Offering a reprieve from bear-market conditions that have pummeled markets for much of 2022, traders bid up prices for most of the major asset classes for the week through Friday, Oct. 21, based on a set of ETFs.

Macro Briefing: 24 October 2022

* Rishi Sunak is set to become Britain’s new prime minister

* Global tension on track to rise as Xi secures third term to lead China

* US rebuts Russia’s claim that Ukraine may use dirty bomb and blame Moscow

* The two Koreas exchange warning shots along disputed sea boundary

* China releases delayed Q3 GDP data, which shows modest rebound in output

* Eurozone economic contraction deepens in October via PMI survey data

* UK economic downturn accelerates in October, PMI survey data shows

* Illegal border crossings into US set to reach record high

* Federal Reserve on track for another 75-basis-points rate hike in November

* US Treasury real yields remain near 13-year highs:

Book Bits: 22 October 2022

● MegaThreats: Ten Dangerous Trends That Imperil Our Future, And How to Survive Them

Nouriel Roubini

Review via Financial Times

At least there were only four horsemen of the apocalypse. But reflecting today’s rampant inflation, Nouriel Roubini now identifies 10 so-called megathreats, spanning various economic, financial, political, technological and environmental disasters. “Sound policies might partially or fully avert one or more of them, but collectively, calamity seems near certain,” Roubini jauntily concludes. “Expect many dark days, my friends.”

Readers of a nervous disposition may want to file this book in the bin before they turn a page. Those braced for an ice bath of pessimism may profit from its gloomy insights about the state of the world. Roubini’s warnings may be alarmingly scary, but they are also disturbingly plausible. One only prays that policymakers have better solutions than the author unearths.

Fed Pivot Watch: 21 October 2022

There are no shortage of risks weighing on markets and economies these days, but perhaps the first question that’s on every investor’s mind: When will the Fed pivot? Everyone has a view, but no one has a clue, which is why monitoring the ebb and flow of key indicators is the first stop on the road to guesstimating when the tide will turn. As the data below suggests, however, a pause in Federal Reserve rate hikes – much less a rate cut – still looks like a low probability event for the immediate future.

Macro Briefing: 21 October 2022

* UK Prime Minister Liz Truss quits but political and economic turmoil will persist

* High inflation is raising political risk for governments in Europe

* 10-year US Treasury yield on track for 12th straight weekly increase

* US home sales continue to fall, dropping for eighth straight month in September

* Philly Fed Manufacturing Index continued to signal sector weakness in October

* US jobless claims fell last week, indicating tight labor market persists

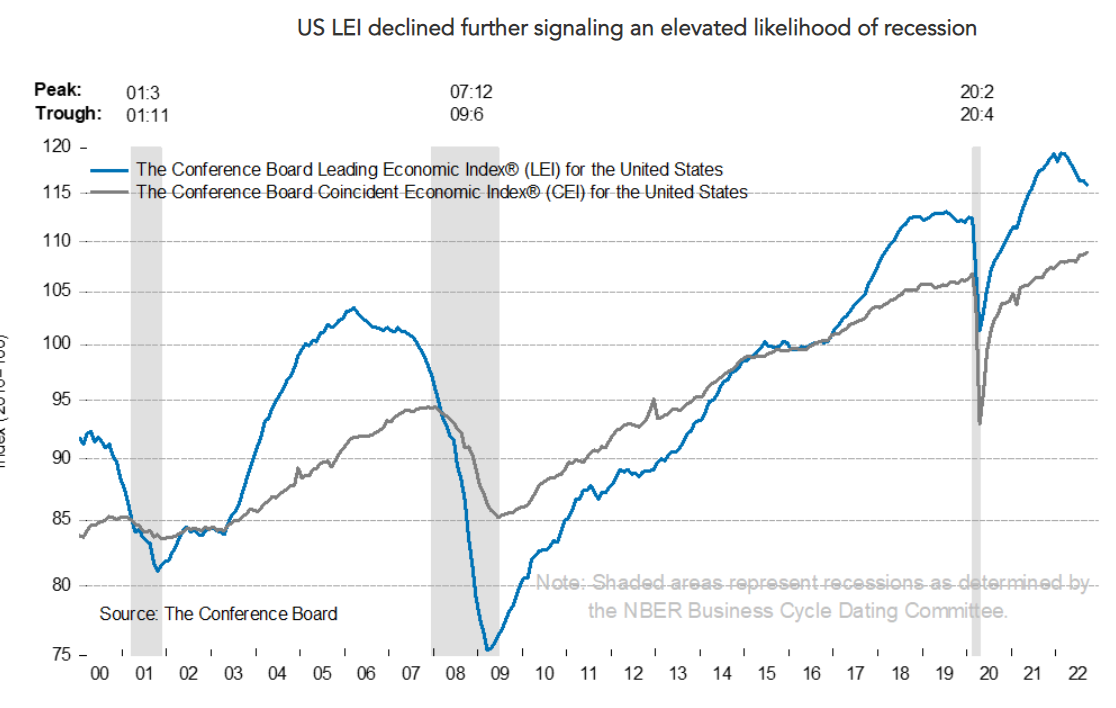

* Leading Economic Index fell again in September, reflecting rising recession risk:

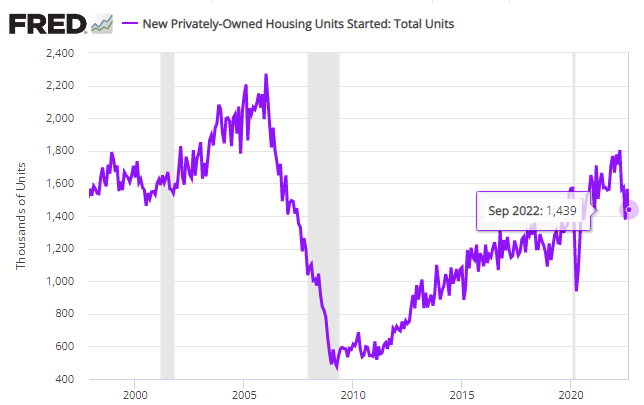

Will The Stumbling Housing Market Drive The US Into Recession?

There’s no mystery why the housing sector is stumbling. Surging mortgage rates are taking a toll: a 30-year fixed rate, for example, is close to 7%, a 20-year high. The question is whether this key slice of the US economy will overwhelm the positive support from a so-far resilient labor market and strong consumer spending?

Macro Briefing: 20 October 2022

* Embattled British Prime Minister Liz Truss under pressure to resign

* Fed’s Beige Book: US economy expands modestly since early September, but…

* Fed survey finds US firms becoming more pessimistic about economic conditions

* Japanese yen at weakest level vs. US dollar since 1990

* Price hikes boost earnings for Procter & Gamble

* Amazon founder Jeff Bezos warns of trouble ahead for US economy

* Home sales fall sharply in September, reports real estate firm Redfin

* Mortgage applications in US slide to a 25-year low in week through Oct. 14

* US housing starts fell more than expected in September:

S&P 500 Risk Profile: 19 October 2022

The US stock market’s bounce in recent days has inspired speculation in some quarters that equities have found a bottom. Maybe, but the strength of downside momentum and other factors suggest otherwise.

Macro Briefing: 19 October 2022

* Biden set to announce of additional oil reserve sales to reduce gas prices

* Central banks will continue to raise rates to fight inflation, predicts Nordea

* Inflation in Britain rose 10.1% n September–a 40-year high

* US homebuilder sentiment falls to 2-1/2 year low in October

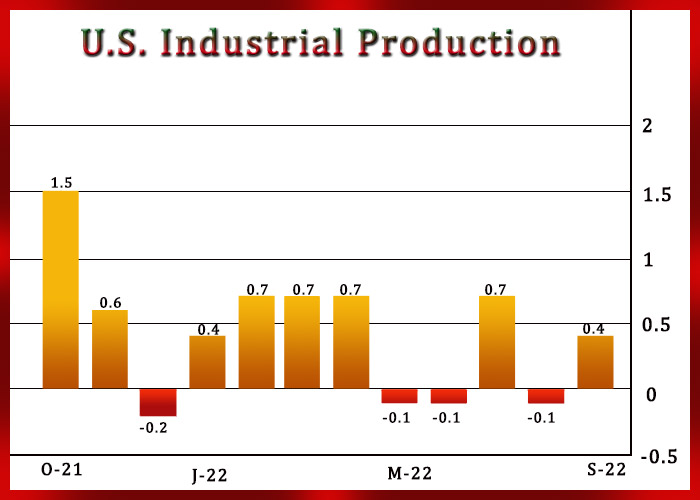

* US industrial production rebounds more than expected in September:

10-Year Treasury Yield ‘Fair Value’ Estimate: 18 October 2022

The US 10-year Treasury yield has been on a tear over the past two months, its rise fueled by persistent high inflation and ongoing increases in short-term interest rates by the Federal Reserve. But CapitalSpectator.com’s fair-value model suggests the 10-year rate’s upside bias is now limited, although strong momentum forces could easily push the benchmark yield higher still in the immediate future.