The US economy remains on track to post a sharp rebound in the fourth-quarter GDP report that’s scheduled for Jan. 27. The momentum, however, is expected to slow in early 2022 amid stronger macro headwinds.

Macro Briefing: 12 January 2022

* Global economic growth will slow in 2022 vs. last year, World Bank predicts

* Fed Chair Powell tells Senators inflation is ‘severe threat’ to jobs

* Omicron may be peaking in the US and UK?

* US economy no longer needs aggressive stimulus, says Fed’s Powell

* Central banks are the main risk factor for global economy in 2022

* Russia keeps West guessing on Ukraine–and that’s the goal

* Debt-fueled spending is making a comeback for US consumers

* China inflation moderated in December

* Eurozone industrial output rose in November despite supply-chain bottlenecks

* US real yield for 10-year inflation-indexed Treasury rises to 9-month high:

Is Inflation Peaking? Maybe, But Don’t Count On It (Yet)

Economists expect that US consumer inflation will continue to tick higher in tomorrow’s December report (scheduled for Wed., Jan. 12). Meanwhile, the Federal Reserve continues to offer increasingly hawkish commentary (on the margins) as the market prepares for one or more interest-rate hikes this year.

Macro Briefing: 11 January 2022

* US Covid-19 cases surge to 1.35 million in a day, a new record

* Pfizer’s omicron vaccine will be ready in March, says CEO

* Fed Chair Powell pledges to control inflation

* Inflation cited as biggest problem since 1981, say small business owners

* Supply of government bonds set to swell in 2022

* N. Korea fires second test missile in six days, says S. Korea

* Bank stocks (KBE) continue to rise as outlook for higher interest rates resonates:

Commodities Are Last Week’s Upside Outlier For Global Markets

A negative tailwind blew through most of the major asset classes, in trading last week (through Friday, Jan. 7) via a set of proxy ETFs. The main exception: commodities, which rallied in the week just passed.

Macro Briefing: 10 January 2022

* Russia warns of misunderstanding re: Ukraine ahead of talks with US

* Goldman Sach predicts four US rate hikes for 2022

* Key events to this week: inflation, interest rates and Fed testimony in Congress

* Emerging-market nations must prepare for US rate hikes, IMF advises

* Higher interest rates are boosting shares of bank stocks

* German 10-year yield poised to rise above zero for first time in 3 years

* US payrolls rose less than forecast in Dec but labor mkt near max employment

* US 10-year Treasury yield starts week at highest level in nearly two years:

Book Bits: 8 January 2022

James A. Fok

Summary via publisher (Wiley)

Rising tensions between China and the United States have kept the financial markets on edge as a showdown between the world’s two largest economies seems inevitable. But what most people fail to recognise is the major impact that the financial markets themselves have had on the creation and acceleration of the conflict. In Financial Cold War: A View of Sino-US Relations from the Financial Markets, market structure and geopolitical finance expert James Fok explores the nuances of China-US relations from the perspective of the financial markets. The book helps readers understand how imbalances in the structure of global financial markets have singularly contributed to frictions between the two countries.

10-Year Treasury Yield ‘Fair Value’ Estimate: 7 January 2022

The US 10-year Treasury yield rose to a nine-month high on Thursday (Jan. 6), which may be a prelude to setting a new pandemic high in the days ahead. If that happens, the increase would signal a higher probability that the benchmark rate would push above levels reached before the pandemic started in early 2020. During the 12 months prior to pandemic, the 10-year rate traded in the roughly 2%-3%-plus range.

Macro Briefing: 7 January 2022

* Markets weigh possibility of three-facet Fed policy-tightening moves

* US 10yr Treasury yield briefly topped 1.75% on Thursday, a pandemic high

* Russia boosts influence in Kazakhstan amid political unrest

* Eurozone inflation ticked up to 5% in December, a new record high

* US jobless claims rose last week but remain near historic low

* US factory orders grew for a seventh-straight month in November

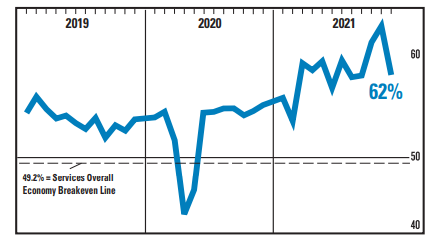

* US services sector growth slowed sharply in December via ISM survey data:

Predicting Risk: Not Easy, But Easier Relative To Return, Part I

Forecasting is a necessary evil in investing. The very act of investing is an exercise in making assumption about future events. If you didn’t expect to book a profit, presumably you wouldn’t make the trade. The trouble starts when you move beyond this basic axiom and start making decisions about how to forecast, what to forecast, and over what time frame. But none of this changes the basic truism that risk is easier to forecast than return. There are caveats, of course, but even small relative advantages can be useful at times.