The Global Market Index’s (GMI) risk-adjusted performance continues to retreat after peaking in December, based on the trailing 3-year Sharpe ratio, a measure of return adjusted by volatility. The sharp reversal has also dragged down the 10-year rolling Sharpe ratio. Both measures fell in February to their lowest levels in nearly a year for this multi-asset-class benchmark.

Macro Briefing: 3 March 2022

* Fed Chair Powell says rate hikes coming, but Ukraine creates uncertainty

* First major Ukrainian city ‘fallen’ to Russian troops

* More than 1 million people flee Ukraine after Russia’s invasion

* The West’s reaction to Ukraine war could cripple Russia’s economy, say analysts

* Commodity prices soar — S&P GSCI index at highest level since 2008

* MSCI pulls Russian stocks from emerging markets indices

* China Composite PMI shows economic growth was “muted” in February.

* Is eastern Europe at risk from Russia?

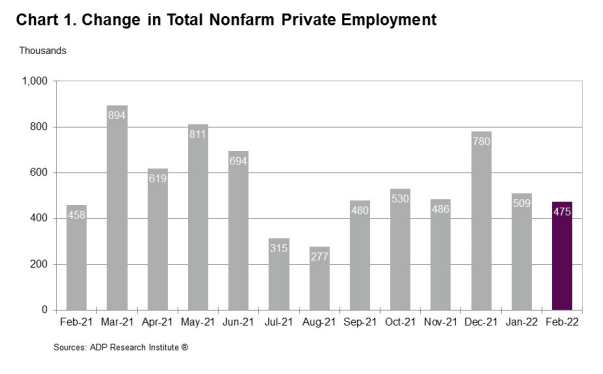

* US companies continued to hire workers at a strong pace in February:

Risk Premia Forecasts: Major Asset Classes | 2 March 2022

War, turmoil and chaos tend to shorten our attention span, and Russia’s invasion of Ukraine is no different. As the world reels from the crisis, the blowback is rippling across the world economy and markets. Volatility and uncertainty have spiked – for the short term. But when it’s hard to look past the next 24 hours, it’s still useful to think long term as a tool to look through the crisis and consider how the long game may unfold for investment strategies.

Macro Briefing: 2 March 2022

* Biden says he’ll halt Russia, fight inflation in State of the Union address

* Oil prices at risk of skyrocketing from already high levels

* Brent oil, the international benchmark, tops $110 a barrel on Wednesday

* Three paths for how the Ukraine war ends

* Global supply chains face new pressures as Ukraine war continues

* White House says US is realigning trade policy toward China

* Eurozone headline inflation rises to record 5.1% January as core inflation eases

* Global manufacturing activity registers moderate pace of growth in February

* US manufacturing activity posts another solid performance in Feb via ISM data

* US Q1 GDP estimate now at 0% growth via Atlanta Fed’s GDPNow model:

Major Asset Classes | February 2022 | Performance Review

Most markets around the world continued to slide in February, marking the second month of widespread losses in 2022 for the major asset classes. The main exceptions: commodities and inflation-indexed government bonds.

Macro Briefing: 1 March 2022

* Russia set to launch all-out assault on Ukraine’s Kyiv

* US economy appears set to withstand shock from Ukraine crisis

* Western sanctions threaten inflation surge and shortages in Russia

* Russian ruble fell about 30% against the US dollar on Monday

* Russian markets increasingly look uninvestable

* ICC will open investigation into charges of war crimes committed in Ukraine

* Shell, BP and other oil firms exit joint ventures with Russia

* China’s factory activity expanded slightly in February

* US trade deficit in goods increased sharply to record high in January

* 10-year Treasury yield falls to 3-week low as risk-off sentiment strengthens:

Markets Tested Risk-On Sentiment Last Week As War Rages Today

Markets tried to look through Russia’s invasion of Ukraine last week, but as the brutal reality of war becomes clearer, and economic blowback spreads across the global economy, sentiment will come under increased pressure in the days ahead.

Macro Briefing: 28 February 2022

* Russian and Ukrainian officials will meet for talks as war rages on

* Next 24 hours will be crucial for Ukraine, says country’s president

* The West adds more sanctions on Russia but largely exempts energy exports

* Putin puts nuclear forces on high alert

* Russian currency plunges amid expanding financial sanctions from the West

* JP Morgan advises that selling equities now faces whipsaw risk

* Geopolitical storm will test consumers’ appetite and ability to spend.

* US consumer spending posts robust gain in January as inflation picked up

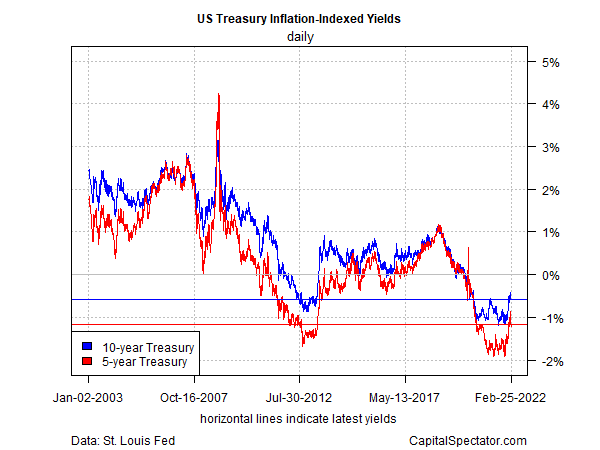

* US real Treasury yields are rebounding but still deeply negative:

Book Bits: 26 February 2022

● The Next Age of Uncertainty: How the World Can Adapt to a Riskier Future

Stephen Poloz

Interview with author via Financial Post

Stephen Poloz, who spent seven years as the Bank of Canada governor before stepping down in July 2020… identifies five “tectonic” forces — an aging population, technological progress, rising inequality, rising debt and climate change — that are going to interact under the surface and create new crises for at least a decade.

We talked about how this will work, the energy transition, inflation, rising interest rates, why he thinks employees will gain an edge over employers and much more.

How Will Russia’s Invasion Of Ukraine Change The Risk Calculus?

Europe’s violent history had been in remission, but it returned with a vengeance this week when Russia invaded Ukraine. It’s been comforting to assume that decades of relative peace on the Continent and its near-periphery had become the new norm and that centuries of war had passed into history as a real and present danger. But the world has been reminded anew that the long arc of history isn’t easily dispatched.