Vincent Petit

Summary via publisher (World Scientific)

The heart of the contemporary argument on climate change and energy transition focuses on how energy supply should be decarbonized to mitigate greenhouse gas emissions. This book proposes an alternative approach. The Age of Fire is Over: A New Approach to the Energy Transition finds that energy transitions are not driven by supply-side driven transformations but rather by evolutions in demand patterns. Exploring the potential of recently emerged key technologies, The Age of Fire is Over argues that the so-called Energy Transition has not yet started. In the future, key technologies will significantly transform demand and provide services at a fraction of today’s cost or offer new services not yet imagined.

The ETF Portfolio Strategist: 25 June 2021

In this issue:

- Bounce back: stocks, real estate and commodities recover

- Strong gains for our portfolio strategy benchmarks

Research Review | 25 June 2021 | Tail Risk

Equity Tail Risk in the Treasury Bond Market

Mirco Rubin (EDHEC) and Dario Ruzzi (Bank of Italy)

December 23, 2020

This paper quantifies the effects of equity tail risk on the US government bond market. We estimate equity tail risk as the option-implied stock market volatility that stems from large negative jumps as in Bollerslev, Todorov and Xu (2015), and assess its value in reduced-form predictive regressions for Treasury returns and an affine term structure model for interest rates. We document that the left tail volatility of the stock market significantly predicts one-month-ahead excess returns on Treasuries both in- and out-of-sample. The incremental value of employing equity tail risk as a return forecasting factor can be of economic importance for a mean-variance investor trading bonds. The estimated term structure model shows that equity tail risk is priced in the US government bond market. Consistent with the theory of flight-to-safety, we find that Treasury prices increase and funds flow from equities into bonds when the perception of tail risk is higher. Our results concerning the predictive power and pricing of equity tail risk extend to major government bond markets in Europe.

Macro Briefing: 25 June 2021

* Biden, bipartisan group of senators agree on near-$1 trillion infrastructure bill

* US bans imports of China solar materials linked to forced labor

* Which China firms are the next to suffer from Beijing’s fintech crackdown?

* The enduring influence of Larry Summers’s views on US economics

* US jobless claims continued to drop last week

* Trade deficit for US widened in May

* Revised US GDP growth in Q1 unchanged at strong 6.4% increase

* US durable goods orders accelerated in May as new orders for planes rose:

US Q2 Economic Estimate Still Expected To Post Strong Growth

Next month’s preliminary estimate of US economic activity for the second quarter remains on track to deliver another round of accelerated growth, based on a set of recent nowcasts.

Macro Briefing: 24 June 2021

* Agreement on infrastructure bill taking shape between White House and Senate

* House committee approves legislation to limit market dominance of Big Tech

* White House replaces director at Federal Housing Finance Agency

* Tense encounter between British warship and Russian forces in in Black Sea

* German business sentiment rises in June to highest level since November 2018

* US economic growth slowed in June but remains strong via PMI survey data

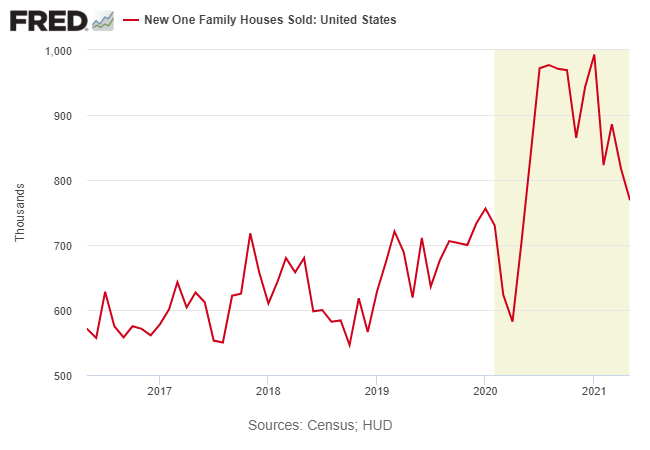

* New US home sales fell in May to 11-month low as prices soared:

The ETF Portfolio Strategist: 23 June 2021

The Treasury market continues to price in rising expectations that the recent inflation surge is temporary. No one knows if this implied forecast will prove correct, but for the moment the moderate slide in 10- and 30-year Treasury yields reflects a crowd that’s inclined to take an ever-more skeptical view of the reflation trade, if only on the margins.

Energy Sector Continues To Lead US Stocks By Wide Margin In 2021

Shares in the conventional energy sector may be destined for dinosaur status as the shift to renewables marches inexorably on, but that hasn’t stopped Big Oil from leading US equity sectors this year.

Macro Briefing: 23 June 2021

* Will Delta variant be the source of next Covid-19 wave in US?

* Fed chairman downplays inflation risk in congressional testimony

* NY Fed president says rate hike is “still way off in the future”

* China condemns latest US warship transit through Strait of Taiwan

* US births tumbled after pandemic started

* Eurozone economy grows at fastest rate for 15 years in June via survey data

* UK growth remains strong in June as employment gain hits record high

* Japan’s economic contraction continues in June via PMI survey data

* Mid-Atlantic manufacturing activity strengthens in June

* Existing home prices in US post highest year-on-year increase on record while…

* US existing home sales fell for fourth straight month in May:

Will The Fed Keep Inflation Contained?

Inflation has surged recently, raising concern that the US economy faces its biggest threat to pricing stability since the 1970s. The counterargument: inflation is transitory and the recent runup in prices will fade as production bottlenecks linked to the economy’s reopening fade. Even if inflation turns out to be more persistent than some forecasters expect, the Federal Reserve will step in and nip the problem in the bud.