The US stock market is sliding in what may or may not presage an extended decline. Whatever unfolds in the weeks and months ahead, the first order of business is recognizing that we’ve been here before by putting the current correction into historical perspective. There’s nothing new under the sun for market corrections, but it can appear otherwise if you’re overwhelmed with recency bias.

Macro Briefing: 13 May 2022

* Russia says it will “retaliate” if Finland Joins NATO

* Finland wants to join NATO. Sweden may be next

* Fed Chair Powell says soft economic landing may be beyond Fed’s control

* US housing market showing nascent signs of cooling

* US wholesale inflation continues to accelerate in April

* Oil giant Saudi Aramco overtakes Apples as world’s most valuable company

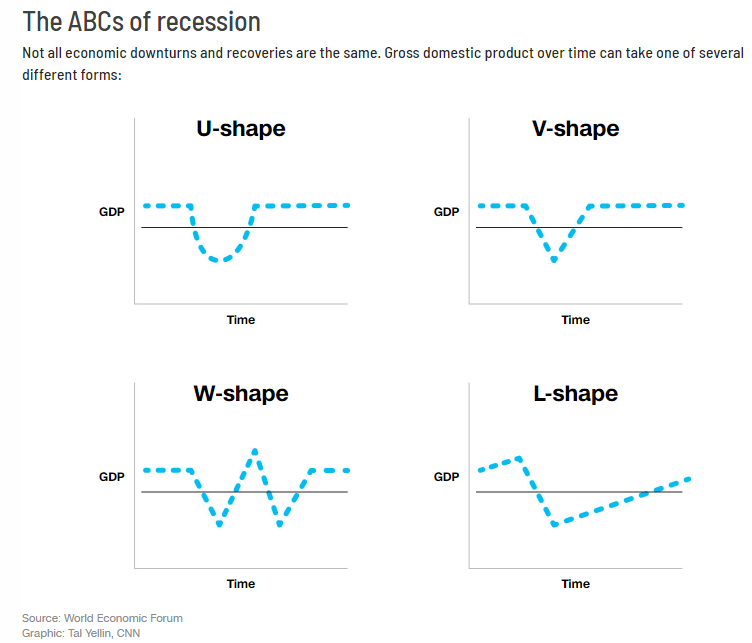

* How will the next recession unfold? Here are several possibilities:

10-Year Treasury Yield ‘Fair Value’ Estimate: 12 May 2022

For the first time in 11 months, the US Treasury 10-year yield is above CapitalSpectator.com’s fair-value model estimate of the benchmark rate. That doesn’t ensure that the 10-year yield will stop rising, of course, but it provides a new talking point for considering why this key rate’s upward bias may moderate or even reverse in the near term.

Macro Briefing: 12 May 2022

* Finland’s prime minister and persident announce support for joining NATO

* Will a prolonged Ukraine war and its economic fallout strain Western resolve?

* China’s economic slowdown is creating headwinds around the world

* China sticks with costly ‘zero Covid’ policy despite economic costs

* UK economy contracts in March as consumers reduce spending

* Bitcoin tumble continues, falling below $27,000 in early Thursday trading

* US annual consumer inflation eases in April but still near 40-year high:

Outlier Risk, Part V: Largest Difference From Average Value

In recent updates to this series (see list below) I’ve been looking at various methodologies to identify extreme values in a time series, such as the S&P 500 Index. One motivation for this analysis is that detecting so-called outlier values offers context for deciding if the risk of trend reversion is relatively high. Let’s add another metric to the tool-kit for this task: finding the value that marks the largest difference vs the average value over a trailing period.

Macro Briefing: 11 May 2022

* NATO leaders fret over uncertain end-game for Ukraine war

* US spy chief says Putin is preparing for long conflict in Ukraine

* Fed officials consider why central bank acted slowly to tame inflation

* Household debt in US in Q1 posts largest single-quarter increase since 2006

* US gasoline prices reach record high price

* China consumer annual inflation rises to 5-month high in April: +2.1%

* China’s upcoming wheat harvest is concern for global food prices

* Are oil stocks the new FAANGs?

* UST, a ‘stablecoin’ designed to maintain a $1 peg, plunges

* US small business sentiment in April remains well below long-term average:

Value Factor Is Relative Haven For Stocks So Far In 2022

There’s no place to hide within the US equities risk factor spectrum, at least in absolute terms. But value stocks continue to shine on a relative basis via light losses this year. Will it last? More importantly, can value stocks regain their mojo and at some point outperform the growth factor with higher gains for an extended period? Or is the historical value premium destined to fade into a perpetual underperforming risk premium?

Macro Briefing: 10 May 2022

* Biden urges Congress to quickly pass new aid package for Ukraine

* Biden worried that Putin doesn’t have exit strategy for Ukraine war

* Germany prepares for sudden end to Russian gas supplies

* Rough year for government retirement funds set to get worse

* Emerging market currencies suffer from rising rates and slower growth

* Consumer inflation outlook falls in April from record high in previous month

* US housing market may be a bubble, or close to it

* Bitcoin trades below $30,000 for first time since last July

* S&P 500 Index’s drawdown sinks to -16.8% — deepest in two years:

Commodities Rebounded Last Week As Stocks, Bonds Tumbled

The major asset classes took another hit for the trading week through Friday, May 6 – with a familiar exception: commodities. After a modest pullback in the second half of April, raw materials rebounded in the first week of May amid a broad selloff in markets elsewhere, based on a set of ETF proxies.

Macro Briefing: 9 May 2022

* Putin says West caused Russia’s invasion of Ukraine in ‘Victory Day’ speech

* China exports take a hit: growth slows to 2-year low in April

* Ferdinand Marcos Jr. appears to win presidential election in Philippines

* US consumer debt levels surged in March 2022, fueled by credit-card spending

* Rising interest rates are a double-edged sword for banks

* Winners and losers from the strengthening US dollar

* Odds for soft US economic landing may higher than expected, says analyst

* 5-year US Treasury yield at highest since 2008 in Monday trading

* US Dollar Index at fresh 20-year high in early trading on Monday: