● The Investing Oasis: Contrarian Treasures in the Capital Markets Desert

J. T. Mason

Summary via publisher (Wiley)

A guided journey revealing hidden values and buried treasures amidst the dangers facing DIY investors. A metaphorical journey through the hot, shifting sands of the capital markets ‘desert’ to awaken readers to the urgency of the “Behavior Gap”—a chronic gap of under-performance relative to the markets experienced by investors worldwide. This is a roadmap of portfolio management concepts and contrarian tactics that can turn misbehaviors, undue risks, and short-term gambles into longer-term strengths. Through 30 chapters and four tiers, the author progressively introduces more powerful tools & techniques used in the founding and successful management of the Oasis Growth Fund, a North American Hedge Fund.

It’s (Still) A Multi-Factor World For Predicting Returns

It’s tempting to assume that you can find a silver bullet for predicting returns. But along with unicorns and free money, reliable (or at least high-confidence) one-factor models for estimating ex ante performance are the stuff that dreams are made of.

Macro Briefing: 26 August 2022

* Markets are focused on today’s speech from Fed Chairman Powell @ 10am ET

* Putin orders increase in Russian military troops

* Russia halts a natural gas shipment to Asia over payment issues

* UK energy bills for households expected to rise 80% in October

* Midwest drought is causing more trouble for grain markets

* Will a housing recession lower house prices? Maybe not, says economist

* US consumers borrow at record levels to buy cars

* US Q2 GDP loss is softer than initially estimated

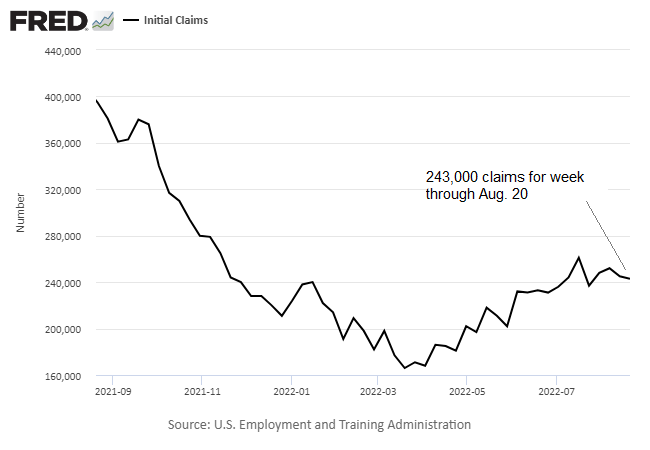

* US jobless claims fall for 2nd week, highlighting tight labor market:

Will Bullish Sentiment Return To Alternative Energy ETFs ?

In a year of upheaval, including worries about conventional energy supplies, the prospects for alternative energy sources should be front and center for investors. Or so one might think. But using a set of ETFs to gauge sentiment suggests the crowd is still lukewarm at best in embracing industries in the alternatives space vs. old-school fossil-fuels stocks.

Macro Briefing: 25 August 2022

* Biden announces student loan forgiveness plan

* California expected to ban sales of new gasoline cars starting in 2035

* China announces more stimulus to support economy

* German leading indicator forecasts continued weakness for economy

* Despite war in Ukraine, Russian goods continue to reach US

* Pending home sales fell again in July but economist says a bottom may be near

* US home prices fell in July–first monthly slide in three years

* New orders for US durable goods flat in July as core orders continue rising:

Rebound Expected For US Q3 GDP, Based On Median Outlook

After two quarters of contraction, US gross domestic product (GDP) is on track to recover in the third quarter, based on the median estimate for a set of nowcasts compiled by CapitalSpectator.com. But there’s a joker in the deck: the implied Q3 estimate based on the latest PMI survey data points to an accelerating slide in output that anticipates a deep recession.

Macro Briefing: 24 August 2022

* Ukraine war at six-month mark, with no end in sight

* Putin reportedly thinks winter will favor Russia in its Ukraine war efforts

* US plans for $3 billion in new aid for Ukraine

* US military strikes target Iran-linked targets in Syria

* More Americans fall into poverty from inflation vs. pandemic or Great Recession

* Streak of falling US gasoline prices offers relief for drivers

* New home sales in US continue to slide in July

* US PMI survey data shows further contraction in business activity in August:

Monitoring Investment Trends With ETF Pairs: 23 August 2022

Markets are still struggling to price in a variety of risk factors, including: How long and how far will interest rates rise? When will inflation peak? How will the war in Ukraine evolve? Is a global recession fate, and if so how deep will it be? No one has a crystal ball and the future’s always uncertain, but trending behavior in markets can offer some useful perspective, particularly when debates about the future are unusually stark.

Macro Briefing: 23 August 2022

* US natural-gas futures reach 14-year high

* Eurozone economic activity fell for second month in August via survey data

* Euro at two-decade low vs. US dollar

* UK economic activity near virtual standstill in August, PMI data shows

* Pimco analyst predicts great moderation for inflation is “fully behind us now”

* Strong US dollar takes a toll on gold and silver prices

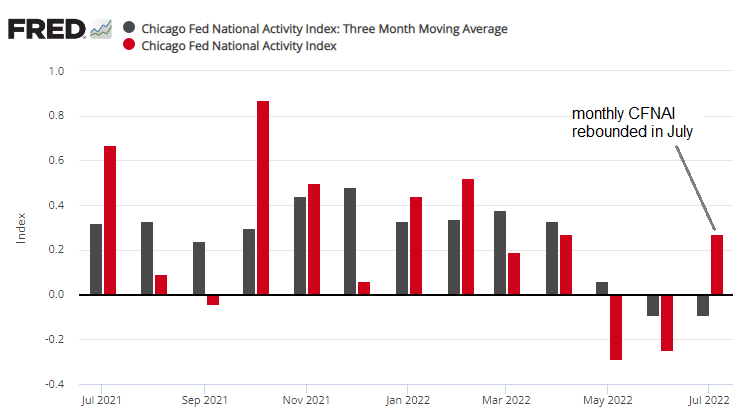

* US economic activity rebounded in July via Chicago Fed Nat’l Activity Index:

All The Major Asset Classes Lost Ground Last Week

A clean sweep of red ink washed over all the major asset classes for the trading week through Friday, Aug. 19, based on a set of ETFs.