* House Dems eye taxes on wealthy, corporations to pay for $3.5 trillion budget

* Sen. Manchin, a key swing vote, says he will not vote for $3.5 trillion budget

* Government-shutdown risk is rising threat for Democrats in Washington

* Delta variant drives another Covid-19 outbreak in China

* North Korea reports testing a new long-range missile

* Russia’s military influence in Africa is rising, posing challenge to status quo

* US job growth won’t regain peak until 2030, new gov’t analysis predicts

* US producer inflation accelerated in August, reaching record 8.3% from year ago:

The ETF Portfolio Strategist: 12 September 2021

Our proprietary strategies lost ground in line with the Global Beta 16 (G.B16) benchmark last week. Year to date, the benchmark is still in the lead, but by a narrowing margin — a mere 20 basis points over this year’s top-performing prop strategy — Global Managed Volatility, which is up 9.2% in 2021 vs. 9.4% for G.B16 through Friday’s close (Sep. 10).

Book Bits: 11 Saturday 2021

Rob Reich, et al.

Excerpt via The Atlantic

After decades of innovation by computer and internet companies unfettered by government regulation, Americans are enjoying the benefits provided by Big Tech—but also contending daily with problems that the industry has ushered in. Even consumers who love their smartphones and Instagram accounts may be concerned about how they siphon up personal data and lure users back with every new alert. While tech platforms help keep people in contact with family and friends, they also rely on opaque algorithms that shape the content we see. Seeing these dynamics, many politicians appear uncertain whether to get cozy with the visionary leaders of Google, Apple, and Facebook—or to campaign against the pollution of the American information ecosystem, the amplification of hate speech and harassment, and the striking concentration of market power among a small number of companies.

The ETF Portfolio Strategist: 10 September 2021

- Losses dominated global markets this week

- All our portfolio strategy benchmarks posted weekly losses

Are the chickens coming home to roost? Maybe, but roosting speculation has been a popular sport for years and, so far, to no avail. It’s not obvious it’s different this time, although eventually it will be. Meantime, there’s plenty of red ink to ponder this week as declines weighed on most of the major asset classes.

10-Year Treasury Yield ‘Fair Value’ Estimate: 10 September 2021

A new survey finds a majority of economists expecting that the Federal Reserve will begin raising interest rates sometime next year to combat inflation. Maybe, but the 10-year Treasury yield’s recent trend still reflects a flat to downside bias.

Macro Briefing: 10 September 2021

* President Biden expands vaccine mandate to combat the pandemic

* Biden’s vaccine mandate is also an effort to support the economy

* US businesses have questions, concerns over new vaccine mandate

* Biden calls China President Xi amid rising tensions between countries

* New survey of economists sees rate hikes in 2022 to counter inflation

* China selling some of its strategic oil reserve in a bid to lower prices

* Two Fed presidents sell stocks to address ethics concerns

* UK economic growth stalled in July, GDP data shows

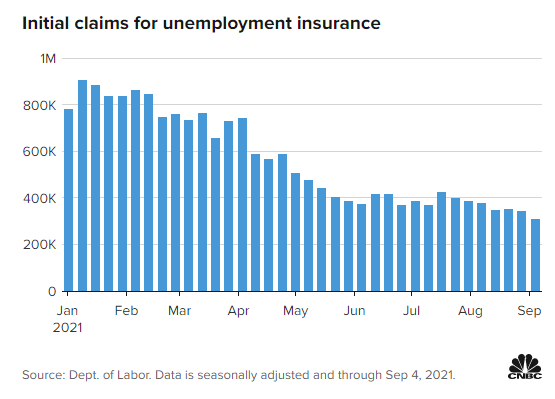

* US jobless claims continued falling last week, dropping to new pandemic low:

Exploring Alternatives To The US 60/40 Benchmark: Part I

There’s been an ongoing debate in recent years about the prospects for the US 60/40 stocks/bonds benchmark, which has become a staple for portfolio analytics. There’s much to criticize here, and arguably the weaknesses of the 60/40 standard are mounting in an increasingly global and complex world. But for good or ill, the 60/40 mix is a common reference point. The question is whether it’s time to move on? Yes, but that’s the easy answer. Next question: What portfolio benchmark should replace it?

Macro Briefing: 9 September 2021

* Treasury Secretary Yellen warns US may default on national debt in October

* US oil output remains squeezed due to ongoing fallout from Hurricane Ida

* Fed’s Beige Book reports higher inflation and slower growth

* Factory-gate price inflation in China rose to 13-year high in August

* Emerging markets split between hawks and doves on dealing with inflation

* Britain set to lose status as one of Germany’s top-10 trading partners

* State Street announces it will buy Brown Brothers Harriman Investor Services

* US job openings rose to a new record high in July:

The ETF Portfolio Strategist: 8 September 2021

You can learn a lot just by watching, runs one of Yogi Berra’s baseball-infused proverbs. Let’s take a page from the famed Yankees catcher and redirect it to the ebb and flow of weights in our strategy benchmarks. Can we learn something by watching the to and fro? Yes, or at least there are times when monitoring this data yields above-average insight.

Managing Data Outliers With Quantile Regression: Part I

One of the more difficult challenges for modeling is deciding how (or if) to deal with extreme data points. It’s a common problem in economic and financial numbers. Fat tailed distributions are standard fare in stock market returns, for example. Meanwhile, the dramatic collapse in the economy during the pandemic last year is a reminder that outliers pop up in macro analytics too.