Banking-Crisis Interventions, 1257 – 2019

Andrew Metrick and Paul Schmelzing (Yale)

September 7, 2021

We present a new database of banking-crisis interventions since the 13th century. The database includes 1886 interventions in 20 categories across 138 countries, covering interventions during all of the crises identified in the main banking-crisis chronologies, while also cataloguing a large number of interventions outside of those crises. The data show a gradual shift over the past centuries from the traditional interventions of a lender-of-last-resort, suspensions of convertibility, and bank holidays, towards a much more prominent role for capital injections and sweeping guarantees of bank liabilities. Furthermore, intervention frequencies and sizes suggest that the crisis problem in the financial sector has indeed reached an apex during the post-Bretton Woods era – but that such trends are part of a more deeply entrenched development that saw global intervention frequencies and sizes gradually rise since at least the late 17th century.

Macro Briefing: 17 September 2021

* FDA will review evidence for recommending Covid-19 booster shot

* Economists expect Fed will announce bond taper in November, survey finds

* IMF chief criticized for favoring China as head of World Bank

* China seeks to join trans-Pacific trade pact that US rejected

* Will Putin’s authoritarianism strengthen after Russia’s elections?

* Population of migrants surge temporary camp in Del Rio, Texas

* Invesco in talks to merge with State Street’s asset-management division

* Jobless claims in US picked up last week but remain near pandemic low

* Philly Fed Mfg Index: strong acceleration in business activity in September

* US retail sales rose in August, beating estimates for decrease by wide margin:

Personal Income Remains Weak Outlier In US Expansion

The US economic expansion to date remains unusually strong overall, with one stark exception: personal income. In contrast with employment, consumer spending and industrial production — collectively known as the big-four macro indicators — the recovery in consumer income has been abnormally weak in comparison with economic recoveries following the end of recessions since 1970.

Macro Briefing: 16 September 2021

* Political anxiety rising in Washington as debt-ceiling showdown looms

* Biden’s economic legislation at risk of delay as Dems debate

* US, UK and Australia announce new security partnership to counter China

* NY Fed Mfg Index shows sector growth accelerated in September

* US import prices eased for first time in 10 months in August

* Atlanta Fed business inflation expectations steady at elevated pace in Sep

* US poverty rate fell in 2020 via stimulus checks and unemployment benefits

* US industrial output growth slowed in August, partly due to Hurricane Ida:

The ETF Portfolio Strategist: 15 September 2021

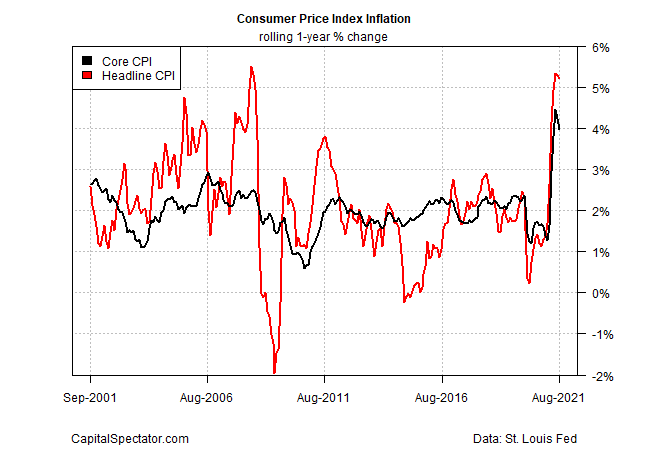

US consumer inflation eased more than expected in August, hinting that the recent surge in pricing pressure may be cooling. But if this was a sign for commodities prices to ease, the market didn’t get the memo.

US Inflation Trend Still Appears To Be Peaking, But Slowly

US consumer inflation’s one-year trend eased in August, marking a second month of lesser pricing pressure, the Bureau of Labor Statistics reports. But the pace of inflation remains elevated and a new run of analytics suggest that the pullback from the recent surge will be unfold slowly.

Macro Briefing: 15 September 2021

* North and South Korea test ballistic missiles as tensions spike on peninsula

* California Gov. Gavin Newsom wins recall election

* Most Americans would see tax cuts in Dems’ tax code plans, estimate shows

* Consumer inflation expectations rose again in August, NY Fed survey reports

* China retail sales rose much slower than expected in July

* Eurozone industrial output increased by more than forecast in August

* US small business sentiment remained middling in August vs. recent history

* SEC chairman says rules for cryptocurrency are in development

* US Consumer Price Index rose less than expected in August:

Profiling Winning And Losing Streaks For The US Stock Market

Is the stock market’s trending behavior changing? Are the winning streaks running longer and the corrections becoming shorter?

Macro Briefing: 14 September 2021

* House Democrats propose new tax hikes to pay for $3.5 trillion spending plan

* Hurricane Nicholas makes landfall on the Texas coast

* Delta variant of coronavirus is weighing on economies around the world

* Covid-19 infections more than double in China’s southeastern province of Fujian

* California’s Gov. Newsom is expected to win today’s recall vote

* UK company payrolls surged in August

* Apple issues emergency security update for iPhones to counter spyware threat

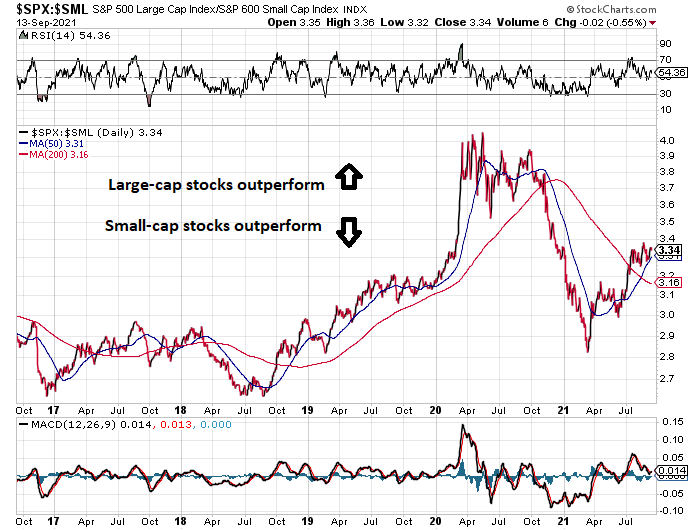

* US small-cap stocks continue to lose ground against large-caps:

Most Markets Retreated Last Week

Nearly every slice of the major asset classes retreated in the trading week through Friday, Sep. 10, based on a set of ETFs. The upside exception: US inflation-indexed Treasuries.