After two straight months of across-the-board gains for the major asset classes, red ink returned in June.

Macro Briefing: 1 July 2021

* NY grand jury indicts Trump Organization and its CFO

* US and Japan conducting war games as China-Taiwan tensions rise

* China president pledges ‘complete reunification’ with Taiwan

* China Mfg PMI: sector growth eased to 3-month low in June

* Fed’s Kaplan: central bank should soon begin paring bond purchases

* Eurozone Mfg PMI rose to record high in June

* US pending home sales rebounded sharply in May

* Chicago area business activity was surprisingly weak in June

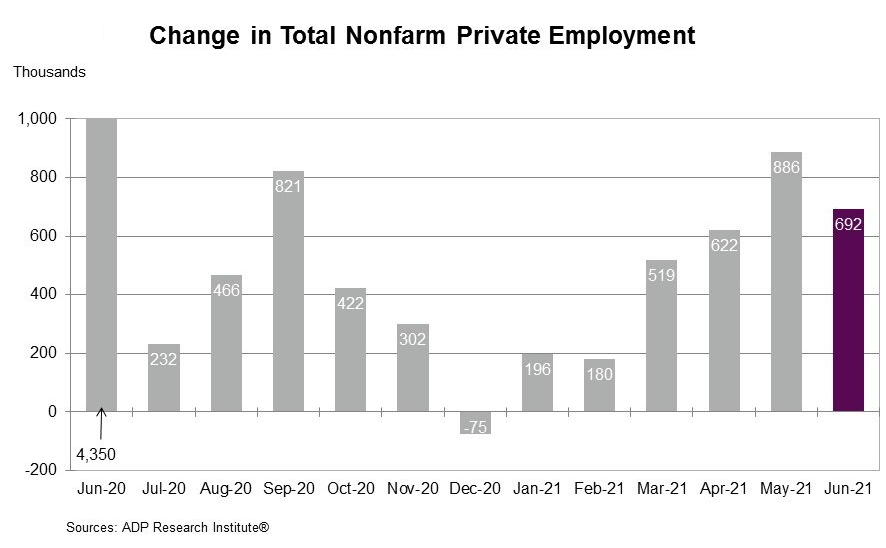

* US private employment rose 692,000 in June — more than economists expected:

The ETF Portfolio Strategist: 30 June 2021

The reflation trade continues to lose momentum, or so the ongoing slide in the 10-year Treasury yield suggests.

Returns For Alternative Energy Stocks Vary Widely This Year

Energy stocks are having a good year, or so it seems by using the usual suspects as a benchmark. Traditional names – Exxon Mobil and Chevron, for example – have posted sharp rallies after suffering in 2020. The wider world for so-called alternative energy, by contrast, is a mixed bag in 2021.

Macro Briefing: 30 June 2021

* Congress under renewed pressure to revise antitrust laws

* US infrastructure plan would boost growth and lower debt, predicts study

* Survey shows economists expect several US rates hikes by 2023

* UK economy fell more than expected in Q1, revised data show

* Eurozone inflation eased in June, ahead of expected rebound in summer

* China Mfg PMI slips to 50.9, indicating a modest pace of growth in June

* US Consumer Confidence rises to new peak in June following onset of pandemic

* US 1-year change in home prices accelerated further in April, above 2005 peak:

Estimating Fair Value For The 10-Year Treasury Yield, Part III

In recent weeks I’ve been building models that estimate a theoretical “fair value” for the world’s most important interest rate: the benchmark 10-year Treasury yield (see here and here). The goal: combine the results to develop a more robust estimate by using the average. As such, more models are better and so today I introduce a third approach to econometrically approximate the “correct” level of the 10-year rate.

Macro Briefing: 29 June 2021

* Militias fire rockets at US troops in Syria after airstrikes

* Federal court dismisses antitrust case against Facebook

* Delta variant is spreading, raising risk of potential Covid-19 spikes in the fall

* US demand revival is driving world economic recovery

* Drought in US West will add to upside pressure on food prices

* Considering what could wrong for markets, the economy and more

* Is fragility the new normal for the US stock market?

* 10yr-3mo Treasury yield curve continues to show downside trending bias:

Broad Rebound In Global Markets Last Week, Except For US Bonds

Nearly every slice of the major asset classes recovered last week from the previous week’s correction, based on a set of exchange traded funds through Friday’s close (June 25). The main exception: US investment-grade bonds.

Macro Briefing: 28 June 2021

* US launches airstrikes on militia targets in Iraq and Syria

* White House and Senate negotiators try to keep infrastructure deal alive

* Fed official highlights risk of a bust after US housing boom

* Central banks start or plan withdrawal of emergency stimulus

* Heatwave scorches US Northwest states

* Biden seeks to shift economic narrative away from inflation to recovery

* US consumer sentiment revised down for June but still higher vs. May

* US consumer spending unchanged in May; incomes dropped for second month:

The ETF Portfolio Strategist: 27 June 2021

Most markets around the world snapped back last week, putting passive beta portfolios back in the lead for performance.