Patrick Geddes

Interview with author via CNBC

“Learning about how your brain is wired and how your emotions drive your investing can actually be even more important than analysis,” Geddes explains.

Sometimes, these emotions get the best of us. He calls this concept of making emotion-based investment decisions the “illusion of control.”

“As investors, we imagine a kind of control over outcomes that doesn’t match the unwelcome reality that stocks behave pretty randomly,” says Geddes, who is the co-founder of investment management firm Aperio Group and former research director at Morningstar.

The ETF Portfolio Strategist: 21 Jan 2022

- Sharp losses this week bring most markets into the red for year-to-date results

- A rough week for all our portfolio strategy benchmarks

Widespread losses… with a few places to hide: Risk assets took a hit this week, or at least most did. But some corners of the global market were havens.

S&P 500 Risk Profile: 21 January 2022

The US stock market is knee-deep in another one of its periodic bouts of selling. Is this the big one or just another short-term correction? The only honest answer, as always: unclear. But whenever the market dives it’s useful to refresh our perspective on how the slide stacks up vs. history. This is no panacea or crystal ball, but developing context for a real-time event is preferable to allowing extremist narratives du jour dominate your thinking.

Macro Briefing: 21 January 2022

* US and Russia meeting in Geneva amid rising fears of Ukraine invasion

* Fed releases study on possibility of rolling out a digital dollar

* Citi expects genuine supply-chain gains no earlier than late-2022

* Pandemic pessimism rising among Americans, Gallup survey shows

* Antitrust tech-sector bill advances in Senate Judiciary Committee

* Intel will invest $20 billion in new chip-making plant in Ohio

* Netflix stock tumbles on forecast of slower subscriber growth

* Philly Fed Mfg Index reflects stronger business activity in January

* US Existing home sales fell in December amid higer prices and low inventory

* US jobless claims increased to a three-month high last week:

A Rough Start For Global Equities In 2022, With Some Exceptions

Stock markets around the world have generally tumbled so far this year, but shares in Latin America and Africa are notable exceptions, based on a set of ETFs tracking the major equity regions through yesterday’s close (Jan. 19).

Macro Briefing: 20 January 2022

In Defense Of (Intelligent) Backtesting

Backtesting is a necessary evil, but how evil is it and how does necessity compel us to use it?

Macro Briefing: 19 January 2022

* US Sec. of State Blinken visits Ukraine; will meet Russian counterpart on Friday

* US raises military aid to Ukraine amid rising tensions with Russia

* Russia moving troops to Belarus for war games

* UK inflation rate soared to a 30-year high in December

* German 10-year yield turns positive for first time since 2019

* Microsoft plans to buy major games company Activision in bet on metaverse

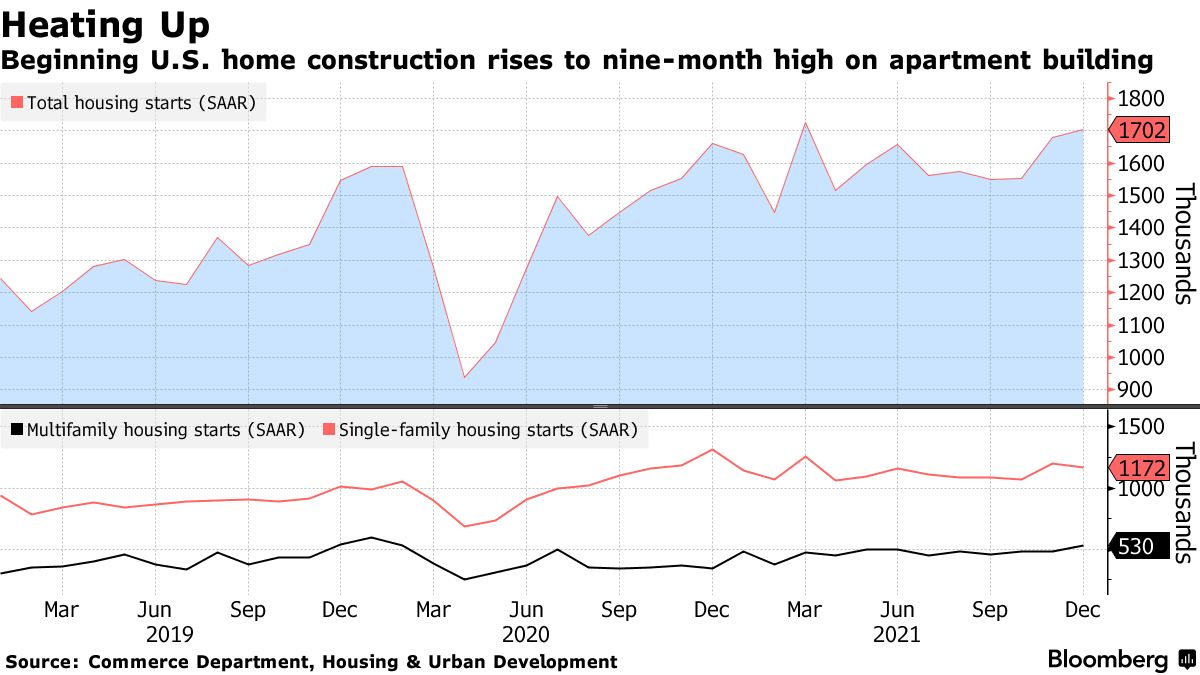

* US homebuilder remain bullish on industry in January via sentiment data

* Growth stalled in January via NY Fed Manufacturing Index:

Outlier Risk, Part IV

Identifying outliers in a data set is conceptually cut and dry. Extremes, by definition, should be conspicuous. But in practice, labeling outliers is a mix of art and science, in part because expectations vary from investor to investor as do sensitivities to “risk.” The analysis can also be muddied by the technique used to crunch the numbers.

Macro Briefing: 18 January 2022

* 10-year US Treasury yield rises to two-year high in early Tuesday trading

* Preliminary Israeli study suggests fourth vaccine doesn’t stop omicron infections

* UK to send missiles to Ukraine for self-defense from possible Russia attack

* US policy of engaging with N. Korea appears mistaken, analyst says

* China’s Xi urges West not to raise interest rates too fast

* US airlines ask for ‘immediate intervention’ in planned rollout of 5G

* Oil reaches 7-year high on Tuesday amid new concerns over supply constraints: