The Federal Reserve on Wednesday raised its target interest rate by ¼ point, the first hike since 2018. The shift in the posture of monetary policy isn’t surprising, given the surge in inflation. Equally unsurprising is the weak performance of fixed-income securities this year, which continue to price in rough times ahead for the asset class overall.

Macro Briefing: 17 March 2022

* West says Russia becoming bogged down in Ukraine war

* Fed raises its benchmark interest rate 1/4 point–first hike since 2018

* Fed Chair Powell says recession risk is “not particularly elevated,” but…

* Some economists predict the Fed will cause a recession

* Russia is seizing hundreds of commercial jets owned by US and European firms

* Import prices for US rose 10.9% over past year, feeding into high inflation

* US homebuilder sentiment slips in March, fourth straight monthly decline

* Atlanta Fed business inflation expectations continue rising in March

* US retail sales rose less than expected in February as inflation heats up:

Fed To Start Hiking Rates As US Growth Slows And Inflation Spikes

The Federal Reserve finds itself in an especially tough spot: raising interest rates at a time when economic growth is slowing. The rationale for tightening policy is that inflation is surging and so pricing pressure overrides any concerns for growth.

Macro Briefing: 16 March 2022

* Ukraine’s Zelensky to ask US Congress for more help in speech today

* European leaders travel to Kyiv as Russia bombs the Ukrainian city

* Russia’s foreign minister says there is ‘hope’ for compromise with Ukraine talks

* Russia may default on its debt today as payments are due

* Forecasters raise US recession risk estimates as inflation outlook increases

* Fed funds futures predict a 25-basis-point rate hike for today’s FOMC meeting

* Raskin withdraws her candidacy for Federal Reserve board

* US wholesale inflation eases in February but still up 10% from year ago

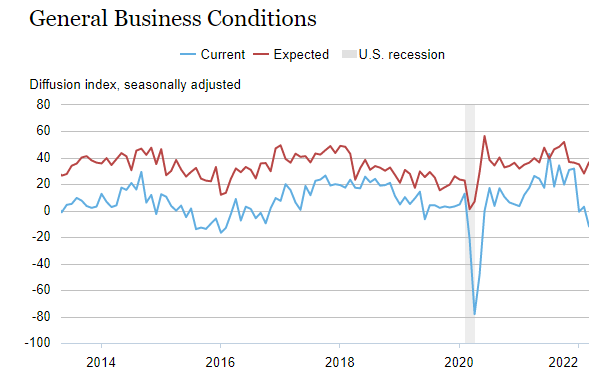

* NY Fed Mfg Index shows contraction in March–first decline in nearly two years:

The Inflation “Cycle” Looks Unusually Hot

We already know that the recent inflation surge is still accelerating, and that it’s likely to heat up further in the months ahead as effects from the Ukraine war begin to factor into the data. One question that comes up is whether some or most of this pricing pressure is noise or signal? For some perspective, let’s estimate the inflation “cycle,” based on a simple estimate that attempts to capture the longer-term ebb and flow of inflation.

Macro Briefing: 15 March 2022

* Ukraine-Russia talks fail as war grinds on

* Will Russia avoid first foreign-currency bond default since 1917 revolution?

* Ukraine war disrupts global supply of key parts and raw materials

* Three European leaders to visit Ukraine’s capital in show of support

* China warns of retaliation if hit with western sanctions linked to Russia

* New “stealth” variant of coronavirus spreading around the world

* Covid-19 cases more than double in one day in China as outbreak accelerates

* China reports better-than-expected growth in retail sales and industrial output

* China stocks falls sharply for second day as new covid lockdowns are announced

* US 10yr Treasury yield rises to 2.14%, near a three-year high:

Inflation-Protected Treasuries Rose As Global Markets Fell

In another week of widespread selling of the major asset classes, US inflation-indexed Treasuries continued to rise, based on a set of ETFs through Friday, Mar. 11.

Macro Briefing: 14 March 2022

* Russian missile strikes near Polish/NATO border raise fears of expanding war

* Russia has requested military support from China, according to US officials

* New efforts emerge for peace talks between Ukraine and Russia

* Russian prosecutors warn that leaders of Western companies could be arrested

* US 10yr Treasury yield rises to 2.08% in early Monday trading, highest since 2019

* China battling multiple outbreaks of Covid-19 across cities

* Don’t let the news of the day derail your strategic investing plan

* US consumer sentiment in March falls to 11-year low as inflation rises:

Book Bits: 12 March 2022

● Work Pray Code: When Work Becomes Religion in Silicon Valley

Carolyn Chen

Q&A with author via Publishers Weekly

Q: What do you mean when you say work is replacing religion in America?

A: The last 40-50 years have shown a decline in American religious participation and affiliation, and an increase in the number of hours that high-skilled professionals are devoting to work. Fifty years ago, white-collar professionals were looking to fulfill their needs for identity, belonging, meaning, and purpose through organizations outside the workplace, such as their churches, temples, synagogues, or neighborhood associations. These days, work consumes so much of their lives, it’s in work that they find their identity, their belonging, their source of meaning, fulfillment, and purpose in life.

Fed Policy Is Wedged Between The Rock And The Hard Place

A few weeks ago, there was still a reasonable debate about whether US inflation would soon begin to peak. Whatever the merits of the argument, it’s been obliterated by the economic blowback from the war in Ukraine.