There are many indicators to monitor for reading the monetary policy tea leaves, each with its own distinctive set of pros and cons. Here’s one more that’s worth pondering: the unemployment rate.

Macro Briefing: 11 June 2025

The World Bank downgrades the outlook for US and global growth, citing tariffs. Due to “a substantial rise in trade barriers,” the US economy would grow half as fast (1.4%) vs. 2024 (2.8%). The new forecast reflects a downgrade from the 2.3% growth forecast for 2025 that the bank published in January. The forecast also projects the slowest decade for global growth since the 1960s.

Fed Policy Is Still On Hold, But For How Long?

A lot of ink has been spilled on the economic and inflation outlook since President Trump shocked markets in April with a dramatic change in US trade policy. But while tariffs have increased and the outlook has become a guessing game, the Federal Reserve’s monetary policy has been a rock of stability and remained frozen. That’s not necessarily a positive, but for the moment it’s one of the few things that’s been reliably boring on the macro landscape.

Macro Briefing: 10 June 2025

Americans reduced expectations for year-ahead inflation, according to survey data for May. One-year-ahead inflation expectations fell 0.4 percentage point to 3.2%, the New York Fed reported. For the 3-year horizon, the outlook fell to 3% and the 5-year forecast ticked down to 2.6%. The declines still leave inflation expectations above the Federal Reserve’s 2% target.

Bitcoin Wins, The US Dollar Loses Since “Liberation Day”

Bitcoin remains a winning asset since President Trump’s tariff announcement on Apr. 2 — “Liberation Day,” as he called it. In relative and absolute terms vs. the world’s primary markets, the cryptocurrency is outperforming by a wide margin, based on a set of ETFs through Friday’s close (June 6). The US dollar, by comparison, has slumped and is the worst performer.

Macro Briefing: 9 June 2025

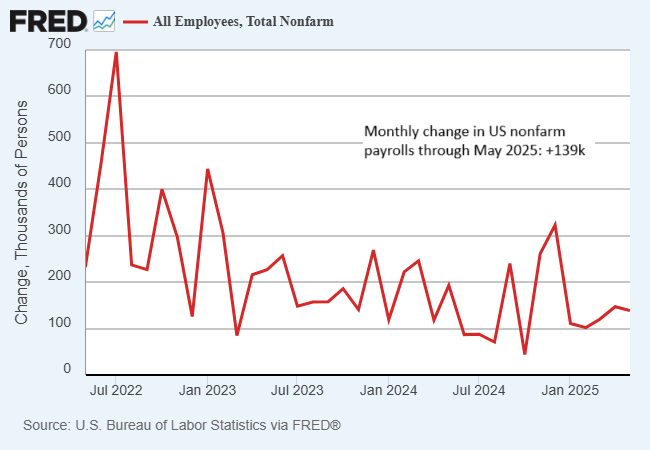

US payrolls rose more than expected in May. The economy added 139,000 jobs last month, the Labor Department reported. “Stronger than expected jobs growth and stable unemployment underlines the resilience of the US labor market in the face of recent shocks,” said Lindsay Rosner, head of multi-sector fixed income investing at Goldman Sachs Asset Management.

Book Bits: 7 June 2025

● How Countries Go Broke: The Big Cycle

● How Countries Go Broke: The Big Cycle

Ray Dalio

Review via Inc.

Billionaire investor Ray Dalio, who founded Bridgewater Associates, the largest hedge fund in the world, is warning that the debt situation in the United States is approaching a “death spiral” that could eventually threaten the entire U.S. economy.

In his new book, How Countries Go Broke: The Big Cycle, Dalio joins a growing chorus of financial experts and billionaires who have been sounding the alarm about government debt levels. The book comes as a report from the Congressional Budget Office released Wednesday found that Donald Trump’s budget bill would add $2.4 trillion to national debt, which currently stands at $36.9 trillion. The problem, Dalio said, is “urgent.”

US GDP Still On Track To Rebound In Q2

Uncertainty and risk continue to weigh on the outlook for the economy, but the latest nowcasts for the government’s second-quarter GDP report (due on July 30) are still pointing to recovery after Q1’s slight contraction.

Macro Briefing: 6 June 2025

US jobless claims rose last week to the highest level since October, raising a possible warning flag for the labor market outlook. “Jobless claims continue to rise, but they are rising at a slow pace, so it’s a trend worth watching, but too soon to sound the alarm,” said Chris Zaccarelli, chief investment officer for Northlight Asset Management.

Mixed Data For May Clouds Outlook For US Economy

May is shaping up to as challenging month for reading the macro tea leaves in an effort to gauge how tariffs are affecting the US economy. Tomorrow’s payrolls report from the Labor Department may provide clarity. Meanwhile, the early profile for last month is a study in contrasts.