* No speaker elected in House after second day

* Until a speaker is elected, normal House governing activity isn’t functioning

* Inflation has not “turned the corner yet,” says IMF official

* Amazon will layoff 18,000 workers, biggest cut in tech recently

* China economy continues contract, mildly, in December via PMI survey data

* China accused of “under-representing” severity of its Covid outbreak, says WHO

* US job openings remain high in November, highlighting tight labor market

* Fed officials expect higher rates for ‘some time’, according to minutes

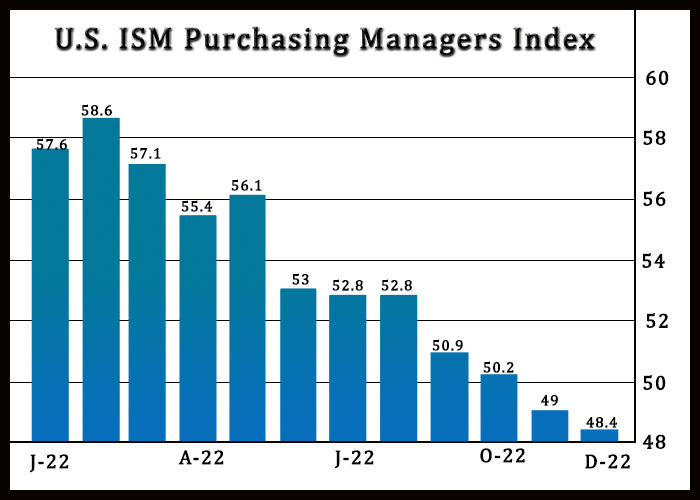

* US ISM Mfg Index falls again in December, marking second month of contraction:

Total Return Forecasts: Major Asset Classes | 4 January 2023

The expected long-run return for the Global Market Index (GMI) ticked lower in December, slipping below 6% annualized, based on the average forecast for three models. Today’s estimate is roughly in line with the trailing 10-year return for GMI, an unmanaged, market-value-weighted portfolio that holds all the major asset classes (except cash).

Macro Briefing: 4 January 2023

* House adjourns without picking a speaker, marking chaotic opening

* New Covid-19 variant has ‘alarming’ immunity evasion, experts advise

* US Treasury yields fall as demand for safe-haven bonds rebound

* Natural gas prices decline amid forecasts of warmer weather

* UK expected to suffer deepest recession in 2023 among G-10 nations

* Global mfg downturn continues in December, based on PMI survey data

* Eurozone recession eases and inflation cools in December via PMI survey data

* US manufacturing recession deepens in December via PMI survey data:

Major Asset Classes | December 2022 | Performance Review

Losses dominated market activity for the major asset classes in 2022. Commodities and cash are the exceptions. The rest of the field lost ground last year, in some cases by hefty degrees, based on a set of proxy ETFs.

Macro Briefing: 3 January 2023

* Recession will strike one-third of countries in 2023, predicts IMF chief

* Leadership of House still uncertain as new Congress is set to convene

* Will the war in Ukraine accelerate India’s ascent?

* The worst may be over for Europe’s factory sector

* First regular shipment of US liquefied natural gas arrives in Germany today

* Tech-industry worker layoffs are accelerating

* Tesla’s Elon Musk is first person ever to lose $200 billion in wealth

* Largest US oil firms refocus on developing supplies in Western Hemisphere

* China economic activity continues to slow in December via PMI survey data:

A Fresh Start…

Best Of Book Bits 2022: Part II

Here’s the second installment to Best of Books 2022. Last week we reviewed highlights from this column over the past year. With just hours to go before 2022 goes dark, here’s the second batch of books that captured our attention over the preceding 12 months. Cheers!

● The Price of Time: The Real Story of Interest

Edward Chancellor

Review via The Economist

The critics who label as artificial the low interest rates that have prevailed in the world economy in recent decades must therefore answer the question: low relative to what?

“The Price of Time” is the answer of Edward Chancellor, a historian and financier who has written a book by that name. Humans prefer jam today to jam tomorrow. Interest rates are the reward for deferring gratification, for renting out money that could have been spent today. When rates fall too low, grave consequences follow: financial instability, higher inequality and pain for savers. As he makes his case, Mr Chancellor’s panoptic survey of the history of interest, and what classical economists said about it, will not fail to dazzle. The argument, however, is seriously flawed.

2022 Review: US Bond Market

With one trading day left in 2022, the US bond market is set to record a deep loss for the year.

Macro Briefing: 30 December 2022

* Biden signs $1.7 trillion spending bill and avoids government shutdown

* Xi and Putin speak via video to highlight Russia-China partnership

* Risk is low that a dangerous new Covid-19 variant is spreading in China

* Estimating China’s covid outbreak is a scientific guessing game

* Vietnam’s economy defies world trend and grows sharply in 2022

* Over half of 50 US states showing signs of slowing economic activity

* Small-business owners say hiring and retaining workers is getting easier

* US mortgage rates rebound after falling for six straight weeks

* US jobless claims (unadjusted) continue to rise vs. year-ago level:

2022 Review: US Equity Sectors

Annual returns for equity sectors are always a study in contrasts, but the blowout performance of energy stocks in 2022 is unusually divergent vs. the rest of the field, based on a set of proxy ETFs.