US retail sales fell the most in four months in May, dropping more than expected. “Tariff announcements have had a clear impact on the timing of large-ticket purchases, notably autos, but there are few signs yet that tariffs are leading to a general pullback in consumer spending,” said Michael Pearce, deputy chief economist at Oxford Economics. “We expect a more marked slowdown to take hold in the second half of the year, as tariffs begin to weigh on real disposable incomes.”

Industrials Take The Lead For US Equity Sectors This Year

In a year of shocks, turmoil, and tariffs, investor sentiment has been whipped to and fro as the crowd struggles to assess the outlook for risk and reward. But as 2025 approaches its mid-point, stocks in the industrial sector have found their footing and are now the performance leader, based on a set of ETFs through Monday’s close (June 16).

Macro Briefing: 17 June 2025

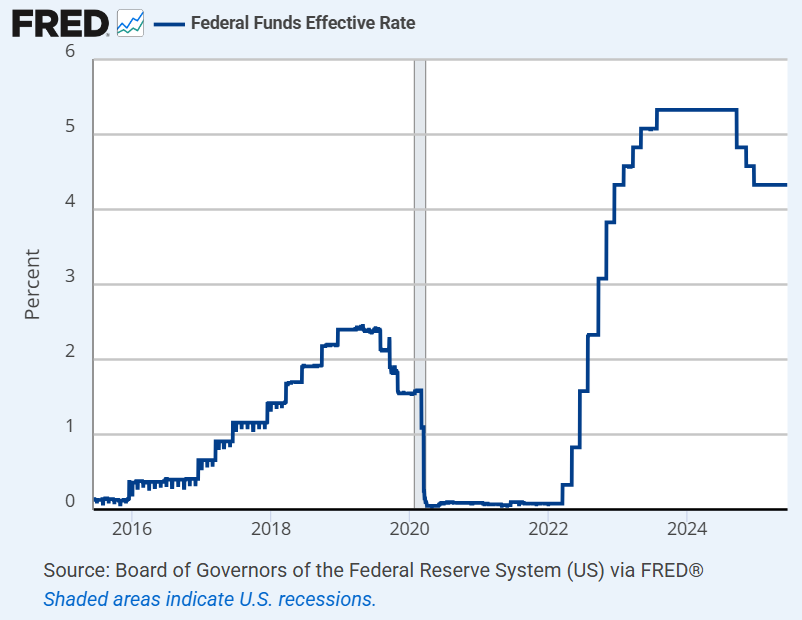

Fed funds futures are pricing in a near certainty that the Federal Reserve will leave its target rate unchanged today for the 2:00pm eastern policy announcement. The main focus will be on comments Fed Chair Jerome Powell in the press conference that starts at 2:30pm. Investors will be listening closely for hints of lingering concern over inflation, the path ahead for rate cuts and the outlook for economic activity. The Fed will also publish revised economic projections today.

The Israel-Iran Conflict Complicates The Macro Outlook

The Israel-Iran conflict continued for a fourth day as each country launched attacks on Monday. The fighting threatens to elevate oil prices for an extended period and bring a new phase of instability to the global economy that’s still reeling from elevated tariff risk.

Macro Briefing: 16 June 2025

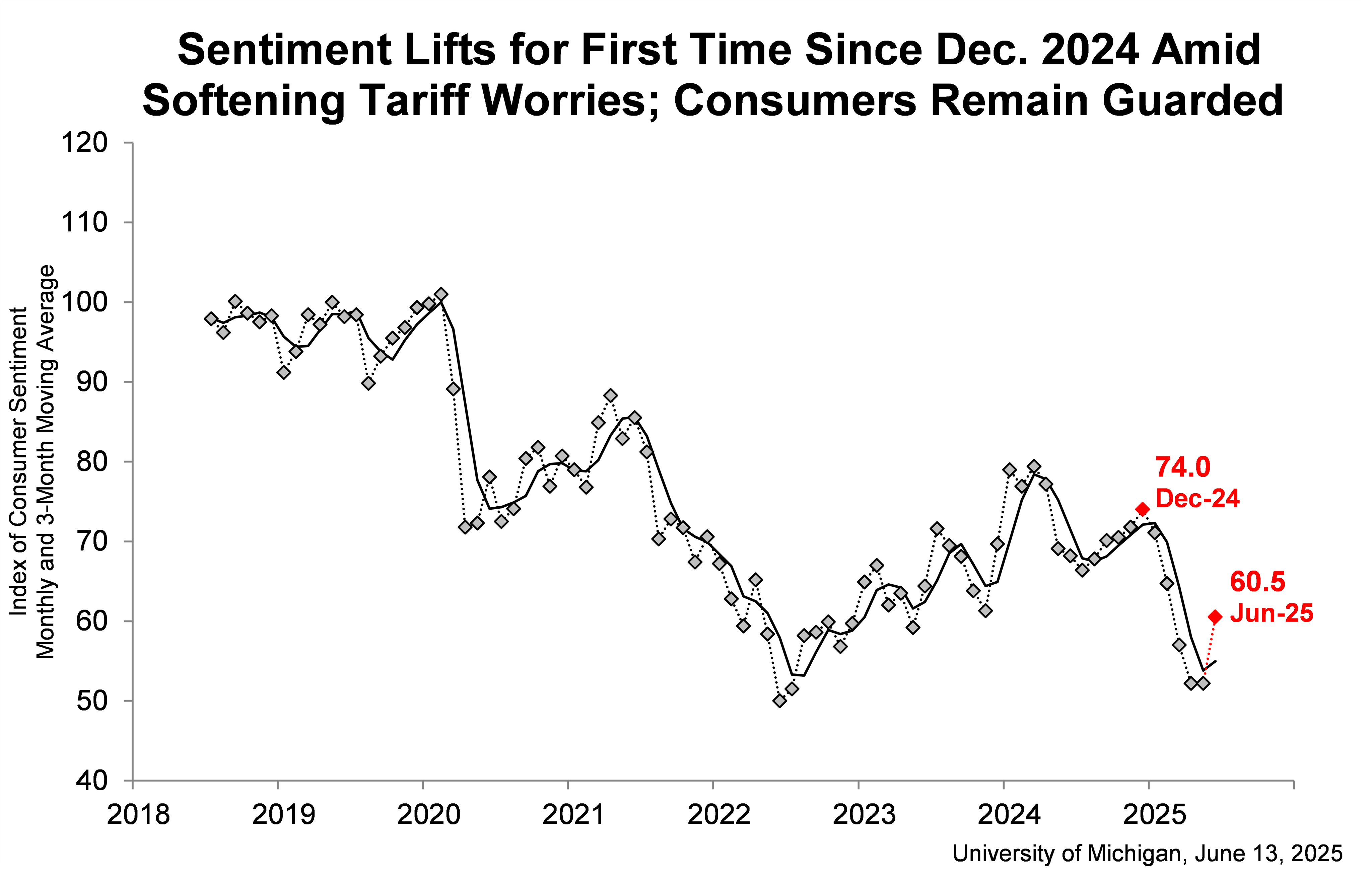

US consumer sentiment improved in June for the first time this year. The rise was modest and still leaves the University of Michigan’s index about 20% below December 2024, when sentiment posted a post-election bump. “Consumers appear to have settled somewhat from the shock of the extremely high tariffs announced in April and the policy volatility seen in the weeks that followed. However, consumers still perceive wide-ranging downside risks to the economy,” said Joanne Hsu, survey director, said in a statement.

Book Bits: 14 June 2025

● The Haves and Have-Yachts: Dispatches on the Ultrarich

● The Haves and Have-Yachts: Dispatches on the Ultrarich

Evan Osnos

Interview with author via Marketplace.org

Currently, there are more than 3,000 billionaires in the world, and nearly one third of them are in the U.S. In the years between President Trump’s first and second inaugurations, 2016 to 2024, the wealth held by America’s billionaires more than doubled.

And yet, these ultra-high-net-worth individuals are something of a mystery to most of us. Average people could probably name a handful of them, such as Jeff Bezos, Mark Zuckerberg, or Warren Buffet, but their habits, their spending, or their values are something of an enigma.

So during those eight years, Evan Osnos, a staff writer for The New Yorker, was studying that population. The essays he wrote in that time have come together in his new book, “The Haves and the Have-Yachts: Dispatches on the Ultrarich.”

Research Review | 13 June 2025 | Analyzing And Monitoring Risk

Stock-Bond Return Correlation: Understanding the Changing Behaviour

David G. McMillan (University of Stirling)

March 2025

The stock and bond return correlation remains important given its central role in, and implications for, portfolio behaviour. Previous, primarily US, evidence indicates sign switching behaviour, which implies that bonds change between being a diversifier and a hedge. This paper considers the time-varying nature of the stock-bond correlation for G7 markets, including its economic drivers, and whether they are themselves time-varying. Using monthly data over a period spanning 1980 to 2023 evidence demonstrates that the correlation switches from positive to negative around 2000 for six of the seven markets (the switch for Japan occurs in the first half of the 1990s).

Macro Briefing: 13 June 2025

Israel attacked Iran’s capital early Friday, targeting the country’s nuclear program. The attacked also killed at least two top military officers. Iran vowed a “harsh” response. President Trump said that “the next already planned attacks” could be ”even more brutal,” and warned that Tehran “must make a deal, before there is nothing left.”

10-Year US Treasury Yield ‘Fair Value’ Estimate: 12 June 2025

The market premium for the US Treasury yield remained mostly unchanged in May vs. a “fair value” estimate. As the 10-year yield continued to trade in a tight range last month, combined with virtually no change an model-based assessment of its fair value, today’s update for May is in line with the previous month’s analysis.

Macro Briefing: 12 June 2025

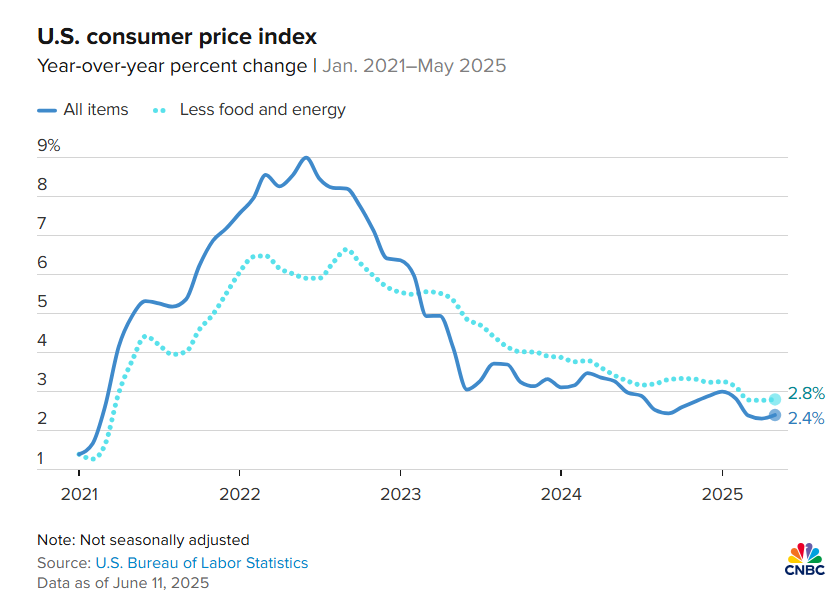

US consumer inflation remains muted in May as headline CPI’s year-over-year change ticked down to 2.4%. Core CPI, a more robust measure of the trend, held steady, which could be a sign that pricing pressure will remain “sticky” at a time when tariffs are only just starting to factor into prices. “It was a very good report,” said Mark Zandi, chief economist at Moody’s. “Basically, it says inflation has finally gotten back to the Federal Reserve’s annual inflation target.” He added: “I think it’s the calm before the inflation storm. This [report] still reflects the disinflation that began a few years ago and continued on through the month of May.”