There was nowhere to hide in last week’s broad-based market decline for our proprietary strategies: all three took it on the chin. The declines for the trading week through Feb. 19 were in line with the benchmark, Global Beta 16 (G.B16). Year to date results, however, are another matter.

Book Bits: 20 February 2021

● How to Avoid a Climate Disaster: The Solutions We Have and the Breakthroughs We Need

● How to Avoid a Climate Disaster: The Solutions We Have and the Breakthroughs We Need

Bill Gates

Review via Associated Press

Gates has crafted a calm, reasoned, well-sourced explanation of the greatest challenge of our time and what we must change to avoid cooking our planet in “How to Avoid Climate Disaster: The Solutions We Have and the Breakthroughs We Need.”

His goal with this book appears to be to explain and persuade and although he doesn’t say so in the book, the implicit theme parallels something President Abraham Lincoln once said: “Give the people the facts and the nation will be safe,” meaning we Americans would make the right decisions about the problems we face if we have the facts.

Will we though?

The ETF Portfolio Strategist: 19 Feb 2021

In this issue:

- Inverse together: interest rates rise and (most) stock markets fall

- Portfolio strategy benchmarks take a hit after two weeks of gain

US equities on the defensive as Treasury yields continue to rise: Maybe it wasn’t solely about the ongoing upswing in rates, but it probably didn’t help. Whatever the reason(s), US shares fell 0.7% this week through Friday’s close (Feb. 19), based on Vanguard Total US Stock Market (VTI). The ETF posted its first weekly decline in three weeks. That still leaves the fund close to a record high, which was set only a week ago. But with interest rates rising, and showing an increasingly robust upside trend, the burning question is: How much tolerance can equities muster if the reflation trade for yields rolls on?

Energy Shares Continues To Lead US Equity Sector Returns In 2021

Late last month I wondered if this year’s strong start for energy stocks would continue? The answer is a resounding “yes,” at least so far through yesterday’s close (Feb. 18).

Macro Briefing: 19 February 2021

* Millions left without safe drinking water in Texas after winter storm

* Texas’ storm cut 40% of US oil output

* Biden plans to tell G7 today to work together on China challenge

* White House ready for talks with Iran to discuss return to 2015 nuclear deal

* Fed governor Lael Brainard: climate change affecting economy

* Treasury Secretary Yellen reaffirms need for large stimulus package

* Eurozone economy contracted for fourth straight month in February

* Manufacturing revival threatened by global chip shortage

* Bitcoin market cap approaches $1 trillion

* Lumber prices briefly topped $1,000 per 1,000 board feet, a record high

* US jobless claims unexpectedly rose last week, reaching a one-month high

* US housing starts eased in January but new building permits surged:

Modeling The ETF Opportunity Set: Part I

When the first exchange-traded fund (ETF) was launched in 1993, expectations were modest. The competition, after all, was the elephant in the room and had roughly a century to establish itself and dominate the industry. Nearly three decades later, open-end mutual funds still hold more assets than ETFs, but the latter long ago became a growth industry while mutual funds increasingly appear to be a sunset industry.

Macro Briefing: 18 February 2021

* Winter weather continues to wreak havoc in Texas

* Fed officials last month discussed outlook for higher inflation

* US interest rates will continue to rise, analysts predict

* US economy could lose $1 trillion if Biden pursues sharp separation from China

* Life expectancy in US fell in first half of 2020 due to pandemic

* US jobless claims expected to ease in today’s report but remain high

* US producer prices increased the most in January since 2009

* Homebuilder sentiment in US remains firmly bullish in February

* Industrial output in US increased more than expected in January

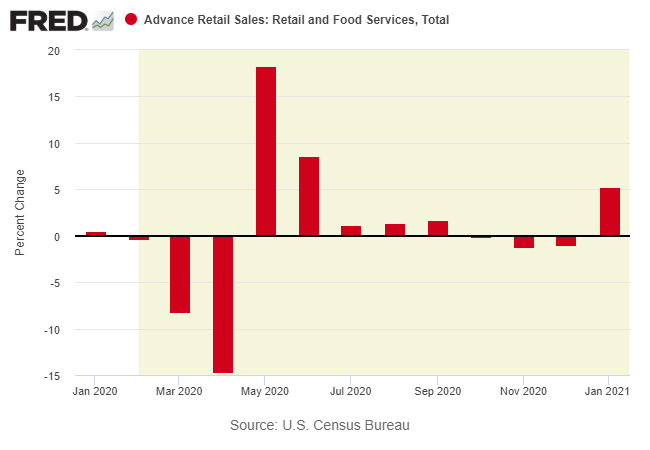

* US retail sales surged in January, rising for first time in 4 months:

The ETF Portfolio Strategist: 17 Feb 2021

In this issue:

- Gold slides to 3-month low

- Energy stocks continue to rally as Goldman turns bullish on the sector

- Another record high for ishares MSCI China ETF (MCHI)

Rising Interest Rates Create Headwinds For Bonds In 2021

Only when the tide goes out do you discover who’s been swimming naked, Warren Buffett famously quipped. A real-time financial example is unfolding in the bond this year, especially after yesterday’s jump in Treasury yields.

Macro Briefing: 17 February 2021

* Biden administration will extend ban on home foreclosures

* Huge protests in Mynamar continue in reaction to military coup

* US retail sales expected to rebound in today’s January udpate

* Electricity prices surge in Texas as deep freeze roils state

* China topped US in 2020 as Europe’s biggest trading partner

* Bitcoin reaches $51,000, a new record

* Widespread business disruption across US in wake of winter storm

* Does extreme weather provide opportunity for infrastructure upgrade?

* Manufacturing activity in New York state expanded in February at a quicker pace

* 10-year Treasury yield rises to 1.30%, near one-year high: