Energy is still the only game in town for strong upside momentum in the US equity sector this year. Or perhaps a better way to explain the 2022 horse race to date: extreme divergence in favor of energy shares rolls on, based on a set of sector ETFs through Tuesday’s close (May 3).

Macro Briefing: 4 May 2022

* European Union calls for gradual ban on Russian oil in new set of sanctions

* World’s second-largest fertilizer producer may be sanctioned by European Union

* Another N. Korean missile launch raises tension in Asia

* Federal Reserve expected to raise its policy rate by 50 basis points today

* Can the Fed tame inflation gently without causing a recession?

* Bank of England confronts what some are calling an inflationary spiral

* Guggenheim Partners CIO: interest rates could ‘trend higher for a generation’

* Beijing restricts public transport as Covid-19 spreads

* German exports fell sharply in March–first hard data on Ukraine-war blowback

* US factory orders rose sharply in March, beating estimates by wide margin

* US job openings in March rose to a series high:

Risk Premia Forecasts: Major Asset Classes | 3 May 2022

The expected risk premium continued sliding in April for the Global Markets Index (GMI). Today’s revision reflects a drop to a 5.4% annualized increase for the long term – a relatively large cut of 40 basis points from last month’s estimate. The new estimate strengthens the outlook, long featured in these updates, for managing expectations down for globally diversified multi-asset-class portfolios relative to realized returns in recent years.

Macro Briefing: 3 May 2022

* Supreme Court to overturn abortion-rights precedent, leaked document shows

* European Union set to propose phased-in ban on Russian oil

* Possibility of Fed mistake in focus ahead of Wednesday’s policy decision

* Is the era of low-cost supply abundance ending?

* Bank of England expected to raise interest rates to 13-year high

* Australia raises interest rates for first time in over a decade

* China’s manufacturing contraction is accelerating via April PMI survey data

* US ISM Mfg Index slips again in April but still indicates moderate growth:

Major Asset Classes | April 2022 | Performance Review

Red ink spilled across nearly every slice of the major asset classes in April. Commodities were the exception, posting a solid gain. Otherwise, losses prevailed, based on a set of ETF proxies.

Macro Briefing: 2 May 2022

* EU energy ministers in crisis talks re: Russia’s energy supplies

* Rumors of Putin’s ill health emerge

* Fed funds futures predicts 1/2-point rate hike at Fed meeting this week

* Three signs that suggest inflation may be peaking

* Inflation has surged, growth has slowed, but experts don’t expect stagflation

* Consumer-staples stocks return to the limelight for jittery investors

* Recession is main concern for institutional investors

* US consumer spending rose for third month in March:

Book Bits: 30 April 2022

● The Rise and Fall of the Neoliberal Order: America and the World in the Free Market Era

Gary Gerstle

Review via Financial Times

It’s rare that one can use the term “instant classic” in a book review, but Gary Gerstle’s latest economic history, The Rise and Fall of the Neoliberal Order, warrants the praise.

It puts neoliberalism, defined as a “creed that prizes free trade and the free movement of capital, goods and people,” as well as deregulation and cosmopolitanism, in a 100-year historical context, which is crucial for understanding the politics of the moment, not just in the US but globally. The book also knits together a century of very complicated economic, political, and social trends, which are often siloed but are in fact quite interrelated, creating a new and important narrative about where America has been, and where it may be going.

Are Financial Market Returns Randomly Distributed? Yes And No

The art and science of modeling returns of financial assets is forever unsatisfying because no one model fully captures the true behavior of asset performances. As a result, there comes a point when researchers are forced to pick a poison that appears less wrong than the alternatives.

Macro Briefing: 29 April 2022

* NATO says it’s prepared to support Ukraine for years

* Is it time to position portfolios for recession, Fed failure? Not yet, says UBS

* Eurozone inflation again reaches record high in April

* Stagflation risk rising for Europe as growth slows

* Jobless claims in US remain near 50-year low

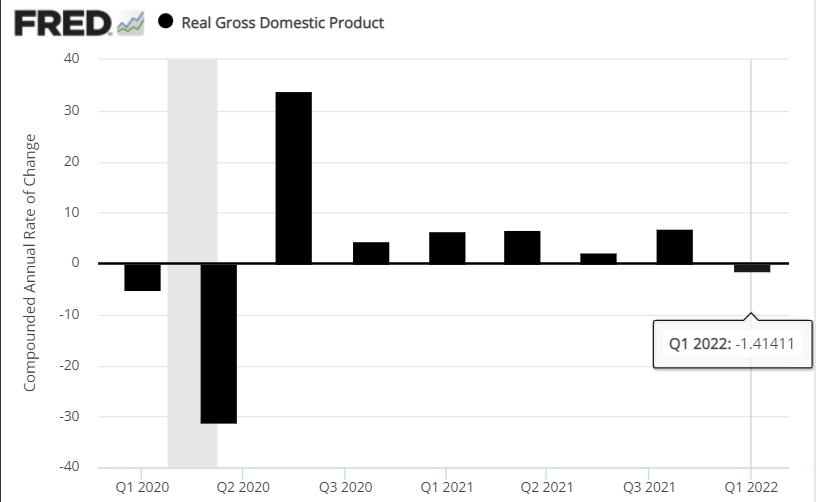

* Despite GDP slide in Q1, economists expect rebound in growth for rest of 2022

* US economy contracted 1.4% in first quarter, well below expectations:

S&P 500 Risk Profile: 28 April 2022

US stocks continue to show a downside bias as the S&P 500 Index retests the lows of 2022. Headwinds continue to blow from a familiar mix of threats: blowback from the Ukraine war, elevated inflation, rising interest rates and slowing economic growth. All these risk factors appear set to continue for the near term, which implies that the market will remain on the defense in the foreseeable future.