● Empire of AI: Dreams and Nightmares in Sam Altman’s OpenAI

● Empire of AI: Dreams and Nightmares in Sam Altman’s OpenAI

Karen Hao

Interview with author via the Global and Mail

In her new book, Empire of AI: The Dreams and Nightmares of Sam Altman’s OpenAI, Hao follows the rise of OpenAI. She tracks how the company transformed from a non-profit that positioned itself as an idealistic underdog into the world’s largest AI company worth US$300-billion.

Alongside the fly-on-the-wall observations of OpenAI’s work culture, built from hundreds of interviews with employees, e-mails and Slack conversations, Hao pulls back the curtain on the departure of early investor Elon Musk, the reinstatement of charismatic Chief Executive Officer Sam Altman and reports from Colombia and Kenya, where she interviews low-wage contract workers who were tasked with categorizing the severity of graphic content used to train ChatGPT.

Inflation Anxiety And The “Big Beautiful Bill”

The mega spending bill that the House passed now awaits debate in the Senate. A key issue for markets is how, or if, the legislation will be amended with respect to projections that, if passed, the bill will deepen an already hefty federal deficit in the years ahead and thereby stoke inflation concerns as the government’s borrowing needs increase.

Macro Briefing: 23 May 2025

US economic activity slowed for second month in April, according to the Chicago Fed’s National Activity Index: “Three of the four broad categories of indicators used to construct the index decreased from March, and three categories made negative contributions in April. The index’s three-month moving average, CFNAI-MA3, was unchanged at +0.05 in April.”

Most US Treasury Prices Slide Since “Liberation Day”

The government bond market had been more or less flatlining since since President Trump on Apr. 2 announced “Liberation Day” and rolled out US tariffs, which sparked concern about inflation. But in recent days a new headwind is weighing on fixed income securities: a US government budget bill (that was approved by the House this morning), which is expected to significantly raise an already hefty federal deficit in the years ahead.

Macro Briefing: 22 May 2025

US 30-year Treasury yield jumps to 5.09%, the highest level since late-2023. “It goes without saying that if Trump is, in fact, looking to the Treasury market as a barometer of investors’ approval of the action in Washington [with regards to the current debate over the federal spending bill], then the recent sell-off that brought 30-year yields from as low as 4.65% earlier this month to 5.095% is without question a troubling development,” said Ian Lyngen, an interest rate strategist at BMO Capital Markets.

Markets Still Expect Fed To Keep Rates Steady For Near Term

Uncertainty about inflation, the economy, and trade policy continue to blur the macro outlook, which in turn supports expectations that the Federal Reserve will leave interest rates unchanged at the next several policy meetings.

Macro Briefing: 21 May 2025

Policy uncertainty has a ‘meaningful’ impact on the US economic outlook, said St. Louis Federal Reserve Bank president Alberto Musalem. “To the extent that the economy requires capital expenditure to continue to occur, that it requires hiring to continue to occur, and if all those decisions have been somewhat paused because of the uncertainty, it would affect the economic outlook I would expect.” An index tracking policy uncertainty has spiked recently, but is starting to fall, although it remains elevated vs. the pre-tariff period.

US Q2 GDP Still Looks Set To Rebound After Q1 Decline

US economic output remains on track to rebound in the second quarter following the slight decline in Q1, based on the median estimate for a set of GDP nowcasts compiled by CapitalSpectator.com.

Macro Briefing: 20 May 2025

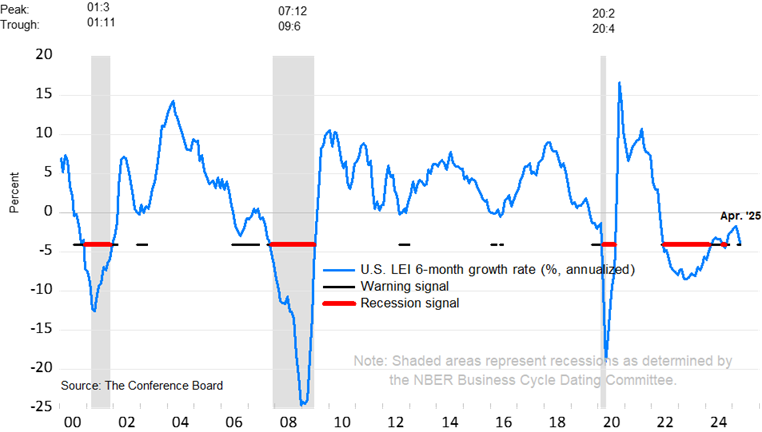

The US Leading Economic Index fell sharply in April, dropping for a fifth straight month, the Conference Board reported. “The US LEI registered its largest monthly decline since March 2023, when many feared the US was headed into recession, which did not ultimately materialize,” said Justyna Zabinska-La Monica, senior manager, business cycle indicators, at the consultancy. The six-month growth rate for the index declined further in April, but remained slightly above the recession signal threshold.

All The Major Asset Classes Posting Gains In 2025 After Latest Rally

Market sentiment has been a wild ride in recent months, but for the moment investors are breathing a sigh of relief, based on a set of ETFs tracking the major asset classes for year-to-date returns through Friday’s close (May 16).