● The Aftermath: The Last Days of the Baby Boom and the Future of Power in America

Philip Bump

Review via The Washington Post

If you’re looking for the highly detailed, data-driven, definitive story of how baby boomers changed America and a little forecasting of what might come next, Philip Bump’s “The Aftermath: The Last Days of the Baby Boom and the Future of Power in America” is it. Generational analyses can often be a bit pat and reductive, with cherry-picked numbers leveraged to support a too-tidy narrative (wealthy and venal boomers screwing the rest of us; avocado-toast-eating millennial snowflakes woke-ing themselves broke). Bump, a national columnist for The Washington Post, offers the opposite: a deep and complicated interrogation of his subject, often challenging his own assumptions, with detailed forecasts of what could lie ahead — all illustrated with charts and visuals to drive a huge amount of data home.

Is US Recession Risk High, Low… Or Both?!?

There’s an old joke in the world of statistics that says if you torture the data long enough, it’ll say anything you want. But sometimes torturing is redundant. Consider the art/science of deciding how to read the state of US business cycle at the moment. Is recession risk high, low or somewhere in between? Yes, yes and yes.

Macro Briefing: 27 January 2023

* US jobless claims fall, highlighting tight labor market conditions

* US durable goods orders rose in December, fueled by aircraft orders

* Chicago Fed Nat’l Activity (3mo avg) falls in December; new economic warning

* Money supply data is back in focus after inflation roller coaster

* Big oil firms expected to report record annual profits

* 10yr US Treasury yield rises above 3.5% after better-than-expected GDP report

* US economy rose 2.9% in fourth quarter, beating expectations:

Is Rally In Communications Stocks Sign Of New Sector Leadership?

Energy was the hot sector last year, but so far in 2023 it looks like a shift in leadership could be unfolding, based on a set of sector ETFs through the close of trading on Jan. 25.

Macro Briefing: 26 January 2023

* Russia launches new attacks on Ukraine, which lauds West’s plan to send tanks

* Hiring surge by small firms complicates Fed’s plans to cool inflation

* Sen. Manchin seeks delay in new tax credits for electric vehicles

* Will a gain in today’s Q4 GDP report minimize recession risk?

* Consumer prices remain high despite softer inflation data

* Investors eye layoffs at investment banks as recession indicator

* Does Google antitrust investigation threaten its dominance in search business?

* Smartphone shipments plunge in Q4, largest decline on record

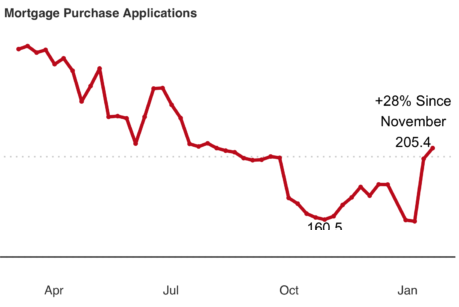

* US housing demand showing signs of rebounding, advises Redfin:

Fed Pivot Watch: 25 January 2023

The Federal Reserve is expected to slow its next rate hike to a quarter-point increase, which would be the smallest since it began lifting rates in March 2022. The outlook has sparked debate on whether the central bank’s policy tightening will end after the upcoming Feb. 1 FOMC meeting.

Macro Briefing: 25 January 2023

* US and Germany set to announce sending tanks to Ukraine

* Treasury takes another “extraordinary” step to buy time in debt-ceiling impasse

* Senators consider Social Security reforms as GOP House members weigh cuts

* A warning for the labor market: companies cutting temporary workers

* Deciding if recession is high is unusually tricky this time

* Climate change may trigger new era of trade wars

* Justice Dept. sues Google, claiming it dominates digital advertising

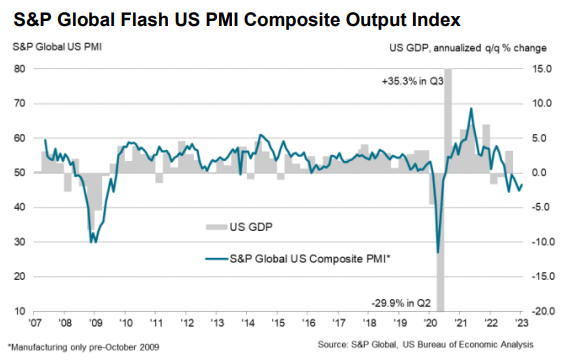

* US economic contraction continues in January via PMI survey data:

US Q4 GDP Nowcasts Project Solid Rise For Thursday’s Report

Recession worries continue to swirl, but the outlook remains upbeat for this week’s initial estimate of fourth-quarter GDP, based on a set of estimates compiled by CapitalSpectator.com.

Macro Briefing: 24 January 2023

* Eurozone economic activity edges back to growth in January via PMI survey data

* UK continues to post “sustained downturn” in January via PMI survey data

* US investment firms look to Europe for growth, start turning away from China

* Analysts expect US stocks will continue to underperform global peers

* The end of easy money is “particularly painful” for tech companies

* Microsoft will invest billions of dollars in OpenAI, creator of ChatGPT

* US Leading Economic Index fell sharply again in December:

Foreign Stocks Continue To Rally As US Shares Retreat

Diversifying into equities ex-US has been a disappointment in recent years, but January suggests the tide may be turning in favor global investing strategies.