Yesterday’s July report on US consumer inflation suggested that the recent surge in pricing pressure may be peaking. That’s also the message in revised data for CapitalSpectator.com’s Inflation Trend Index (ITI).

Macro Briefing: 12 August 2021

* Census Bureau data expected to show US population diversifying at record rate

* Afghan capital could fall to Taliban within weeks

* US stimulus tapering could begin as early as this year, says Fed’s Daly

* US budget deficit narrowed to $2.5 trillion in first 10 months of fiscal year

* China says crackdown on businesses will go on for years

* Delta variant has pinched oil demand, IEA says

* UK GDP rebounded in Q2

* Eurozone industrial output fell again in June

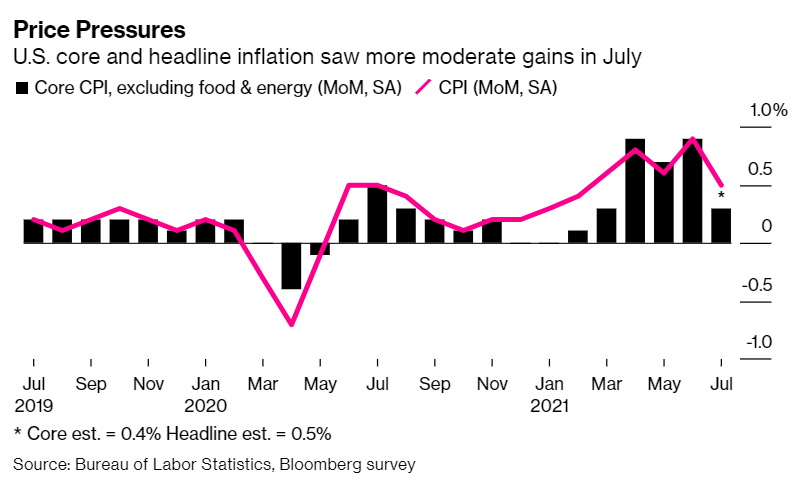

* US consumer inflation slowed in July:

Modeling US Stock Market Expected Returns, Part III

I recently outlined two models for estimating the US stock market’s return for the decade ahead. Let’s add a third model to the mix with the plan to take the average as a relatively robust forecast.

Macro Briefing: 11 August 2021

* Senate narrowly passes budget for $3.5 trillion spending plan

* N. Korea warns of ‘crisis’ over US-S. Korea military exercises

* Taliban take control of another provincial capital in northern Afghanistan

* Minimal impact on global economy so far from Delta variant of coronavirus

* Tropical Storm Fred formed Tuesday night with US in its path

* US productivity slowed in Q2; labor costs weaker than previously expected

* US small business sentiment fell in July as labor shortages persist:

High Beta Stocks Continue To Top US Equity Factor Returns In 2021

The strategy of holding stocks with the highest beta risk have stumbled recently, but remain comfortably in the lead year to date for US equity factors, based on a set of exchange traded funds.

Macro Briefing: 10 August 2021

* Dems unveil $3.5 trillion budget as infrastructure bill closer to Senate approval

* Two Fed officials suggest tapering and rate hike are near

* Delta variant of Covid-19 strains hospitals across US

* Covid outbreak due to Delta variant raises risks for China’s economy

* German investor sentiment weakens for third month in a row in August

* Unfilled job openings rose to another record high in June

* US job openings in June increased to 10.1 million–a series high:

Foreign Developed-Market Stocks Led Asset Classes Last Week

Shares in developed markets ex-US topped returns for the major asset classes last week, based on a set of exchange-traded funds. Overall, it was a mixed week with a wide range of gains and losses.

Macro Briefing: 9 August 2021

* Will Biden reappoint Fed Chair Powell? Probably, an economist reasons

* UN climate panel warns climate change is ‘code red for humanity’

* Infrastructure bill on track to pass in Senate, perhaps as early as Monday

* Infrastructure bill’s economic impact will be modest, economists predict

* Pandemic won’t soon end, predicts former WHO epidemiologist

* Cash is arguably the least worst option for savers

* US payrolls rose in July at fastest pace in nearly a year

* Is last week’s jump in the 10yr-3mo Treasury yield spread the start of a reversal?

The ETF Portfolio Strategist: 8 August 2021

It was a good week for our three proprietary strategies—in absolute terms. On a relative basis, however, passive beta continues to dominate the horse race.

Book Bits: 7 August 2021

Steve Cadigan

Review via BlueInk Review

Corporate America has found it difficult to get people back to work after the pandemic. But talent shortages, especially in fields like tech that drive the economy, were a problem even before the pandemic. Steve Cadigan’s compelling book Workquake explains why.

Cadigan posits that the pace of technological change makes employees’ skills obsolete in less than five years, particularly in fields that depend on knowledge-work. Future skill-sets are so uncertain that older employment models that emphasized regularity and employee retention are no longer relevant.