Risk-off sentiment continues to dominate market behavior. In other words, nothing much has changed vs. recent history.

Macro Briefing: 7 July 2022

* Boris Johnson to resign as UK prime minister as scandals mount

* Another 75-basis-point rate hike appears likely for July 26-27 Fed meeting

* Fed minutes show policymakers are focused on fighting inflation

* Growth for US services industry slows to 2-year low

* Demand for mortgages falls despite drop in mortgage rates

* Euro continues to slide against US dollar

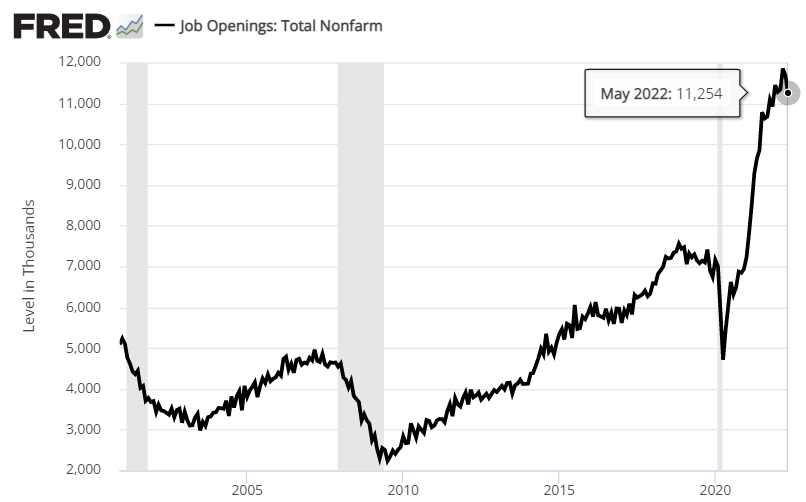

* US job openings fell in May but still exceed available workers by 2 to 1:

Risk Premia Forecasts: Major Asset Classes | 6 July 2022

The estimated risk premium for the Global Market Index (GMI) continues to ease. The revised long-term outlook projects an annualized return of 4.9%. Echoing previous updates in recent history, today’s estimate reaffirms the case for managing expectations down for globally diversified multi-asset-class portfolios relative to realized returns in previous years.

Macro Briefing: 6 July 2022

* UK Prime Minister Johnson’s leadership is hanging by a thread

* Demand for US workers still robust, according to private-sector estimates

* New covid outbreaks in China put millions under lockdown In China

* Will today’s release of Fed minutes support another 75-basis-point rate hike?

* US dollar’s international status remains unchallenged, Fed study finds

* Chinese automaker BYD overtakes Tesla world’s largest electric vehicle seller

* Oil fell below $100 on Tuesday for first time in almost two months

* US factory orders rose more than expected in May:

Factor Diversification Offers Relief, But Only In Relative Terms

Diversifying an equity portfolio based on risk factors has paid off this year, but only in relative terms, according to a set of ETF proxies. Across-the-board losses for equities have hammered portfolios in 2022, but the degree of red ink varies dramatically, depending on how you carved up factor exposure.

Macro Briefing: 5 July 2022

* Macro outlook remains uncertain due to Ukraine war and inflation risks

* China economic activity rebounds sharply in June via PMI survey data

* Eurozone still posting modest economic growth in June via PMI survey data

* Germany reports first trade deficit in over 30 years

* Euro at 20-year low vs. US dollar as Eurozone recession risk rises

* Slower but still healthy growth expected for US payrolls in June

“A republic, if you can keep it.”

Book Bits: 2 July 2022

● The Illusion of Control: Why Financial Crises Happen, and What We Can (and Can’t) Do About It

Jon Danielsson

Review via Foreign Affairs

“Not another book about financial crises!” one is tempted to exclaim. Fortunately, this is an exceptionally provocative and original addition to an ample literature. Drawing on the historical record, Danielsson explains why regulators have not been more successful at limiting financial instability. They tend to focus excessively on exogenous risks (shocks coming from outside the financial system) while neglecting endogenous risks—the destabilizing responses of the participants in financial markets to those same exogenous shocks and, no less, to regulatory action. Having been encouraged in the wake of past crises to develop numerical measures of financial risks, regulators tend to place excessive confidence in the accuracy of those numbers, which are better at predicting the last crisis than the next one, given the ever-changing nature of the financial system.

Major Asset Classes | June 2022 | Performance Review

As risk-off messages go, the markets couldn’t be any clearer in June. Losses weighed on every slice of the major asset classes, based on a set of proxy ETFs. Even cash took a hit, albeit a fractional one.

Macro Briefing: 1 July 2022

* Supreme Court limits EPA rules for curbing power plant emissions

* US consumer spending growth slowed in May, raising concerns for economy

* US jobless claims hold steady, suggesting upbeat labor market outlook

* Eurozone mfg activity continues to slow, weakening to 22-month low in June

* Eurozone inflation hits record pace in June

* US dollar bucks the trend vs. most assets with a Q2 gain

* Atlanta Fed’s revised nowcast for US GDP turns negative for Q2: