* NATO chief condemns Putin’s latest threat of nuclear war

* Federal Reserve lifts interest rates with third straight 1/4-point hike

* Fed’s Powell suggests recession may be price for taming inflation

* Fed anticipates lifting rates as high as 4.6% to tame inflation

* Bank of England under pressure to follow Fed with big rate hike

* Home sellers are scarce as rising rates convince homeowners to stay put

* Yen rises after Japan intervenes in currency market for first time since 1998

* After Switzerland’s rate hike, Japan is last country with negative rates

* US existing home sales fell for seventh straight month in August:

Guesstimating The Terminal Rate For Fed Policy

The Federal Reserve is expected to raise interest rates today and another 75-basis-points hike is widely expected. What’s less clear is how long and how fast the central bank tightens policy. No one knows the answer at this point, not even the Fed and so the path ahead is arguably the main known risk factor for the markets. In turn, pondering where the terminal rate lies is the burning question for investors and analysts trying to forecast economic activity.

Macro Briefing: 21 September 2022

* Russia announces ‘partial mobilization’ of citizens in escalation of Ukraine war

* Federal Reserve expected to raise interest rates 75 basis points today

* US and Canadian warships sail through Taiwan Strait

* Germany nationalizes energy giant Uniper amid energy crisis

* Asia’s developing economies set to grow faster than China’s

* European businesses rethink plans for a ‘closed’ China

* Disinflation may return, predicts economist at Capital Economics

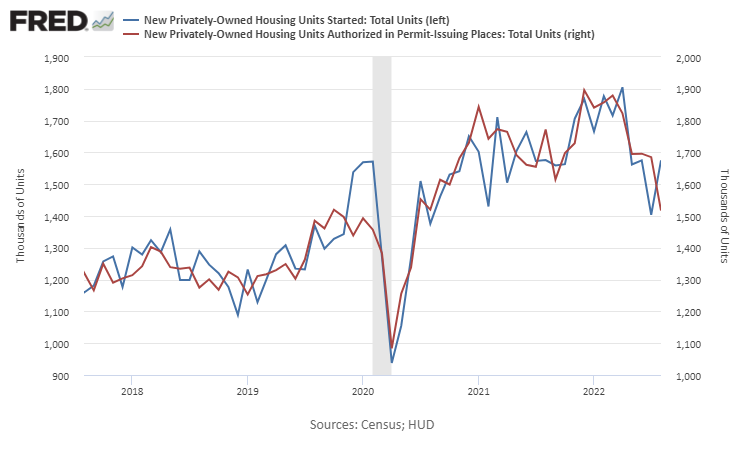

* US housing starts rebounded in August as new permits plunged:

10-Year Treasury Yield ‘Fair Value’ Estimate: 20 September 2022

The Federal Reserve is widely expected to lift its target interest rate by 75 basis points tomorrow (Wed., Sep. 21). The question is whether the bond market has priced in the change? That’s a tough call until there’s deeper clarity on where inflation is headed.

Macro Briefing: 20 September 2022

* Wall Street is anxious ahead of another expected rate hike on Wednesday

* Policy-sensitive 2yr Treasury yield set to rise above 4%

* Rate hikes by central banks may bring ‘string of financial crises,’ says World Bank

* US arrests at southwestern border exceed 2 million in a year for first time

* Mortgage rates rise to new 14-year high

* Sweden’s central bank lifts policy rate 100bps to fight surging inflation

* US Housing Market Index (homebuilder sentiment) fell again in September:

Clean Sweep Of Losses For Major Asset Classes Last Week

Bearish expectations for growth, interest rates and inflation took another toll on markets around the world last week, based on a set of proxy ETFs representing the primary asset classes as of Friday’s close (Sep. 16).

Macro Briefing: 19 September 2022

* Biden reaffirms US defense of Taiwan if China attacks

* Pandemic is ‘over’, says Biden

* Markets eye another big rate hike from the Federal Reserve this week

* Rising bond yields change expectations for stocks

* Strong US dollar threatens to exacerbate a global economic slowdown

* Some European factories closing due to surging energy prices

* Hurricane Fiona batters Dominican Republic and Puerto Rico

* Millions evacuated in Japan as Typhoon Nanmadol strikes

* US 10yr Treasury yield rises for seventh straight week through Friday’s close:

Book Bits: 17 September 2022

● Superabundance: The Story of Population Growth, Innovation, and Human Flourishing on an Infinitely Bountiful Planet

Marian L. Tupy and Gale L. Pooley

Essay by author (Tupy) via The Spectator

By our count, abundance has been doubling every 20 years or so. So, a 60-year-old Westerner has seen his standard of living rise from one to two, from two to four, and from four to 8 in his lifetime. Too slow, you say? That’s the modern mind speaking. Prior to the mid-18th century, life remained pretty much the same for millennia and no one thought that unusual. Generations of people lived and died without seeing or experiencing even the tiniest of improvements in their lives. What’s more, the scope for future improvements is immense.

Desperately Seeking Yield: 16 September 2022

The dark side of rising interest rates is conspicuous near and far, but there’s also a bright side: higher yields, which are a byproduct of risk assets that take a beating in price, which in turn lifts trailing payout rates.

Macro Briefing: 16 September 2022

* World Bank sees higher risk of 2023 recession amid global rate hikes

* Putin admits China has ‘questions and concerns’ over Russia’s war in Ukraine

* China retail sales, industrial output rise more than expected

* US industrial output dips in August but manufacturing activity turns up

* US jobless claims fell for a fifth straight week

* Worker strikes on the rise amid new demands for pay raises

* Gold falls to 2020 pandemic levels as rate hikes take a toll

* Philly Fed Manufacturing Index fell in September

* New York Fed Manufacturing Index rebounds in September

* US retail sales picked up in August, posting upside surprise: