There are no shortage of risks weighing on markets and economies these days, but perhaps the first question that’s on every investor’s mind: When will the Fed pivot? Everyone has a view, but no one has a clue, which is why monitoring the ebb and flow of key indicators is the first stop on the road to guesstimating when the tide will turn. As the data below suggests, however, a pause in Federal Reserve rate hikes – much less a rate cut – still looks like a low probability event for the immediate future.

Macro Briefing: 21 October 2022

* UK Prime Minister Liz Truss quits but political and economic turmoil will persist

* High inflation is raising political risk for governments in Europe

* 10-year US Treasury yield on track for 12th straight weekly increase

* US home sales continue to fall, dropping for eighth straight month in September

* Philly Fed Manufacturing Index continued to signal sector weakness in October

* US jobless claims fell last week, indicating tight labor market persists

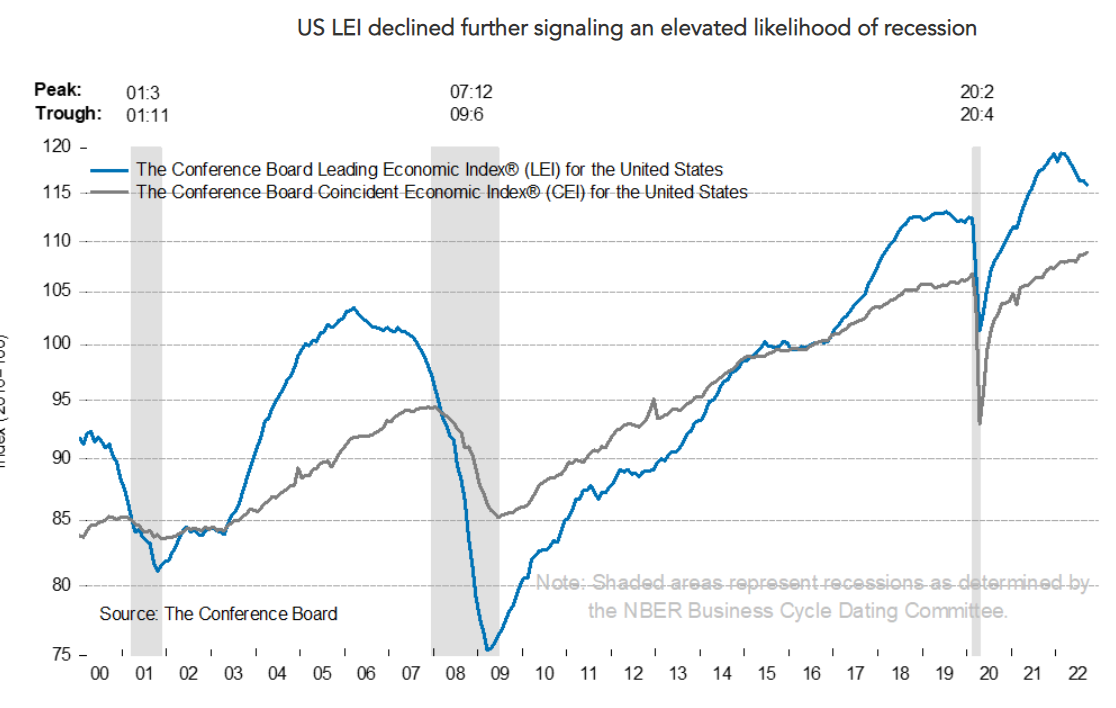

* Leading Economic Index fell again in September, reflecting rising recession risk:

Will The Stumbling Housing Market Drive The US Into Recession?

There’s no mystery why the housing sector is stumbling. Surging mortgage rates are taking a toll: a 30-year fixed rate, for example, is close to 7%, a 20-year high. The question is whether this key slice of the US economy will overwhelm the positive support from a so-far resilient labor market and strong consumer spending?

Macro Briefing: 20 October 2022

* Embattled British Prime Minister Liz Truss under pressure to resign

* Fed’s Beige Book: US economy expands modestly since early September, but…

* Fed survey finds US firms becoming more pessimistic about economic conditions

* Japanese yen at weakest level vs. US dollar since 1990

* Price hikes boost earnings for Procter & Gamble

* Amazon founder Jeff Bezos warns of trouble ahead for US economy

* Home sales fall sharply in September, reports real estate firm Redfin

* Mortgage applications in US slide to a 25-year low in week through Oct. 14

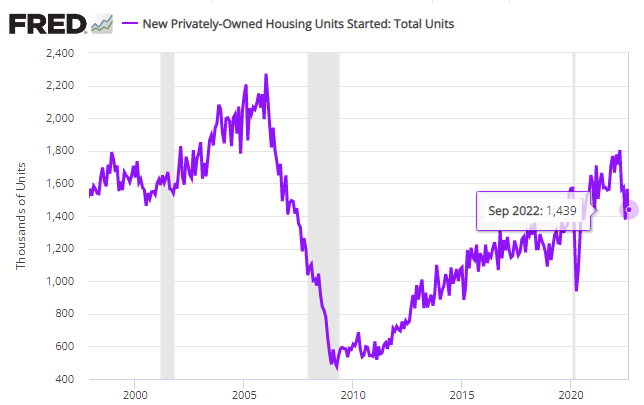

* US housing starts fell more than expected in September:

S&P 500 Risk Profile: 19 October 2022

The US stock market’s bounce in recent days has inspired speculation in some quarters that equities have found a bottom. Maybe, but the strength of downside momentum and other factors suggest otherwise.

Macro Briefing: 19 October 2022

* Biden set to announce of additional oil reserve sales to reduce gas prices

* Central banks will continue to raise rates to fight inflation, predicts Nordea

* Inflation in Britain rose 10.1% n September–a 40-year high

* US homebuilder sentiment falls to 2-1/2 year low in October

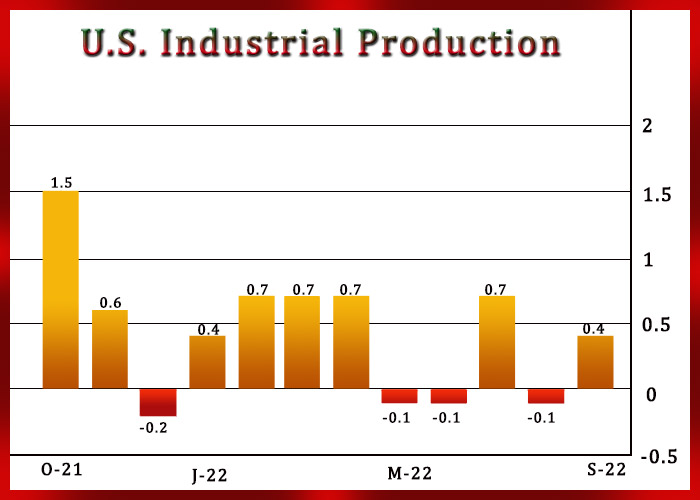

* US industrial production rebounds more than expected in September:

10-Year Treasury Yield ‘Fair Value’ Estimate: 18 October 2022

The US 10-year Treasury yield has been on a tear over the past two months, its rise fueled by persistent high inflation and ongoing increases in short-term interest rates by the Federal Reserve. But CapitalSpectator.com’s fair-value model suggests the 10-year rate’s upside bias is now limited, although strong momentum forces could easily push the benchmark yield higher still in the immediate future.

Macro Briefing: 18 October 2022

* Russia continues to attack Ukraine with drones, targeting energy facilities

* Europe generates record level of wind, solar power as Russian gas supply falls

* China economic outlook downgraded via Xi Jinping’s political agenda

* Strong US dollar is spreading economic pain around the world

* Solid earnings growth for Bank of America imply strong US consumer sector

* Microsoft announces job cuts, citing softer growth in revenue and sales

* Oil market eyes another possible release from Strategic Petroleum Reserve

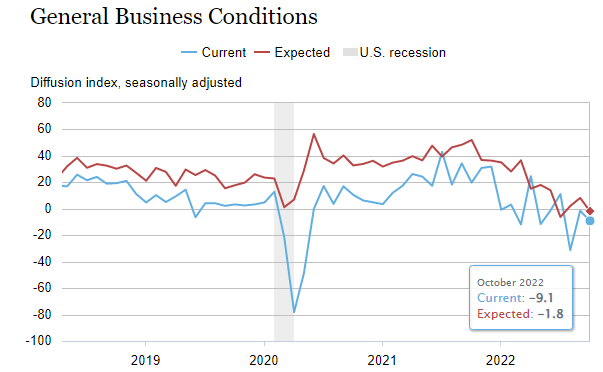

* NY Fed Mfg Index contracts for third straight month in October:

Last Week’s Upside Outlier: US Inflation-Linked Treasuries

US government bonds offering inflation hedging provided the only positive return for the major asset classes in last week’s trading through Friday, Oct. 14, based on a set of proxy ETFs.

Macro Briefing: 17 October 2022

* Russia attacks Ukraine capital with more drone strikes

* China delays release of key economic data

* US assets expected to lead rebound once bear market ends, survey finds

* Strong US dollar is a factor supporting rebound in small-cap stocks

* Supply chain congestion shows signs of easing after two years of disruption

* Sterling rebounds after new UK finance minister announces policy changes

* The recent surge in rental costs continues to cool in September

* US retail spending was flat in September as prices rose sharply

* US consumers’ year-ahead inflation expectations rise to 5.1% in October: