World

Ha-Joon Chang

Summary via publisher (Public Affairs Books)

For decades, a single, free-market philosophy has dominated global economics. But this intellectual monoculture is bland and unhealthy. Bestselling author and economist Ha-Joon Chang makes challenging economic ideas delicious by plating them alongside stories about food from around the world, using the diverse histories behind familiar food items to explore economic theory. For Chang, chocolate is a lifelong addiction, but more exciting are the insights it offers into postindustrial knowledge economies; and while okra makes Southern gumbo heart-meltingly smooth, it also speaks of capitalism’s entangled relationship with freedom. Myth-busting, witty, and thought-provoking, Edible Economics serves up a feast of bold ideas about globalization, climate change, immigration, austerity, automation, and why carrots need not be orange.

Research Review | 20 Jan 2023 | ETFs and Related Strategies

Do Sector ETFs Outperform Treasury Bills?

Gow-Cheng Huang (Tuskegee U.) and Kartono Liano (Mississippi State U.)

June 2022

Unlike individual stocks, more than 67% of sector ETFs have lifetime buy-and-hold returns that are higher than the T-bill rates. Thus, the majority of sector ETFs outperform T-bills. However, less than 26% of sector ETFs have lifetime buy-and-hold returns that are higher than SPY, an index ETF that is a proxy for the overall stock market. Consequently, most sector ETFs underperform the market index.

Macro Briefing: 20 January 2023

* US government hits debt ceiling, begins “extraordinary measures” to pay bills

* NATO meets amid dissent over sending tanks for Ukraine

* Global economic outlook improves but “doesn’t quite yet mean good:” IMF chief

* Big oil is moving into the electric-vehicle charging industry

* Google will cut about 12,000 jobs, or 6% of its workforce

* Japan inflation reaches 41-year high

* US jobless claims fall to 190,000, lowest in 15 weeks

* Philly Fed Mfg Index: softer pace of contraction in January

* US housing starts and building permits continue to slide in December:

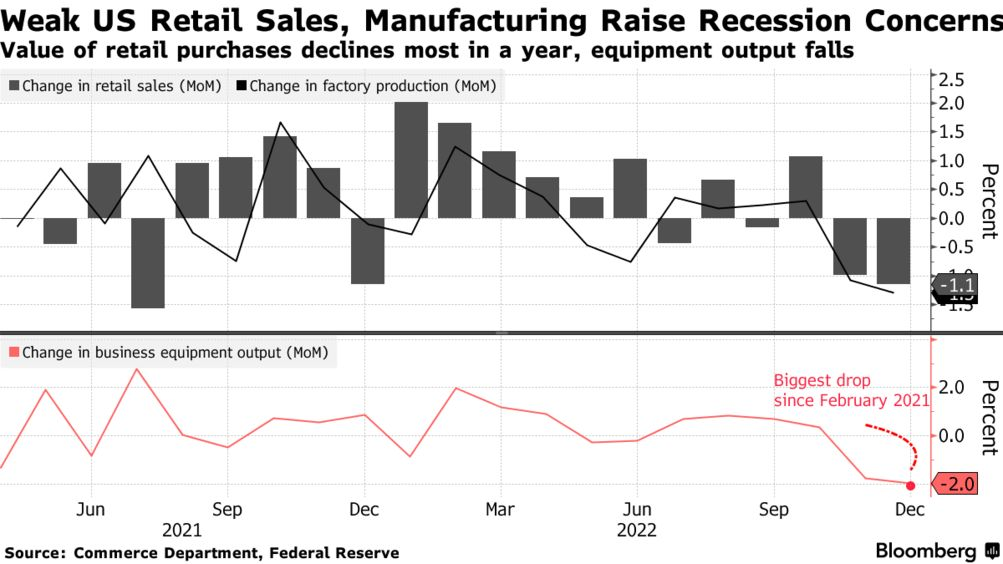

Falling US Retail Sales Raise Warning Flag For Consumer Sector

Economists were expecting a decline, but the 1.1% slide in retail spending in December was deeper than expected. Even worse, the monthly slide marks the second straight decline. It could be noise, but in the current climate it’s reasonable to read yesterday’s news on the consumer sector as a new warning that business-cycle risk remains elevated.

Macro Briefing: 19 January 2023

* US Treasury’s “extraordinary measures” start today for paying government’s bills

* US producer price inflation cooled in December

* Job cuts in tech industry spread as Microsoft plans to lay off 10,000 workers

* Fed chairman Jerome Powell tests positive for coronavirus

* Cryptocurrency firm Genesis Global Capital set to file for bankruptcy

* Global bond sales surge to record start in 2023: nearly $600 Billion

* US industrial output falls more than expected in December

* Fed’s Beige Book: inflation slowing while job market remains tight

* Home builder sentiment rises in January–first monthly gain in a year

* US retail sales decline for second month in December:

S&P 500 Risk Profile: 18 January 2023

The US stock market has stabilized recently and trades moderately above its recent low. The recovery inspires hope that the worst is over. Maybe, but a review of various metrics suggest that there’s a good case for staying defensive until stronger evidence emerges the latest bounce is the start of an extended rebound.

Macro Briefing: 18 January 2023

* Americans have reduced spending in recent months: NY Fed survey

* US-China officials discuss economic relations

* China says it’s open for business after its Covid lockdown

* China’s economy looks poised for a rebound, predicts fund manager

* Record oil demand expected this year as China reopens, predicts IEA

* Fed asks big banks how they’re preparing for climate change

* Former economic adviser to Trump says US has ‘weathered’ economic storm

* UK inflation slips for second month but remains high at +10.5% in December

* Fund managers’ allocation to US equities falls sharply in January: BofA survey

* NY Fed Manufacturing Index falls deeper into the red in January:

High Beta, Small Cap Value Top US Factor Returns In 2023’s Start

It’s too early in the new year to draw hard conclusions, but the initial results for 2023 through the first half of January show a broad-based rally in most equity factors led by so-called high beta shares, based on a set of ETF proxies.

Macro Briefing: 17 January 2023

* China’s economic growth slows to 3.0% in 2022, near historic lows

* China reports smaller population, first decline in decades

* Will China’s reopening trigger a sharp rise in oil price? Maybe not

* Putin is “weaponizing food”, has global implications, warns head of fertilizer firm

* Japan rearming again to counter China’s ambitions to control Asian-Pacific region

* Corporate executives, economists at Davos meeting expect global recession

* More central-bank digital currencies are being tested

* Microsoft plans to add artificial-intelligent tools to all its products

* Bitcoin rallies sharply year to date after rough 2022

* Some analysts predict gold will rise to near record high this year: