Trump’s new tariffs take effect on biggest US trading partners, creating more uncertainty for the global economy. “The primary question… is whether or not there will be negotiations,” said Thierry Wizman, a global strategist at the investment bank Macquarie. “And no one has an answer to that because it’s going to depend on the approach and the disposition of the negotiating parties.”

Uncertainty Clouds Outlook For Trump’s Tariff Goals

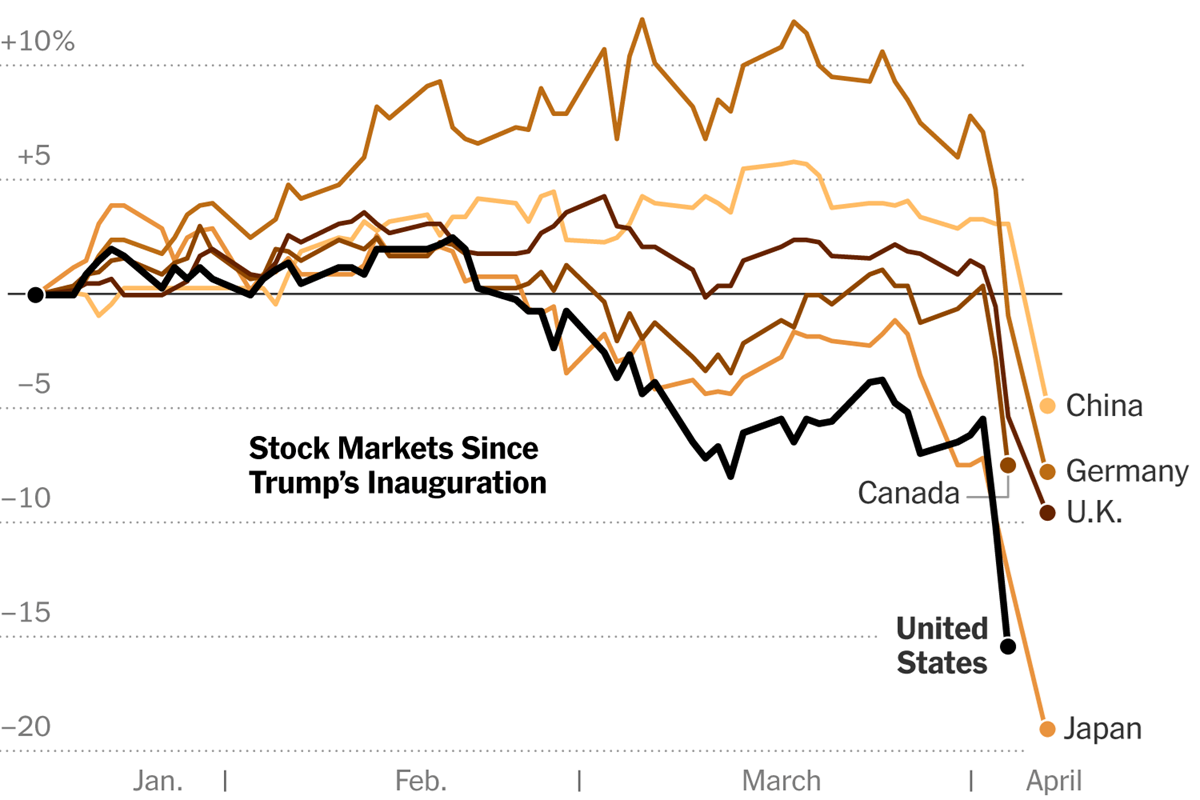

Pursuing a structual, sudden change in US trade policy is one thing. That alone is disruptive. Even if it’s a net plus in the longer term (a debatable proposition), the current burden that’s weighing on markets and the economic outlook is a lack of clarity on what the end game is and how the US will get there. It adds up to a one-two gut punch for investor, consumer and business sentiment.

Macro Briefing: 8 April 2025

China says it will “fight to the end” as it retaliates against US import tariffs, which rose to over 100% on Wednesday in response to China’s decision to match the “reciprocal” duties Trump announced last week. “If China does not withdraw its 34% increase above their already long term trading abuses by tomorrow, April 8th, 2025, the United States will impose ADDITIONAL Tariffs on China of 50%, effective April 9th,” Trump wrote on Truth Social. “Additionally, all talks with China concerning their requested meetings with us will be terminated!”

Is A US Recession Inevitable?

A rising chorus of forecasts suggest as much. But for the moment, this is still guesswork as markets struggle to price in a dramatically altered macro outlook due to the rising risk of a global trade war.

Macro Briefing: 7 April 2025

President Trump hints he’s ready to negotiate on tariffs as stocks around the world continue to tumble on Monday. On Sunday evening he said he’s “open to talking” with world leaders on new trade deals. “I’m willing to deal with China, but they have to solve their surplus,” he said aboard Air Force One. But he also advised that the tariffs will continue until the US trade deficit is eliminated: “Unless we solve that problem, I’m not going to make a deal.”

Book Bits: 5 April 2025

● The Measure of Progress: Counting What Really Matters

● The Measure of Progress: Counting What Really Matters

Diane Coyle

Summary via publisher (Princeton U. Press)

The ways that statisticians and governments measure the economy were developed in the 1940s, when the urgent economic problems were entirely different from those of today. In The Measure of Progress, Diane Coyle argues that the framework underpinning today’s economic statistics is so outdated that it functions as a distorting lens, or even a set of blinkers. When policymakers rely on such an antiquated conceptual tool, how can they measure, understand, and respond with any precision to what is happening in today’s digital economy? Coyle makes the case for a new framework, one that takes into consideration current economic realities.

US Services Sector, An Exporting Powerhouse, At Risk In Trade War

The US is the world’s leading exporter of services to the global economy. The services sector is also the dominant source of economic activity in America. Those are strengths, but they’re also vulnerabilities in a global trade war.

Macro Briefing: 4 April 2025

The US bond market rallied yesterday amid rising fears that a global trade war is unfolding. The Vanguard Total Bond Market ETF (BND), a proxy for US government bonds and investment-grade credits, rallied to its highest level since September, fueled by a rush for safe havens amid a stock market rout on Thursday. US stocks, by contrast, suffered their worst daily loss on Thursday since 2020, with the steepest declines in tech and energy sectors.

Managing Expectations For A Global Trade War

The sweeping policy change for US tariffs announced yesterday by President Trump is a game changer for the global economy. Exactly how trade flows shift, economies pivot and governments around the world react is unclear, but most forecasts point to slower growth, higher inflation and a reduction in global trade. Trump, by contrast, says the tariffs will “quickly” usher in a new era of prosperity for the US.

Macro Briefing: 3 April 2025

President Trump announced a sweeping set of tariffs on Wednesday that threaten to trigger a global trade war as governments around the world say they will respond. The shift in US policy marks the biggest change to global trade in a century. The core change is a universal tariff of 10% on all imports, plus additional tariffs on the “worst offenders.” A notable exception: Russia. A White House official says Russia is “not on this list because sanctions from the Ukraine war have already rendered trade between the two countries as zero.”