US economic growth is expected to slow in the third quarter, but preliminary nowcasts of GDP suggest the deceleration will be moderate.

Macro Briefing: 17 August 2021

* Biden defends chaotic collapse of Afghan government

* With rare earth metals at stake, China may align with Taliban in Afghanistan

* Five US states broke records for average number of daily new Covid cases

* US declares first-ever cuts on water use from Colorado River

* China unveils more rules to tighten grip on its tech sector

* Revised Eurozone GDP data for Q2 confirms 2% growth

* NY Fed Mfg Index points to sharply softer growth in August

* US 10-year yield resumes decline, falling to 1.26%–a seven-day low:

Property Shares Ex-US Led Most Markets Higher Last Week

International real estate stocks ex-US, followed by foreign developed-market companies, topped returns for the major asset classes for the trading week through Friday, Aug. 13, based on a set of ETFs.

Macro Briefing: 16 August 2021

* Chaos at Kabul airport as Taliban take control of Afghanistan’s capital

* Biden White House on defensive as Afghanistan falls to Taliban rule

* Afghanistan’s collapse creates new set of new problems for US and its allies

* Global economic risk from shipping bottlenecks persist

* Delta variant is pinching demand and raising costs for companies

* Support within Fed is rising for announcing tapering in September

* China retail spending and industrial output are softer than expected for July

* Japan’s economy rebounded faster than expected in Q2

* Short-seller shop Hindenburg Research is having a moment

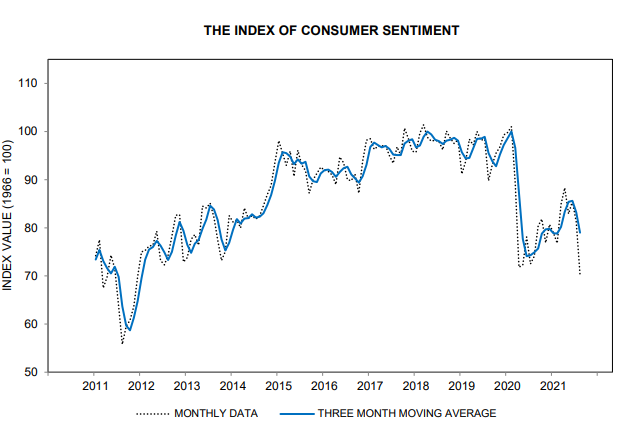

* US consumer sentiment falls to 10-year low in early August:

The ETF Portfolio Strategist: 15 August 2021

Book Bits: 14 August 2021

Tom Standage

Review via The Wall Street Journal

Tom Standage, the deputy editor of the Economist and one of our best writers of nonfiction, has cultivated a special niche: exploring the history of technology with an eye on both the past and the future. When he finds the right subject—such as the roots and repercussions of digital communication in his 2013 book “Writing on the Wall”—his work is both thought-provoking and scintillating. “A Brief History of Motion: From the Wheel, to the Car, to What Comes Next” isn’t quite in the class of its predecessor, but like all of Mr. Standage’s books, it is rewarding: the product of deep research, great intelligence and burnished prose. Moreover, he always comes up with offbeat and intriguing facts that I, for one, never knew.

The ETF Portfolio Strategist: 13 August 2021

- Europe shares are catching the bull-market bug

- US stocks end the week at another record high

- All our strategy benchmarks enjoy solid gains this week

The Continent’s hot: And we’re not just talking weather. Yes, temperatures are sky-high in several regions across Europe. Sicily stands out by setting a new record high for Europe this week — a fiery 119.8 degrees Fahrenheit.

Research Review | 13 August 2021 | Market and Asset Analytics

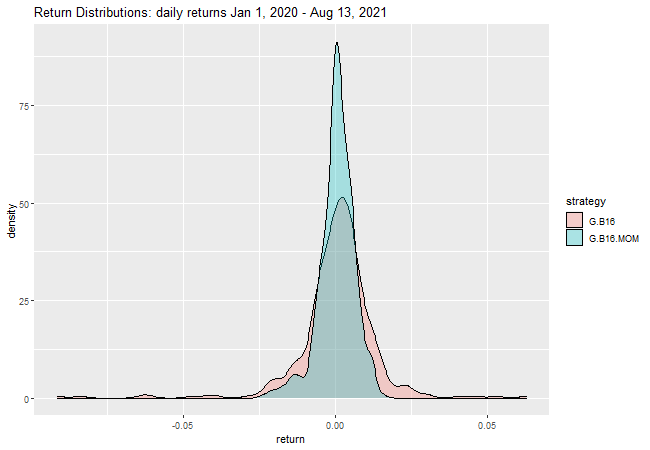

Decomposing Momentum: Eliminating its Crash Component

Pascal Büsing (University of Muenster), et al.

July 15, 2021

We propose a purely cross-sectional momentum strategy that avoids crash risk and does not depend on the state of the market. To do so, we simply split up the standard momentum return over months t-12 to t-2 at the highest stock price within this formation period. Both resulting momentum return components predict subsequent returns on a stand-alone basis. However, the long-short returns associated with the first component completely avoid negative skewness since momentum crashes are entirely driven by the second component.

Macro Briefing: 13 August 2021

* Supreme Court won’t block Indiana University’s vaccine mandate

* UK defence secretary: Afghanistan at risk of becoming a ‘failed state’

* US home prices surged in nearly every part of country

* Economists predict Fed will unveil tapering plan in September

* Disney reports better than expected earnings for Q3

* Severe weather events trigger second-highest ever first-half losses for insurers

* Growth forecasts cut for China as Delta variant spreads across the country

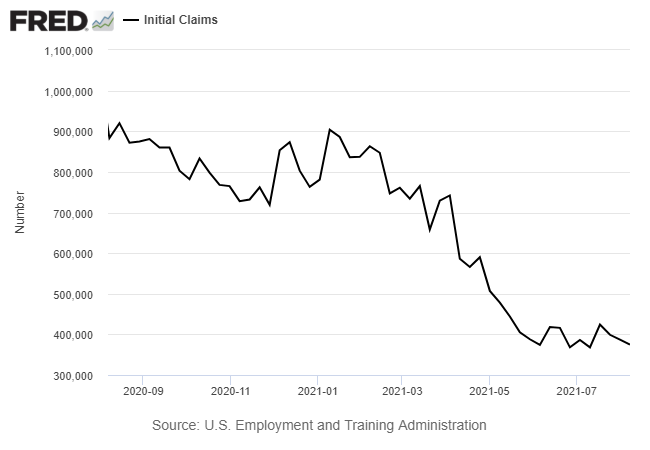

* US jobless claims fell for a third straight week:

US Macro Trend Index

The US Macro Trend Index (MTI) measures the strength of the directional bias of US economic activity. MTI reflects analysis of two business cycle indexes: ADS Index, published by the Philly Fed, and the Weekly Economic Index (WEI) via the New York Fed. Each index takes a different approach to monitoring US economic activity in real time, using a variety of indicators, some of which are published at daily and weekly frequencies. The goal with MTI is to quantify the degree of deceleration and acceleration in the overall macro trend via ADS and WEI. As such, MTI is not a measure of growth or contraction per se; rather, MTI is an index quantifying the strength or weakness of the overall trend.

MTI is a tool for developing context for assessing the overall strength or weakness of the current economic trend and quantifying the trend’s evolution.

MTI is designed as follows:

1. Calculate the mean of the 1-, 2-, 5- and 10-period differences for ADS.

2. Calculate the mean of the 1- and 2-period differences for WEI.

3. Calculate the mean for 1 and 2; transform to Z-scores on a rolling 1-year basis.