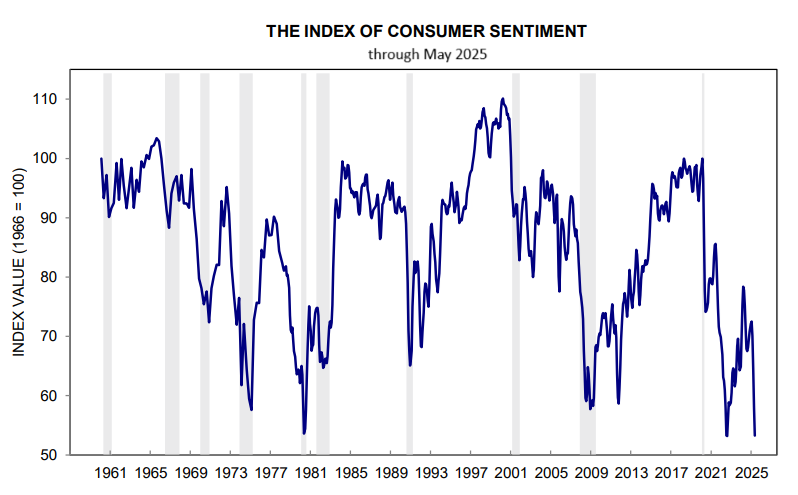

US Consumer Sentiment Index dropped to second-lowest level on record in May, based on polling by the University of Michigan. The caveat is that most of the survey was conducted before the US and China agreed to a 90-day pause on most tariffs. “Tariffs were spontaneously mentioned by nearly three-quarters of consumers, up from almost 60% in April; uncertainty over trade policy continues to dominate consumers’ thinking about the economy,” Joanne Hsu, director of the Surveys of Consumers, advised.

Book Bits: 17 May 2025

● Capitalism and Its Critics: A History: From the Industrial Revolution to AI

● Capitalism and Its Critics: A History: From the Industrial Revolution to AI

John Cassidy

Review via The New York Times

Trump makes a few cameo appearances in John Cassidy’s new book, “Capitalism and Its Critics,” for his demonstrated ability to brag about his riches while tapping into growing discontent with the global capitalist system. Some of the critics Cassidy features in this book wanted to replace capitalism entirely; others, like Trump, have sought to preserve a core of self-interest while remaking capitalism’s rules. Rejecting a world financial order fueled by free trade and a bedrock American dollar, the president has been promoting a grab bag that includes both tariffs and crypto — a Trumpian hybrid of the very old and the very new.

Research Review | 16 May 2025 | Asset Allocation

Rethinking the Stock-Bond Correlation

Thierry Roncalli (Amundi Asset Management & University of Evry)

February 2025

The stock-bond correlation is a basics of finance and is related to some of the fundamentals of asset management. However, understanding the stock-bond correlation is not easy. In this presentation, we answer the following questions What is the natural sign of the stock-bond correlation? Why do some investors prefer a positive stock-bond correlation while others prefer a negative stock-bond correlation? How does the stock-bond correlation relate to the theory of risk premia? What is the leverage effect of correlation? What are the conditions for negative stock-bond correlation? What are the implications for strategic asset allocation (SAA) and tactical asset allocation (TAA)?

Macro Briefing: 16 May 2025

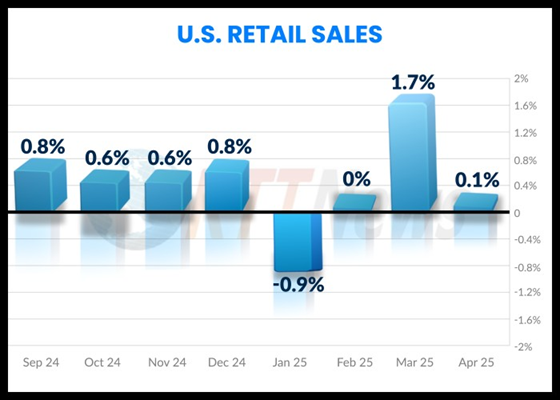

US retail sales slowed to a fractional gain April, rising 0.1% after surging in March, reportedly fueled by front-running purchases to avoid tariffs. Core sales, which excludes several volatile categories and factors into the gross domestic product (GDP) reading for the quarter, fell 0.2%. “We are now witnessing the first-order effects of tariffs on the economy through reduced spending,” said Tuan Nguyen, a US economist at RSM US. “While a recession is no longer our base case over the next 12 months due to the recent reduction in tariffs, the likelihood has increased that the US economy will experience several quarters of sluggish growth.”

Foreign Bonds Lead US Fixed Income By Wide Margin In 2025

Global diversification for bonds has been a tough sell in recent years, but 2025 is another story. Year to date, fixed-income securities ex-US are outperforming the investment-grade US benchmark for bonds by a hefty degree, based on a set of ETFs through Wednesday’s close (May 14).

Macro Briefing: 15 May 2025

10-Year US Treasury Yield ‘Fair Value’ Estimate: 14 May 2025

The US 10-year yield was steady in April in terms of the market premium relative to a “fair value” estimate. The 10-year yield’s monthly average last month remained mostly unchanged at roughly 40 basis points-plus over the average fair value via three models run by CapitalSpectator.com.

Macro Briefing: 14 May 2025

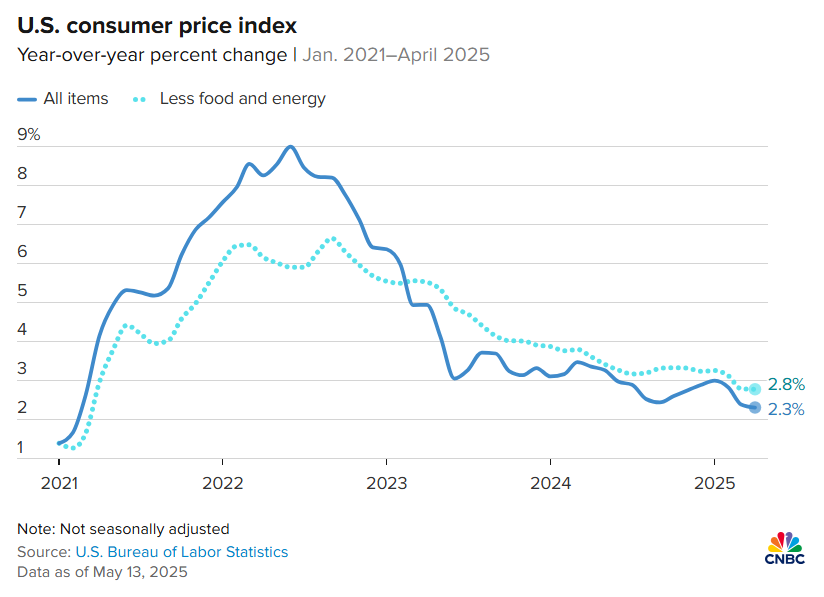

US consumer inflation dipped to an annual 2.3% in April, the lowest in four years. “Good news on inflation, and we need it given inflation shocks from tariffs are on their way,” said Robert Frick, corporate economist at Navy Federal Credit Union. “Non-tariffed goods are still in the pipeline, and perhaps some importers have absorbed their tariff costs for now.”

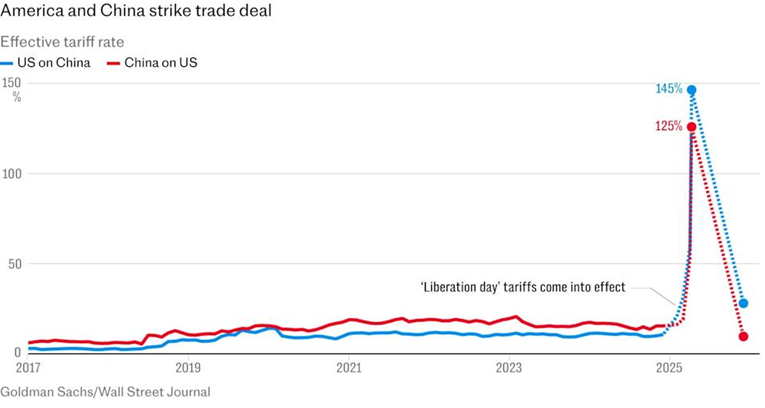

US-China Trade Deal Lifts Markets, But US Stocks Still Trail

Sunday’s announcement that the US and China will sharply reduce tariffs and continue to negotiate sparked a monster rally in equities around the world. The assumption is that progress on trade talks reduces recession risk, here and abroad. US stocks, however, remain the odd man out vs. the rest of the major asset classes year to date, although American shares have recovered most of their recent losses.

Macro Briefing: 13 May 2025

The tariff truce between the US and China dials down recession risk, or so it appears, based on the sharp rise in global equity markets on Monday. Economists also note that the 90-day pause announced on Sunday is a plus for sidestepping recession. “More de-escalation and progress on deals within the 90-day relief period are helping markets to buy time on the recession endgame,” analysts at Barclays wrote ahead of the US-China announcement. Mark Williams, at Capital Economics, advised: “The new status quo isn’t too far from our baseline assumption for tariffs [of] 10% for most countries [and] 60% for China, which underpins our view that the US economy will avoid recession.”