The long-run expected total return for the Global Market Index (GMI) fell again in March, dropping to an annualized 6.9% vs. the previous month’s 7.1%. The analysis is based on three models (defined below) for GMI, a global benchmark that’s based on a market-value weighted mix of the major asset classes (excluding cash).

Macro Briefing: 2 April 2025

New US tariffs are set to start today, according to the Trump administration. Analysts are hoping that the details will provide more clarity on the policy shift. This much is clear: the stakes are high. “The main channel from trade policy uncertainty to GDP is via business investment. Under higher trade policy uncertainty, future revenue streams of an investment become more uncertain, raising the option value of delaying investment decisions until the situation is clearer,” Oxford Economics analysts said in a research note.

Major Asset Classes | March 2025 | Performance Review

Commodities led widespread rallies in March for the major asset classes, based on a set of ETFs. US assets posted the only losses last month, with American shares leading on the downside.

Macro Briefing: 1 April 2025

Gold rose to another record high on Monday, increasing to $3,124 an ounce. The precious metal has rallied 19.1% so far in 2025.

Equities Demand Higher Risk Premium As Uncertainty Spikes

Measuring shifts in uncertainty is a slippery beast, but it’s easier to intuit when big changes unfold vs. the recent past. We’re knee-deep in one of those moments. One of the tell-tale signs: the US stock market is demanding a higher risk premium to compensate for the spike in uncertainty, a.k.a. prices are falling, which translates to a higher expected return for some forward time horizon.

Macro Briefing: 31 March 2025

US core inflation remained “sticky” in February, based on the core PCE index, which is closely monitored by the Federal Reserve. Core PCE ticked up to a 2.8% year-over-year pace, well above the Fed’s 2.0% inflation target. “It looks like a ‘wait-and-see’ Fed still has more waiting to do,” said Ellen Zentner, chief economic strategist at Morgan Stanley Wealth Management. “Today’s higher-than-expected inflation reading wasn’t exceptionally hot, but it isn’t going to speed up the Fed’s timeline for cutting interest rates, especially given the uncertainty surrounding tariffs.”

Book Bits: 29 March 2025

● The Behavioral Portfolio: Managing Portfolios and Investor Behavior in a Complex Economy

● The Behavioral Portfolio: Managing Portfolios and Investor Behavior in a Complex Economy

Phillip Toews

Summary via publisher (Harriman House)

The investment advisory industry is beset by two largely unacknowledged problems. First, the history and risks of both stock and bond portfolios far exceed what most investors and advisory practices can endure. Second, the approach that most advisors take to communicate about portfolios does virtually nothing to prevent investors from known biases and bad decision making. In The Behavioral Portfolio, Felipe Toews guides advisors build all season’s portfolios designed to both invest optimistically and address the real-world contingencies of investing in a high debt world. He begins by re-defining foundational portfolio objectives such such as gains with the market, low risk of extreme losses, and protection against high inflation. He then walks us through the process of quantifying and building these portfolios, illustrating that in so doing, advisors can improve probabilities of success.

US Economic Growth Remains On Track To Slow In Q1

Economic output is estimated to downshift sharply in next month’s official GDP report for the first quarter, based on the median nowcast from several sources compiled by CapitalSpectator.com. Recessionary conditions will likely be avoided, at least for now, but Q1 data appears set to highlight an increased vulnerability in Q2 and beyond.

Macro Briefing: 28 March 2025

US jobless claims edged lower last week, holding at a middling level relative to recent history. Initial claims for unemployment insurance eased to 224,000, seasonally adjusted, which reflects a low number compared with the historical record and suggests ongoing growth, or at least stability, for the labor market.

Bonds Continue To Offer A Haven Amid High Macro Uncertainty

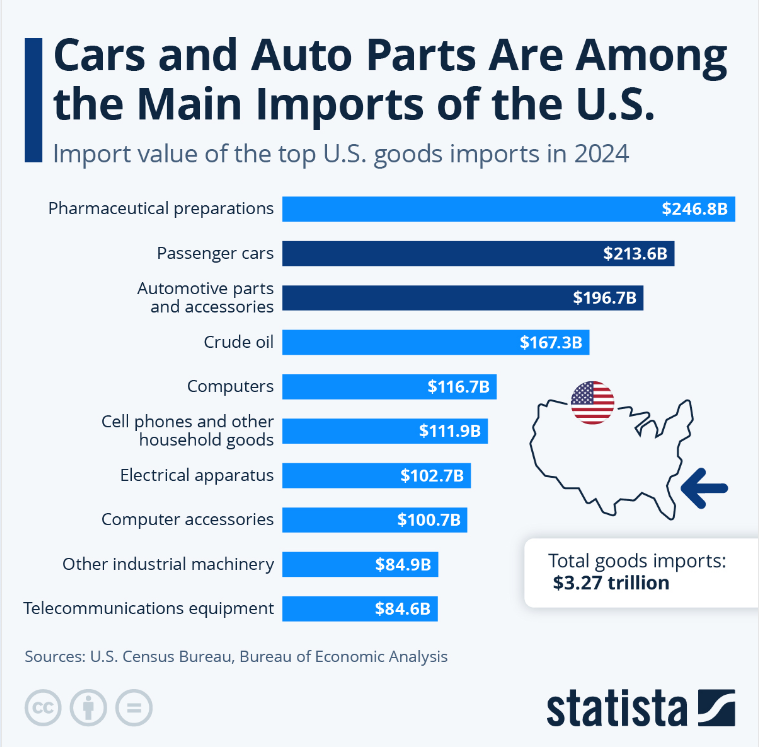

President Trump’s latest announcement on tariffs is a reminder that macro uncertainty is high and will probably remain so for the near term. “What we’re going to be doing is a 25% tariff on all cars not made in the US,” he said on Wednesday. It wasn’t exactly a surprise, given the President’s preference for tariffs, but it’s another wake-up call that the White House intends to pursue its policies, which suggests a rough ride for making assumptions based on the standard playbook for the economy and financial markets.