Shares in emerging markets led the winners in an otherwise mixed run of trading for the major asset classes last week, based on a set of ETFs through Friday’s close (Jan. 14).

Macro Briefing: 17 January 2022

* Omicron and inflation weigh on US economic outlook

* China’s zero-tolerance Covid policy is a risk factor for global manufacturing

* China GDP rose 4.0% in Q4 vs. year-ago level–slowest rise in nearly two years

* China central bank cuts interest rates to offset growth risk

* Oil price near highest level in more than six years

* N. Korea fires 2 missiles–fourth test this month

* Q4 earnings in focus this week: Will value and cyclicals outperform tech?

* US retail sales fell in Dec. (seasonally adj), but unadjusted data shows a surge:

Book Bits: 15 January 2022

Christopher Leonard

Excerpt via Politico

Between 2008 and 2014, the Federal Reserve printed more than $3.5 trillion in new bills. To put that in perspective, it’s roughly triple the amount of money that the Fed created in its first 95 years of existence. Three centuries’ worth of growth in the money supply was crammed into a few short years. The money poured through the veins of the financial system and stoked demand for assets like stocks, corporate debt and commercial real estate bonds, driving up prices across markets. Hoenig was the one Fed leader who voted consistently against this course of action, starting in 2010. In doing so, he pitted himself against the Fed’s powerful chair at the time, Ben Bernanke, who was widely regarded as a hero for the ambitious rescue plans he designed and oversaw.

Research Review | 14 January 2022 | Inflation

The Time-Varying Relation between Stock Returns and Monetary Variables

David G. McMillan (University of Stirling)

November 2, 2021

The nature of the relation between stock returns and the three monetary variables of interest rates (bond yields), inflation and money supply growth, while oft studied, is one that remains unclear. We argue that the nature of the relation changes over time and this variation is largely driven by shocks, with a change in risk associated with each variable shifting the pattern of behaviour. We show a change in the correlation between each of the three variables with stock returns. Notably, a predominantly negative correlation with bond yields and inflation becomes positive, while the opposite is true for money supply growth. The shift begins with the bursting of the dotcom bubble but is exacerbated by the financial crisis. Results of predictive regressions for stock returns also indicate a switch in behaviour. Predominantly negative predictive power switches temporarily to positive around economic shocks. This suggests that higher yields, inflation and money growth typically depress returns but support the market during periods of stress. However, after the financial crisis, higher inflation and money growth exhibit persistent positive predictive power and suggests a change in the risk perception of higher values.

Macro Briefing: 14 January 2022

* Supreme Court blocks Biden virus mandate for big firms

* Russia says Ukraine talks at ‘dead end’

* Hack attack brings down government web site in Ukraine

* Omicron persuades economists to cut US growth outlook for Q1

* Veteran Wall St economist–“Dr Doom”–criticizes Fed policy re: inflation

* China trade surplus with US rose for second year in 2021

* Global surge in energy demand may lead to more market volatility, IEA warns

* US producer price inflation up 9.7% last year–highest since 2010

* US jobless claims rose last week to highest level since November:

Energy And High-Yield Stocks Are Market Leaders So Far In 2022

Does US market action in January set the tone for the rest of year? If it does, the investment gods will favor shares in the energy sector and stocks with relatively high dividend yields in 2022, courtesy of strong runs for both slices of the market so far this month, based on a set of ETFs.

Macro Briefing: 13 January 2022

* Fed’s Lael Brainard to tell Congress that cutting inflation is top priority

* Seek out companies with strong pricing power as inflation hedge, advises analyst

* US economy grew at modest pace in closing weeks of 2021: Fed Beige Book

* Russia is cause for Europe’s worsening natural gas crisis, IEA charges

* Grocery-store shortages are back, due to several causes

* Firms’ year-ahead inflation expectations steady in January at 3.4% (avg)

* Oil rally expected to continue in 2022, analysts predict

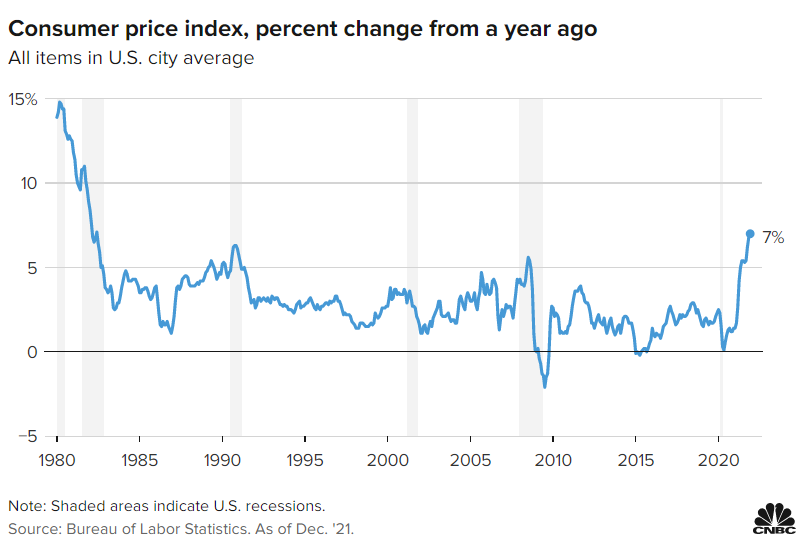

* US consumer inflation accelerated to 7% in December, a 40-year high:

Upcoming US Q4 GDP Release Expected To Report Strong Growth

The US economy remains on track to post a sharp rebound in the fourth-quarter GDP report that’s scheduled for Jan. 27. The momentum, however, is expected to slow in early 2022 amid stronger macro headwinds.

Macro Briefing: 12 January 2022

* Global economic growth will slow in 2022 vs. last year, World Bank predicts

* Fed Chair Powell tells Senators inflation is ‘severe threat’ to jobs

* Omicron may be peaking in the US and UK?

* US economy no longer needs aggressive stimulus, says Fed’s Powell

* Central banks are the main risk factor for global economy in 2022

* Russia keeps West guessing on Ukraine–and that’s the goal

* Debt-fueled spending is making a comeback for US consumers

* China inflation moderated in December

* Eurozone industrial output rose in November despite supply-chain bottlenecks

* US real yield for 10-year inflation-indexed Treasury rises to 9-month high:

Is Inflation Peaking? Maybe, But Don’t Count On It (Yet)

Economists expect that US consumer inflation will continue to tick higher in tomorrow’s December report (scheduled for Wed., Jan. 12). Meanwhile, the Federal Reserve continues to offer increasingly hawkish commentary (on the margins) as the market prepares for one or more interest-rate hikes this year.