Portfolio managers say that inflation has replaced the coronavirus as the primary risk for Wall Street, according to a survey released by Bank of America on Tuesday (Mar. 16). That may be understating the continuing if receding threat from the pandemic in the months ahead. Nonetheless, it’s highly likely that the inflation trend will rise as last year’s temporary bout of deflation, triggered by the initial coronavirus shock, washes out of the year-over-year data. The question is what happens beyond the initial rebound?

Macro Briefing: 17 March 2021

* US imposes financial sanctions on Chinese officials ahead of China talks

* Biden endorses changes to Senate’s filibuster rules

* Wells Fargo expects 10-year Treasury yield to rise to 2.25% this year

* Fed will likely reaffirm it’s too early to raise rates or reduce bond buying

* Fed expected to upgrade economic forecasts in today’s FOMC meeting

* Inflation risk replaces Covid-19 as Wall Street’s main worry

* Homebuilder confidence falls in March after setting record highs

* US industrial output declined in February after four monthly gains

* US retail sales fell more than expected in February:

Desperately Seeking Yield: 16 March 2021

Finding a respectable yield in the global markets hasn’t been easy in recent years and nothing’s changed in 2021. This is a bit surprising when you consider that interest rates have been rising this year. But while investors buying medium-to-long-term Treasuries, for example, are offered higher rates these days, it’s another story in major asset classes via a set of ETF proxies.

Macro Briefing: 16 March 2021

* Variant risk for virus is still lurking for the US

* Europe’s suspension of AstraZeneca shots disrupts vaccinations plans

* ECB aims to keep yields from rising until economy is stronger

* Southwest border becoming a crisis for Biden due to surge in migrants

* N. Korea issues warning over US-S. Korea military exercises

* Markets focused on this week’s Fed meeting

* The pandemic triggered a housing boom that’s different from the last one

* Facebook to pay for news content in Australia

* NY Fed Mfg Index (current reading) rises to two-year high

* US economic recovery on track to outperform Europe’s rebound:

REITs Surged Amid Mixed Run For Major Asset Classes Last Week

US real estate investment trusts (REITs) rebounded in last week’s trading (through Mar. 12), posting the best performance by far for the major asset classes, which delivered mixed results overall, based on a set of proxy ETFs.

Macro Briefing: 15 March 2021

* President Biden considers first major federal tax hike since 1993

* Fauci points to Europe’s covid surge as reason to keep mask restrictions

* Migrant traffic rising on US-Mexico border

* After bloodiest day in Myanmar protests, military extends martial law

* Chinese economic activity surged in January and February

* Unemployment rate for China’s young people holds at high 13.1%

* Emerging markets face risk of rising rates amid higher debt levels

* Investors overreact when companies hit by natural disaster, study finds

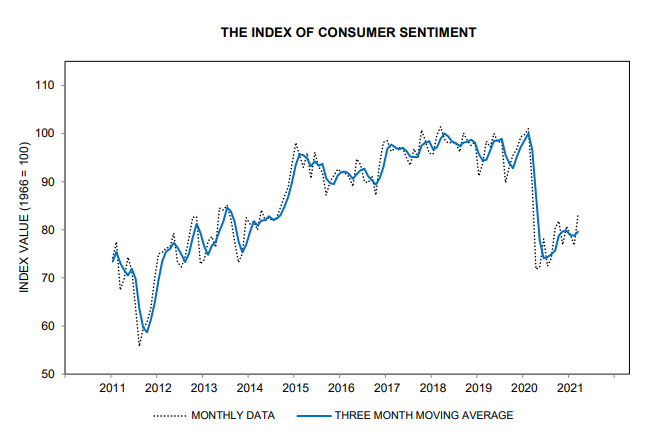

* US Consumer Sentiment Index rebounds to 1-year high in March:

Book Bits: 13 March 2021

● Futureproof: 9 Rules for Humans

● Futureproof: 9 Rules for Humans

in the Age of Automation

Kevin Roose

Adaptation excerpt via New York Times

White-collar workers, armed with college degrees and specialized training, once felt relatively safe from automation. But recent advances in A.I. and machine learning have created algorithms capable of outperforming doctors, lawyers and bankers at certain parts of their jobs. And as bots learn to do higher-value tasks, they are climbing the corporate ladder.

The trend — quietly building for years, but accelerating to warp speed since the pandemic — goes by the sleepy moniker “robotic process automation.” And it is transforming workplaces at a pace that few outsiders appreciate. Nearly 8 in 10 corporate executives surveyed by Deloitte last year said they had implemented some form of [robotic process automation] R.P.A. Another 16 percent said they planned to do so within three years.

The ETF Portfolio Strategist: 12 Mar 2021

In this issue:

- US small-cap stocks explode higher

- No sign of trouble for our strategy benchmarks, which continue to trend up

Measuring Return Streaks, Part II

Yesterday we reviewed the basics for calculating so-called performance streaks in markets. Let’s go a bit deeper and slice and dice the data with a bit more granularity.

Macro Briefing: 12 March 2021

* President Biden signs into law the $1.9 trillion coronavirus relief package

* Biden directs states to offer vaccines to everyone by May 1

* Three European countries halt use of AstraZeneca’s vaccine

* Treasury Sec. Yellen: Americans will start receiving relief payments this weekend

* Eurozone industrial output was much stronger than expected in January

* UK’s economy fell less than expected in January

* UK exports to Eurozone fell 40% in January

* US job openings rose in January to pandemic high

* US jobless claims fall more than expected but still unusually high: